What Is Experian Boost: A Complete Guide To Boosting Your Credit Score

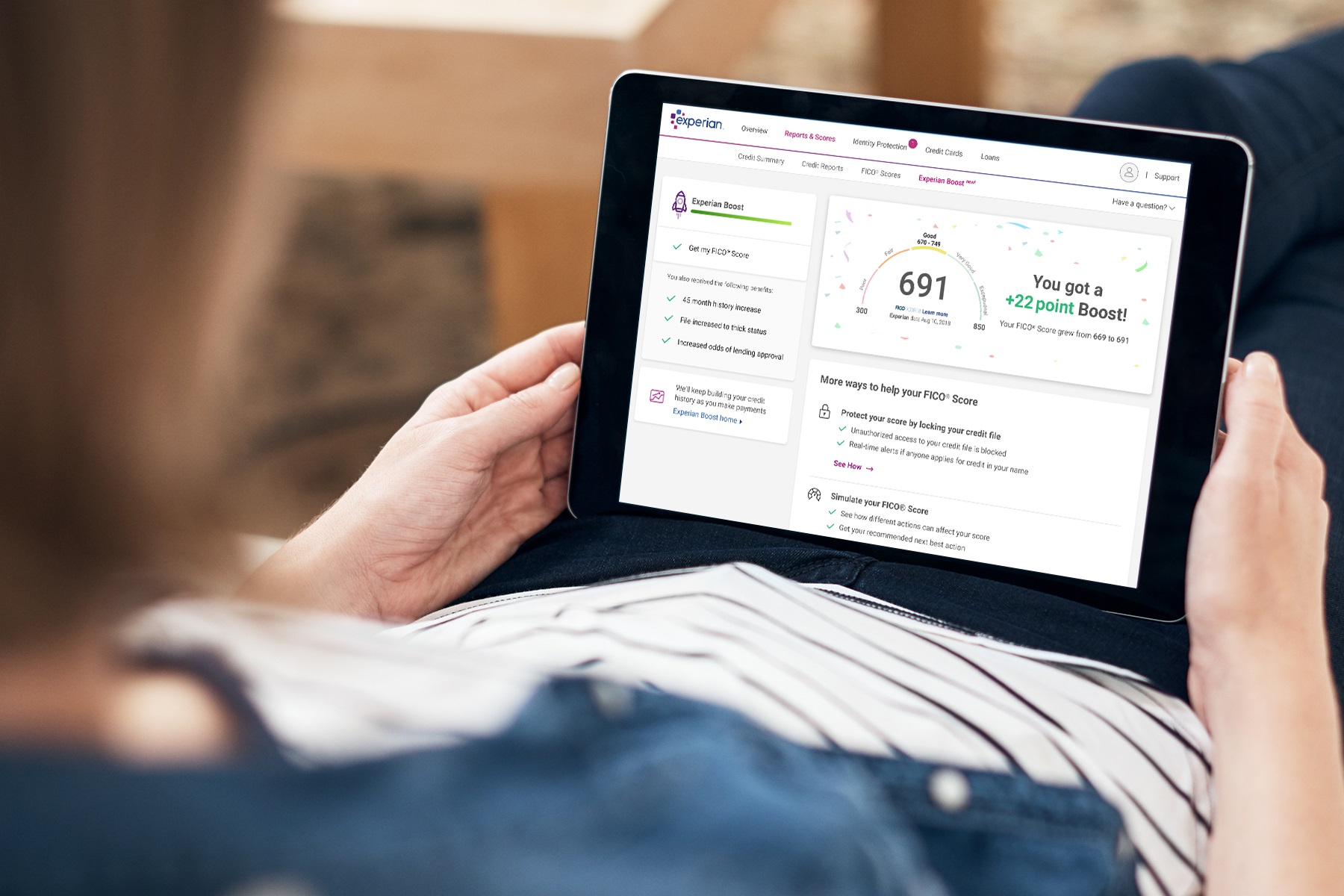

Have you ever wondered how to give your credit score a quick and effective boost without waiting years for traditional credit-building methods? Experian Boost might just be the answer you're looking for. This innovative financial tool allows you to include utility and telecom payments in your credit report, potentially increasing your credit score instantly. For individuals struggling with limited credit history or looking to improve their financial standing, Experian Boost offers a simple and accessible solution. It’s not just about improving a number—it’s about unlocking better financial opportunities, like securing loans, credit cards, or even favorable interest rates.

Experian Boost is a game-changer in the world of credit scoring because it leverages everyday payments that were previously ignored by traditional credit reporting systems. By adding your on-time utility, phone, and streaming service payments to your credit file, you can demonstrate financial responsibility to lenders. This is particularly beneficial for those who may not have a robust credit history but consistently pay their bills on time. The best part? It’s completely free and easy to set up, making it an accessible tool for almost anyone looking to improve their credit health.

