Understanding JPMCB Card Services Account: Features, Benefits, And More

Managing your finances effectively often starts with choosing the right banking partner. JPMCB Card Services Account offers a seamless way to streamline your financial activities while ensuring security and convenience. Whether you're looking to manage your credit card payments, track expenses, or explore exclusive perks, this service is designed to meet your needs. With a robust platform and user-friendly interface, JPMCB Card Services Account stands out as a reliable tool for individuals seeking financial clarity and control.

As one of the leading financial institutions, JPMCB (JPMorgan Chase Bank) has consistently prioritized customer satisfaction by offering innovative solutions. Their Card Services Account is no exception, providing users with access to a suite of features that simplify financial management. From real-time transaction updates to personalized spending insights, this service ensures that you stay on top of your financial game. It’s not just about convenience; it’s about empowering you to make smarter financial decisions.

In today’s fast-paced world, having a centralized platform to manage your credit card accounts is more important than ever. JPMCB Card Services Account ensures that you can access your account anytime, anywhere, using your preferred device. With advanced security measures in place, you can rest assured that your financial information is protected. Whether you're a new user or a long-time customer, this service is tailored to enhance your banking experience and provide peace of mind.

Read also:Exploring Adam Savages Children A Glimpse Into Their Lives And Influence

Table of Contents

- What is JPMCB Card Services Account and How Does It Work?

- Key Features of JPMCB Card Services Account

- What Are the Benefits of Using JPMCB Card Services Account?

- How to Access and Manage Your JPMCB Card Services Account?

- What Security Measures Does JPMCB Card Services Account Offer?

- Common Issues with JPMCB Card Services Account and How to Resolve Them

- How Does JPMCB Card Services Account Compare to Other Banking Services?

- Frequently Asked Questions About JPMCB Card Services Account

What is JPMCB Card Services Account and How Does It Work?

JPMCB Card Services Account is a specialized platform designed to help users manage their credit card accounts efficiently. This service is offered by JPMorgan Chase Bank, one of the largest and most trusted financial institutions globally. The platform allows users to monitor their credit card transactions, make payments, and access personalized insights into their spending habits. It serves as a one-stop solution for all credit card-related activities, ensuring that users have full control over their financial health.

So, how does JPMCB Card Services Account work? Once you sign up for the service, you gain access to a secure online portal or mobile app where you can view your account details. The platform provides real-time updates on your transactions, enabling you to track your expenses as they happen. You can set up automatic payments to avoid late fees or manually schedule payments based on your preferences. Additionally, the service offers tools like budgeting calculators and spending categorization to help you stay on top of your financial goals.

One of the standout features of JPMCB Card Services Account is its integration with other Chase banking products. If you have a checking or savings account with Chase, you can link it to your card services account for seamless money transfers. This interconnectedness makes it easier to manage multiple accounts from a single platform. Furthermore, the service is available 24/7, ensuring that you can access your account whenever you need to. Whether you're at home or on the go, JPMCB Card Services Account is designed to adapt to your lifestyle.

Key Features of JPMCB Card Services Account

JPMCB Card Services Account comes packed with features that cater to a wide range of user needs. These features are designed to enhance convenience, security, and overall user experience. Below, we’ll explore some of the most notable aspects of this service.

Real-Time Transaction Tracking

One of the most valuable features of JPMCB Card Services Account is its ability to provide real-time transaction updates. This means that every time you use your credit card, the transaction is immediately reflected in your account. This feature allows you to monitor your spending habits closely and identify any unauthorized transactions promptly. Real-time tracking is particularly useful for those who want to stay on top of their finances and avoid overspending.

Personalized Spending Insights

Another standout feature is the personalized spending insights offered by the platform. These insights are generated based on your transaction history and provide a detailed breakdown of your spending patterns. For example, you can see how much you’ve spent on groceries, dining, or entertainment over a specific period. This feature helps you identify areas where you can cut back and make more informed financial decisions.

Read also:Understanding Steve Dulcichs Illness A Comprehensive Guide

Automatic Payment Scheduling

For users who prefer a hands-off approach to managing their credit card payments, JPMCB Card Services Account offers automatic payment scheduling. This feature allows you to set up recurring payments for your credit card bills, ensuring that you never miss a payment deadline. You can choose to pay the minimum amount due, the full balance, or a custom amount based on your preferences.

Integration with Other Chase Products

As mentioned earlier, JPMCB Card Services Account seamlessly integrates with other Chase banking products. This integration allows you to link your credit card account with your checking or savings account for easy money transfers. It also enables you to view all your accounts in one place, making it easier to manage your overall financial picture.

24/7 Account Access

Lastly, the service is available 24/7, ensuring that you can access your account whenever you need to. Whether you’re checking your balance, making a payment, or reviewing your transaction history, you can do so at any time of the day or night. This round-the-clock availability is particularly beneficial for users with busy schedules or those who travel frequently.

What Are the Benefits of Using JPMCB Card Services Account?

