Understanding CVV2 Amex: A Comprehensive Guide To Security And Usage

When it comes to online shopping or card-not-present transactions, the CVV2 Amex code plays a pivotal role in ensuring security and protecting your financial information. This three-digit code, found on the front of American Express cards, is more than just a random number—it’s your first line of defense against fraud. Whether you're a frequent online shopper or someone who occasionally makes digital payments, understanding CVV2 Amex is essential. This guide will walk you through everything you need to know, from its purpose to how it safeguards your transactions.

With the rise of e-commerce and digital payment platforms, the need for robust security measures has never been greater. CVV2 Amex ensures that even if someone gets hold of your card number, they cannot complete a transaction without this critical code. It adds an extra layer of verification, making unauthorized purchases significantly harder. This article will explore the intricacies of CVV2 Amex, its role in fraud prevention, and how you can use it confidently while staying safe online.

As we delve deeper into this topic, you'll discover why CVV2 Amex is such an integral part of modern payment systems. From its origins to its practical applications, we’ll cover all aspects to help you make informed decisions. Whether you’re a business owner, a consumer, or simply curious about payment security, this guide has something for everyone. Let’s begin by breaking down the basics of CVV2 Amex and why it matters so much in today’s digital age.

Read also:Dawn Wells Measurements A Complete Guide To Her Life And Career

Table of Contents

- What is CVV2 Amex and Why Is It Important?

- How Does CVV2 Amex Work in Online Transactions?

- Why Is CVV2 Amex Essential for Fraud Prevention?

- How to Safeguard Your CVV2 Amex Code?

- Common Misconceptions About CVV2 Amex: What You Need to Know

- Can Your CVV2 Amex Code Be Changed If Compromised?

- How to Identify Phishing Scams Targeting CVV2 Amex?

- Frequently Asked Questions About CVV2 Amex

What is CVV2 Amex and Why Is It Important?

