How To Check My Turbo Card Balance: A Comprehensive Guide

Managing your finances has never been easier with the Turbo Card, a versatile payment solution designed to simplify your life. Whether you’re using it for everyday purchases or saving up for something special, keeping track of your balance is crucial to staying in control. In this article, we’ll walk you through everything you need to know about how to check my turbo card balance. From online tools to mobile apps and customer service options, you’ll discover multiple ways to monitor your account seamlessly. With Turbo Card’s user-friendly features, you can ensure you’re always aware of your spending limits and financial health.

For many users, the Turbo Card has become an indispensable tool for managing expenses. However, knowing how to check your balance is just the beginning. We’ll explore the various methods available to access your account information, ensuring you’re equipped with the knowledge to make informed financial decisions. Whether you’re a new Turbo Card user or a seasoned one, this guide will provide valuable insights to help you stay on top of your finances.

Additionally, we’ll address common questions and concerns about the Turbo Card, such as troubleshooting issues and understanding fees. By the end of this article, you’ll have a clear understanding of how to check my turbo card balance and manage your account effectively. Let’s dive in and empower you with the tools and knowledge to take charge of your financial journey.

Read also:Discovering The Impact Of Fox Lisa Boothe A Comprehensive Guide

Table of Contents

- What is Turbo Card?

- Why Checking Your Turbo Card Balance Matters

- How Can I Check My Turbo Card Balance Online?

- Is There a Mobile App to Check My Turbo Card Balance?

- Alternative Ways to Check Your Turbo Card Balance

- Common Issues When Checking Your Turbo Card Balance

- How Often Should You Check Your Turbo Card Balance?

- Frequently Asked Questions About Checking Your Turbo Card Balance

What is Turbo Card?

The Turbo Card is a prepaid debit card designed to provide users with a convenient and secure way to manage their money. Unlike traditional credit cards, Turbo Cards are preloaded with funds, making them an excellent option for budget-conscious individuals who want to avoid debt. Users can load money onto their cards through direct deposits, bank transfers, or cash reloads at participating retailers. This flexibility allows users to tailor their financial management to their specific needs.

Turbo Cards come with a host of features that make them appealing to a wide range of consumers. For instance, they often include tools for tracking spending, setting budget limits, and even earning rewards on purchases. Additionally, Turbo Cards are accepted wherever major credit cards are accepted, making them a versatile payment option for both online and in-store transactions. These features make the Turbo Card a practical choice for individuals looking to streamline their financial lives.

One of the standout benefits of using a Turbo Card is the ability to monitor your spending in real time. By learning how to check my turbo card balance regularly, users can avoid overspending and maintain better control over their finances. Whether you’re using the card for everyday expenses or saving up for a specific goal, the Turbo Card offers a reliable and user-friendly solution to help you stay on track.

Why Checking Your Turbo Card Balance Matters

Staying on top of your Turbo Card balance is essential for maintaining financial stability and avoiding unexpected surprises. By regularly checking your balance, you can ensure that you always know how much money is available for spending. This awareness helps prevent declined transactions, overdraft fees, and other inconveniences that can arise when you exceed your available funds. In short, knowing how to check my turbo card balance is a key step in managing your finances responsibly.

Beyond avoiding financial mishaps, monitoring your Turbo Card balance also empowers you to make smarter spending decisions. For example, if you notice that your balance is running low, you can adjust your spending habits or prioritize essential purchases. This proactive approach to financial management can help you stay within your budget and achieve your financial goals more effectively. Additionally, keeping track of your balance allows you to identify any unauthorized transactions or errors, ensuring that your account remains secure.

Another reason to check your Turbo Card balance regularly is to take full advantage of its features. Many Turbo Cards offer rewards programs, cashback incentives, or other perks that are tied to your spending habits. By staying informed about your balance, you can maximize these benefits and make the most of your card. Whether you’re saving for a vacation, paying off bills, or simply managing day-to-day expenses, understanding your Turbo Card balance is a crucial part of financial success.

Read also:Diane Furnberg Exploring Her Life Achievements And Impact

How Can I Check My Turbo Card Balance Online?

Checking your Turbo Card balance online is one of the easiest and most convenient methods available. To get started, visit the official Turbo Card website and log in to your account using your credentials. If you’re a new user, you’ll need to create an account by providing some basic information, such as your card number and personal details. Once logged in, you’ll have access to a dashboard where you can view your current balance, transaction history, and other important account details.

In addition to viewing your balance, the online platform offers several tools to help you manage your Turbo Card more effectively. For instance, you can set up alerts to notify you when your balance falls below a certain threshold or when a new transaction is made. These features make it easier to stay informed and avoid any unexpected issues. The website is also optimized for mobile devices, so you can check your balance on the go without any hassle.