Using JPMCB Card Services Account comes with a host of benefits that make it an attractive option for managing your credit card activities. These benefits range from enhanced convenience to improved financial management, making it a valuable tool for users of all backgrounds.

Convenience and Accessibility

One of the primary benefits of JPMCB Card Services Account is the convenience it offers. With a user-friendly interface and 24/7 access, you can manage your credit card account from anywhere in the world. Whether you’re using a desktop computer, smartphone, or tablet, the platform is designed to provide a seamless experience. This level of accessibility ensures that you’re always in control of your finances, no matter where you are.

Improved Financial Management

Another significant benefit is the platform’s ability to improve your financial management. With features like real-time transaction tracking and personalized spending insights, you can gain a deeper understanding of your financial habits. This knowledge empowers you to make smarter decisions, such as cutting back on unnecessary expenses or setting realistic budgeting goals. Over time, these small changes can lead to significant financial improvements.

Enhanced Security

Security is a top priority for JPMCB Card Services Account, and the platform offers several measures to protect your financial information. From two-factor authentication to encryption protocols, the service ensures that your account is safeguarded against unauthorized access. This peace of mind is invaluable, especially in an era where cyber threats are increasingly common.

Exclusive Perks and Rewards

Many users also appreciate the exclusive perks and rewards offered through JPMCB Card Services Account. Depending on the type of credit card you have, you may be eligible for cashback offers, travel rewards, or discounts at partner merchants. These benefits not only enhance your banking experience but also provide tangible value that can save you money in the long run.

Customer Support

Finally, JPMCB Card Services Account provides excellent customer support to assist you with any issues or questions. Whether you need help setting up your account, resolving a transaction dispute, or understanding your spending insights, the support team is available to guide you. This level of service ensures that you’re never left in the dark when it comes to managing your finances.

How to Access and Manage Your JPMCB Card Services Account?

Accessing and managing your JPMCB Card Services Account is a straightforward process, but it’s important to follow the right steps to ensure a smooth experience. Below, we’ll walk you through the process of setting up your account, accessing it, and managing your credit card activities effectively.

Setting Up Your Account

To get started, you’ll need to create an account on the JPMCB Card Services platform. Visit the official Chase website and navigate to the card services section. From there, you can click on the option to create a new account. You’ll be prompted to enter your credit card details and set up a username and password. Once your account is created, you can log in using these credentials.

Accessing Your Account

Once your account is set up, you can access it through the Chase website or mobile app. Simply enter your login credentials to view your account dashboard. From here, you can see your current balance, recent transactions, and available credit. The dashboard also provides quick links to features like payment scheduling and spending insights, making it easy to manage your account.

Managing Your Credit Card Activities

Managing your credit card activities is where JPMCB Card Services Account truly shines. You can make payments, set up automatic payment schedules, and review your transaction history with just a few clicks. Additionally, the platform offers tools like budgeting calculators and spending categorization to help you stay on top of your financial goals. If you encounter any issues, the customer support team is available to assist you.

Using the Mobile App

For added convenience, you can download the Chase mobile app to access your JPMCB Card Services Account on the go. The app offers all the features available on the website, along with additional tools like mobile check deposit and push notifications for transaction updates. This ensures that you can manage your account anytime, anywhere, without missing a beat.

What Security Measures Does JPMCB Card Services Account Offer?

Security is a top priority for JPMCB Card Services Account, and the platform employs several measures to protect your financial information. These measures are designed to safeguard your account against unauthorized access and ensure that your data remains confidential at all times.

Two-Factor Authentication

One of the most effective security measures offered by JPMCB Card Services Account is two-factor authentication. This feature requires you to provide two forms of identification before accessing your account. Typically, this involves entering your password and a one-time code sent to your registered mobile device. Two-factor authentication adds an extra layer of security, making it significantly harder for unauthorized users to gain access to your account.

Encryption Protocols

Another critical security measure is the use of encryption protocols to protect your data. All information transmitted between your device and the JPMCB Card Services platform is encrypted using advanced algorithms. This ensures that your financial details, such as your credit card number and transaction history, remain confidential and cannot be intercepted by third parties.