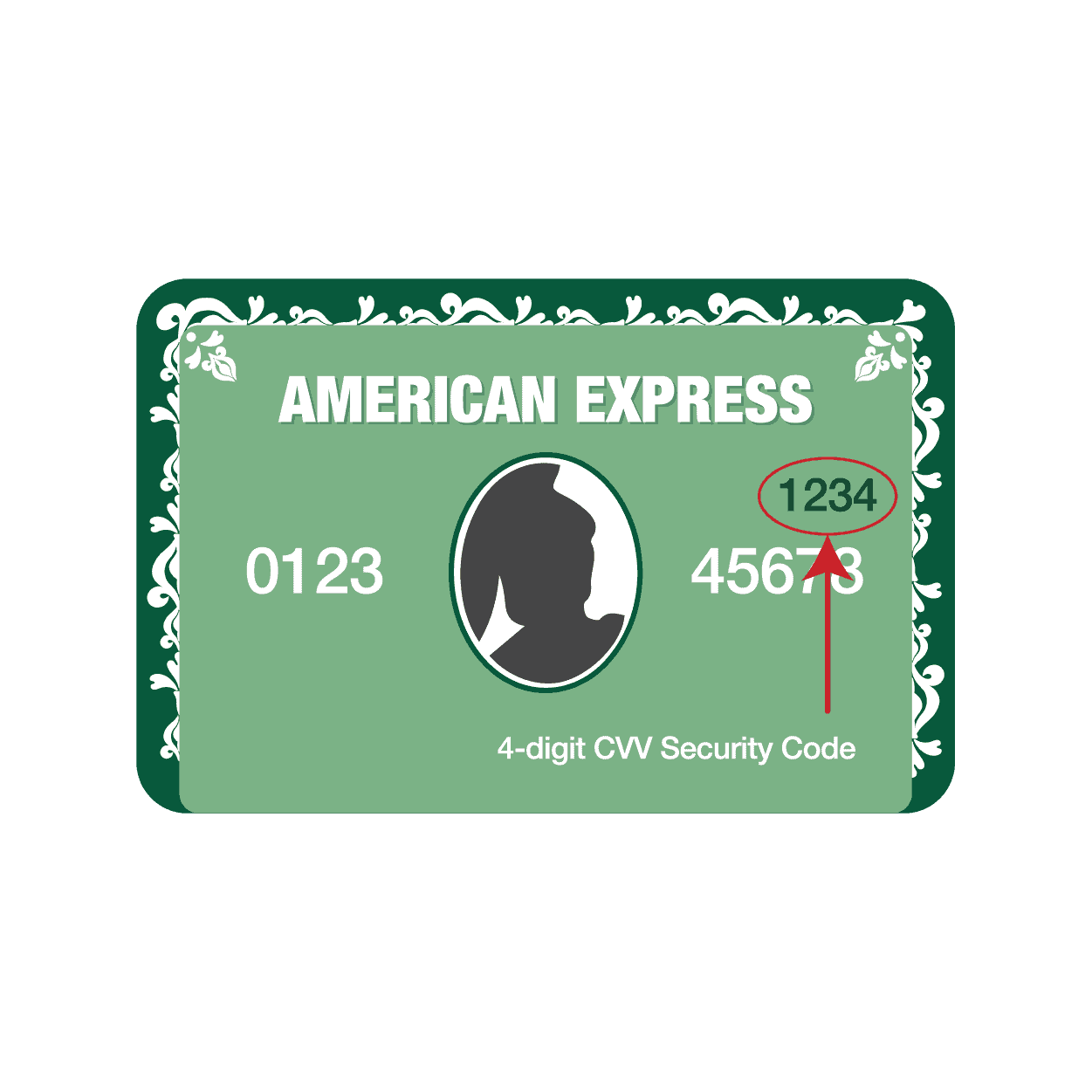

CVV2 Amex, or Card Verification Value 2, is a three-digit security code unique to American Express cards. Unlike other card networks, such as Visa or Mastercard, which place their CVV codes on the back of the card, American Express displays the CVV2 Amex code on the front, just above the card number. This code is used to verify that the person making the transaction physically possesses the card, adding an extra layer of security during online or phone purchases.

So, why is CVV2 Amex so important? The answer lies in its role as a fraud deterrent. In card-not-present transactions, such as online shopping or booking services over the phone, merchants cannot physically check the card. This creates an opportunity for fraudsters to use stolen card numbers. By requiring the CVV2 Amex code, merchants can ensure that the person initiating the transaction has access to the actual card, significantly reducing the risk of unauthorized purchases.

Additionally, CVV2 Amex is not stored in databases by merchants or payment processors, making it harder for hackers to steal. This further enhances its effectiveness as a security measure. For consumers, understanding the importance of CVV2 Amex can help them make safer transactions and avoid falling victim to scams. By using this code correctly and keeping it confidential, you can protect yourself from potential fraud.

How Does CVV2 Amex Work in Online Transactions?

When you make an online purchase, the CVV2 Amex code serves as a critical piece of information that validates your identity. During the checkout process, you are typically asked to enter your card number, expiration date, and CVV2 Amex code. This information is then sent to the payment processor, which verifies the details with American Express. If the CVV2 Amex code matches the one on file, the transaction is approved.

But how exactly does this verification process work? The CVV2 Amex code is generated using a combination of your card number, expiration date, and a secret encryption key known only to American Express. This ensures that the code is unique to your card and cannot be easily replicated. When you enter the code during a transaction, it is cross-referenced with the encrypted version stored in American Express’s secure database. If the two match, it confirms that the card is legitimate and in the possession of the rightful owner.

Here’s a step-by-step breakdown of how CVV2 Amex works in practice:

Read also:Discover The Magic Of Richard Dreyfuss Movies A Journey Through Time

- You provide your card details, including the CVV2 Amex code, during an online purchase.

- The merchant sends this information to their payment processor.

- The payment processor forwards the CVV2 Amex code to American Express for verification.

- American Express checks the code against its encrypted database.

- If the code matches, the transaction is authorized; otherwise, it is declined.

This process ensures that even if someone manages to steal your card number, they cannot complete a transaction without the CVV2 Amex code. It’s a simple yet highly effective way to enhance payment security.

Why Is CVV2 Amex Essential for Fraud Prevention?

Fraud prevention is a top priority for both consumers and financial institutions, and CVV2 Amex plays a crucial role in this effort. By requiring the CVV2 Amex code for online transactions, merchants can significantly reduce the risk of fraudulent purchases. This is especially important in today’s digital age, where cybercriminals are constantly looking for ways to exploit vulnerabilities in payment systems.

One of the key reasons CVV2 Amex is so effective is that it is not stored in merchant databases. Unlike card numbers and expiration dates, which are often saved for convenience, the CVV2 Amex code is entered manually by the cardholder during each transaction. This means that even if a merchant’s database is compromised, hackers cannot access the CVV2 Amex code. As a result, stolen card numbers become far less valuable to fraudsters.