For users who prefer a more streamlined experience, many Turbo Card providers offer a dedicated portal specifically designed for balance inquiries. This portal allows you to check my turbo card balance quickly without navigating through multiple pages. Simply enter your card number and follow the prompts to access your account information. With just a few clicks, you’ll have all the details you need to stay on top of your finances.

Is There a Mobile App to Check My Turbo Card Balance?

Yes, there is a mobile app available for Turbo Card users, and it’s one of the most convenient ways to check your balance. The Turbo Card app is available for both iOS and Android devices and can be downloaded for free from the App Store or Google Play Store. Once installed, you’ll need to log in using your account credentials or create a new account if you’re a first-time user. The app provides a user-friendly interface that makes it easy to access your balance, transaction history, and other account details.

One of the standout features of the Turbo Card app is its real-time balance updates. Whether you’re making a purchase, reloading funds, or checking your balance, the app ensures that your information is always up to date. This real-time functionality is particularly useful for users who want to stay informed about their spending habits and avoid exceeding their available funds. Additionally, the app allows you to set up custom notifications, such as low-balance alerts or transaction confirmations, to keep you in the loop at all times.

Beyond balance inquiries, the Turbo Card app offers a variety of tools to enhance your financial management. For example, you can use the app to track your spending, categorize transactions, and even set budget goals. These features make it easier to stay organized and make informed decisions about your finances. With the Turbo Card app, you can check my turbo card balance anytime, anywhere, ensuring that you’re always in control of your financial health.

Alternative Ways to Check Your Turbo Card Balance

While online and mobile app options are the most popular methods for checking your Turbo Card balance, there are several alternative ways to access your account information. These methods are particularly useful if you encounter technical issues or prefer a more traditional approach to managing your finances. Below, we’ll explore two of the most common alternatives: phone support and in-person assistance.

Phone Support for Balance Inquiries

If you’re unable to access your Turbo Card balance online or through the app, you can always reach out to customer support for assistance. Most Turbo Card providers offer a dedicated helpline that you can call to check your balance. Simply dial the number listed on the back of your card or on the official website, and follow the prompts to speak with a representative. In many cases, you can also use an automated system to retrieve your balance by entering your card number and other identifying details.

Phone support is an excellent option for users who prefer a more personal touch or need immediate assistance. Representatives are trained to help with a variety of issues, including balance inquiries, transaction disputes, and account updates. Additionally, many providers offer 24/7 support, ensuring that you can check my turbo card balance at any time, day or night. Be sure to have your card and identification ready when calling to streamline the process.

In-Person Assistance at Partner Locations

For users who prefer face-to-face interactions, visiting a partner location is another viable option for checking your Turbo Card balance. Many retail stores, banks, and financial institutions that partner with Turbo Card providers offer balance inquiry services at no extra cost. Simply bring your card and a valid ID to the location, and a representative will assist you with accessing your account information.

This method is particularly useful for users who may not have access to the internet or a smartphone. It’s also a great way to resolve any issues or discrepancies you may encounter while managing your account. Partner locations are often equipped with tools and resources to help you check my turbo card balance quickly and efficiently. Be sure to check the official Turbo Card website for a list of nearby partner locations before visiting.

Common Issues When Checking Your Turbo Card Balance

While checking your Turbo Card balance is generally a straightforward process, users may occasionally encounter issues that can cause frustration or confusion. Understanding these common problems and knowing how to address them can save you time and ensure a smooth experience. Below, we’ll discuss some of the most frequent challenges users face when trying to check my turbo card balance.

One of the most common issues is difficulty logging into your account. This can happen if you forget your password or if your account becomes locked due to multiple failed login attempts. To resolve this, most Turbo Card providers offer a “Forgot Password” feature that allows you to reset your credentials via email or text message. If your account remains locked, you may need to contact customer support for further assistance. Keeping your login information secure and up to date can help prevent these issues from occurring.

Another challenge users may face is discrepancies in their balance or transaction history. For example, you might notice a transaction that you don’t recognize or a balance that doesn’t match your expectations. In such cases, it’s important to review your recent activity and compare it with your receipts or bank statements. If you’re unable to resolve the issue on your own, reaching out to customer support is the best course of action. They can investigate the matter and provide clarification or corrections as needed. By staying vigilant and addressing issues promptly, you can ensure that your Turbo Card balance remains accurate and reliable.

How Often Should You Check Your Turbo Card Balance?

Checking your Turbo Card balance regularly is a smart financial habit that can help you stay on top of your spending and avoid potential issues. But how often should you check my turbo card balance to ensure you’re managing your finances effectively? The answer depends on your personal spending habits and financial goals, but a good rule of thumb is to review your balance at least once a week. This frequency allows you to stay informed about your available funds and make any necessary adjustments to your budget.