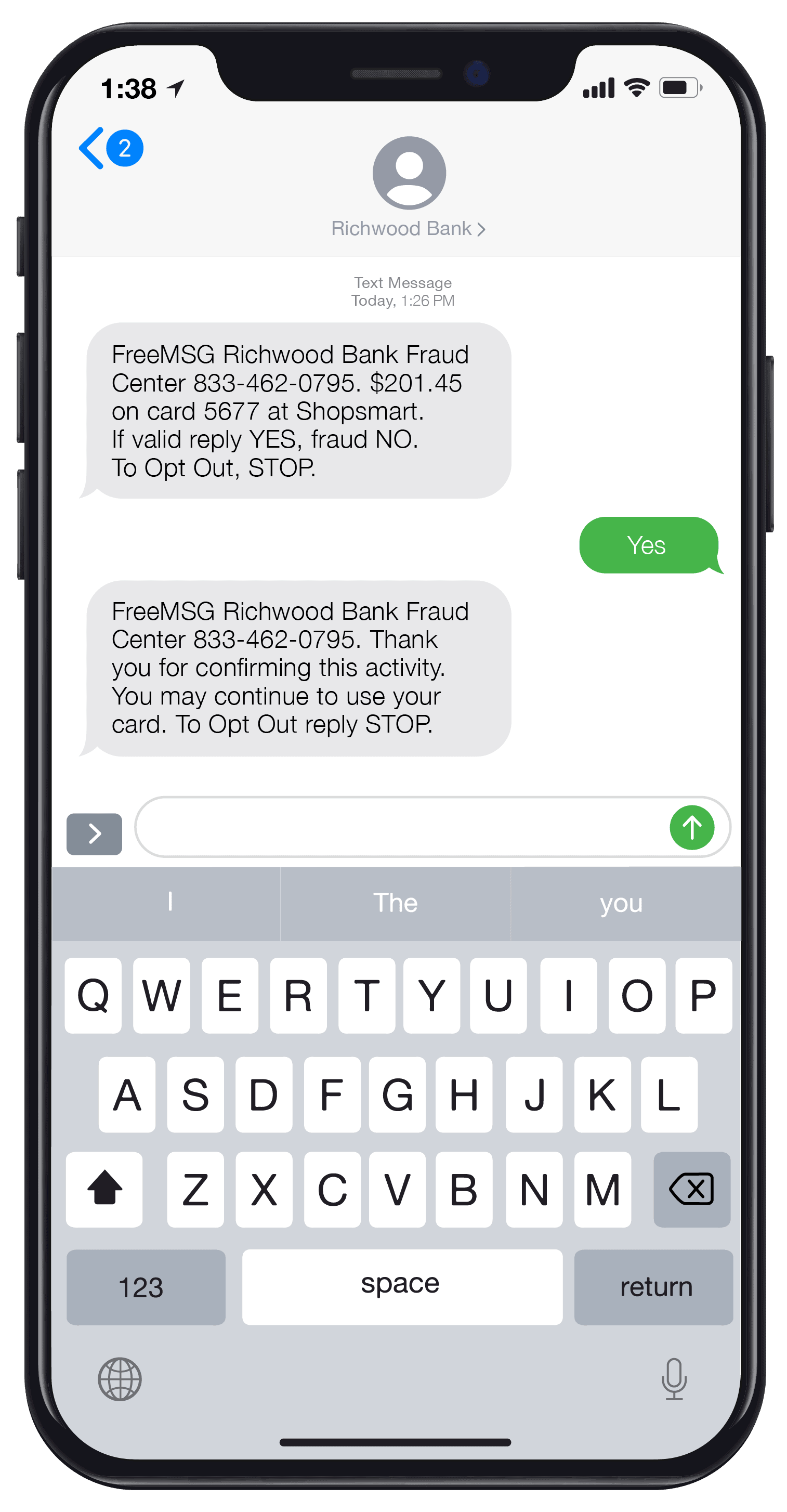

Fraud Detection Systems

JPMCB Card Services Account also employs sophisticated fraud detection systems to monitor your account for suspicious activity. These systems analyze your transaction patterns and flag any anomalies that may indicate fraudulent behavior. If a suspicious transaction is detected, you’ll be notified immediately, allowing you to take action and prevent potential losses.

Account Lockout Policies

To further enhance security, the platform implements account lockout policies. If multiple failed login attempts are detected, your account will be temporarily locked to prevent unauthorized access. This policy ensures that even if someone tries to guess your password, they won’t be able to access your account after a certain number of attempts.

Customer Support for Security Issues

Finally, JPMCB Card Services Account provides dedicated customer support to assist you with any security-related issues. Whether you need help resetting your password, reporting a suspicious transaction, or understanding your account’s security features, the support team is available to guide you. This level of service ensures that you’re never left in the dark when it comes to protecting your financial information.

Common Issues with JPMCB Card Services Account and How to Resolve Them

While JPMCB Card Services Account is designed to provide a seamless user experience, like any digital platform, it may encounter occasional issues. Understanding these common problems and knowing how to resolve them can help you maintain uninterrupted access to your account.

Forgotten Passwords

One of the most frequent issues users face is forgetting their login credentials, particularly their passwords. Fortunately, JPMCB Card Services Account offers a straightforward password reset process. Simply click on the “Forgot Password” link on the login page and follow the instructions to reset your password. You’ll typically receive

Discover The Amazing Benefits Of Seaweed Snacks For A Healthier Lifestyle

Discover The Largest Mall In California: A Shopper's Paradise

Exploring Lil Scrappy Relationship Status: A Deep Dive Into His Personal Life

Jpmcb Card Services Fraud Phone Number

Who Is Jpmcb Card Services