How Does CVV2 Amex Compare to Other Security Measures?

While CVV2 Amex is a powerful tool for fraud prevention, it is just one piece of the puzzle. Other security measures, such as two-factor authentication and tokenization, also play important roles in protecting cardholders. However, CVV2 Amex stands out because of its simplicity and effectiveness. It doesn’t require additional devices or software, making it accessible to everyone.

What Happens If CVV2 Amex Is Not Required?

If a merchant does not require the CVV2 Amex code for online transactions, the risk of fraud increases significantly. Without this additional layer of verification, stolen card numbers can be used more easily, leading to higher rates of unauthorized purchases. This is why reputable merchants always ask for the CVV2 Amex code and why consumers should be wary of websites that do not.

How to Safeguard Your CVV2 Amex Code?

Protecting your CVV2 Amex code is crucial to ensuring the security of your financial information. While the code itself is a powerful tool against fraud, it is only effective if you take steps to keep it safe. Here are some practical tips to help you safeguard your CVV2 Amex code:

- Never Share Your CVV2 Amex Code: Treat your CVV2 Amex code like a password. Only enter it on secure websites and never share it with anyone, including friends, family, or customer service representatives.

- Be Wary of Phishing Scams: Fraudsters often use phishing emails or fake websites to trick people into revealing their CVV2 Amex code. Always verify the authenticity of a website or email before entering your card details.

- Use Secure Networks: Avoid entering your CVV2 Amex code on public Wi-Fi networks, as these are often unsecured and vulnerable to hackers. Use a trusted internet connection instead.

Common Misconceptions About CVV2 Amex: What You Need to Know

Despite its importance, there are several misconceptions about CVV2 Amex that can lead to confusion or misuse. Understanding these myths is essential for using your card safely and effectively.

Is CVV2 Amex the Same as a PIN?

No, CVV2 Amex is not the same as a PIN. While both are used for verification purposes, a PIN is typically required for in-person transactions, such as withdrawing cash from an ATM or making a purchase at a physical store. CVV2 Amex, on the other hand, is used exclusively for online or phone transactions.

Can CVV2 Amex Be Used for In-Store Purchases?

No, CVV2 Amex is not required for in-store purchases. When you use your card at a physical store, the payment terminal reads the chip or magnetic stripe on your card, eliminating the need for a CVV2 Amex code.

Can Your CVV2 Amex Code Be Changed If Compromised?

If you suspect that your CVV2 Amex code has been compromised, it’s important to act quickly. While the code itself cannot be changed, you can request a new card from American Express. This will generate a new CVV2 Amex code, effectively rendering the old one useless.

How to Identify Phishing Scams Targeting CVV2 Amex?

Phishing scams are a common method used by fraudsters to steal CVV2 Amex codes. These scams often involve fake emails, text messages, or websites designed to trick you into revealing your card details. Here are some red flags to watch out for:

- Unsolicited requests for your CVV2 Amex code.

- Urgent or threatening language, such as “Your account will be suspended.”

- Links to websites that look similar to legitimate ones but have slight differences in the URL.

Frequently Asked Questions About CVV2 Amex

What Should I Do If I Forget My CVV2 Amex Code?

If you forget your CVV2 Amex code, you can find it on the front of your card, just above the card number. If your card is lost or damaged, contact American Express customer service to request a new one.

Is It Safe to Save My CVV2 Amex Code Online?

No, it is not safe to save your CVV2 Amex code online. Unlike card numbers and expiration dates, the CVV2 Amex code should always be entered manually for each transaction to ensure security.

Can I Use My CVV2 Amex Code for International Transactions?

Yes, you can use your CVV2 Amex code for international transactions. It works the same way as it does for domestic purchases, providing an additional layer of security.

Conclusion

CVV2 Amex is a vital tool for ensuring the security of your online transactions. By understanding its purpose and how to use it safely, you can protect yourself from fraud and enjoy peace of mind while shopping online. Remember to keep your CVV2 Amex code confidential, be vigilant against phishing scams, and take advantage of other security measures to enhance your protection.

For more information on payment security, you can visit the American Express Security Center.

Discovering The Majestic Height Of A T-Rex: Unveiling The Secrets Of The King Of Dinosaurs

Understanding Slice White Bread Calories: A Complete Guide To Nutrition And Health

Understanding The Bleach Lifespan: How Long Does It Really Last?

What is CVV on a Credit Card and how does it work?

What is CVV? CVC Code