For users who rely on their Turbo Card for daily expenses, checking the balance more frequently—such as every day or after major purchases—can be beneficial. This practice helps you avoid overspending and ensures that you always have enough funds for essential transactions. On the other hand, if you use your Turbo Card less frequently or primarily for specific purposes, such as bill payments or travel expenses, checking your balance once or twice a month may suffice. The key is to establish a routine that works for your lifestyle and financial needs.

It’s also important to consider external factors that may impact your Turbo Card balance.

Who Is Timpf Husband? A Deep Dive Into His Life And Influence

Discover Springwell Senior Living Community: A Haven For Active Seniors

Who Is Leah Pruett's Dad? A Deep Dive Into Her Family And Racing Legacy

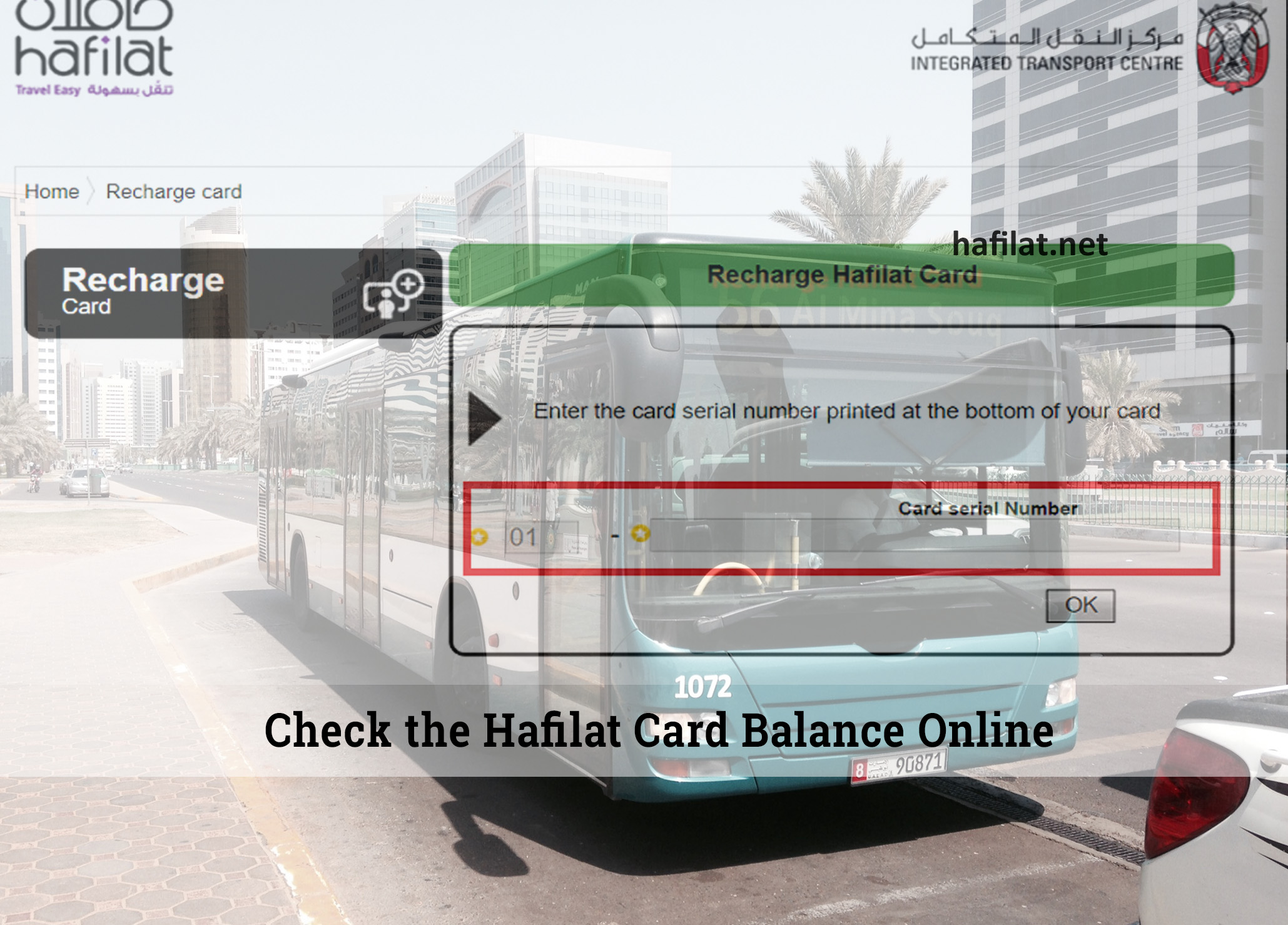

Check Hafilat Card Balance 2024 HAFILAT CARD

:max_bytes(150000):strip_icc()/005_how-to-check-amazon-gift-card-balance-4689958-ca9ed530ab6c472d858d19efe3b372b5.jpg)

Check My Big 5 Gift Card Balance Ebba Neille