As we dive deeper into the details of Experian Boost, we’ll explore how it works, who can benefit from it, and whether it’s the right choice for you. We’ll also address common concerns, such as its impact on your credit score and how it compares to other credit-building strategies. Whether you're new to credit or looking to refine your financial profile, understanding Experian Boost could be the key to unlocking your financial potential.

Read also:What Are Examples A Comprehensive Guide To Understanding And Using Examples Effectively

Table of Contents

- How Does Experian Boost Work?

- Who Can Benefit from Experian Boost?

- Is Experian Boost Safe to Use?

- How to Set Up Experian Boost

- What Are the Limitations of Experian Boost?

- How Does Experian Boost Affect Your Credit Score?

- Alternatives to Experian Boost

- Frequently Asked Questions About Experian Boost

How Does Experian Boost Work?

Experian Boost operates on a simple yet powerful premise: it allows you to incorporate your on-time utility, phone, and streaming service payments into your credit report. These payments are typically not reported to credit bureaus, meaning they don’t contribute to your credit score. However, Experian Boost changes that by giving you the ability to include these payments in your credit file, potentially improving your credit score instantly.

Here’s how it works step by step:

- Link Your Bank Account: To get started, you’ll need to create a free Experian account and link your bank account. Experian uses secure encryption to protect your financial information, ensuring your data remains safe throughout the process.

- Identify Eligible Payments: Once your account is linked, Experian scans your transaction history to identify eligible payments, such as utility bills, phone bills, and even streaming service subscriptions like Netflix or Hulu.

- Verify and Add Payments: After identifying these payments, you’ll have the opportunity to review and confirm which ones you’d like to add to your credit file. Once verified, these payments are included in your Experian credit report.

- Instant Credit Score Update: The final step is the most exciting—your credit score is recalculated in real-time to reflect the addition of these payments. Many users see an immediate improvement in their credit score, sometimes by as much as 10 to 20 points.

By leveraging Experian Boost, you’re essentially turning your everyday financial habits into a tool for credit improvement. It’s a unique approach that highlights the importance of consistent bill payments, even for services that aren’t traditionally associated with credit reporting. This innovation is particularly valuable for individuals who may not have access to traditional credit-building methods like credit cards or loans.

Who Can Benefit from Experian Boost?

Not everyone will see the same level of benefit from Experian Boost, but certain groups stand to gain significantly from this tool. Let’s explore who can benefit the most and why.

Are You a Credit Newbie? Experian Boost Can Help!

If you’re new to the world of credit, Experian Boost can be a lifesaver. Many people, especially young adults or those new to the financial system, struggle to build credit because they lack a credit history. Traditional credit scoring models rely heavily on credit card usage, loans, and other financial products that may not be accessible to everyone. Experian Boost bridges this gap by allowing you to include utility and telecom payments, which are often the first financial obligations people take on.

What About Individuals with Thin Credit Files?

Individuals with thin credit files—those who have limited credit history—can also benefit greatly from Experian Boost. A thin credit file makes it difficult for lenders to assess your creditworthiness, often resulting in higher interest rates or denied applications. By adding consistent bill payments to your credit report, Experian Boost provides lenders with a more comprehensive view of your financial behavior, potentially improving your chances of approval for loans, credit cards, and other financial products.

Read also:Unlock The Fun Infinite Craft Unblocked Ndash The Ultimate Guide

Other Beneficiaries of Experian Boost

- Renters: If you’re paying rent on time but your landlord doesn’t report it to credit bureaus, Experian Boost can help you get credit for this significant monthly expense.

- Consumers with Fair Credit: If your credit score is hovering in the fair range, Experian Boost could push it into the good or excellent range, opening up better financial opportunities.

- People Rebuilding Credit: For those recovering from financial setbacks, Experian Boost offers a way to rebuild credit by showcasing positive payment behavior.

Is Experian Boost Safe to Use?

When it comes to sharing financial information online, safety is a top concern for many users. Fortunately, Experian Boost is designed with robust security measures to protect your data and ensure peace of mind.

How Does Experian Protect Your Data?

Experian uses bank-level encryption and secure authentication protocols to safeguard your information. When you link your bank account, Experian only accesses the data necessary to identify eligible payments—it does not store or share sensitive financial details like account numbers. This ensures that your personal information remains confidential and secure throughout the process.

What About Privacy Concerns?

Privacy is another critical consideration. Experian Boost operates on an opt-in basis, meaning you have full control over which payments are added to your credit report. You can review and approve each transaction before it’s included, ensuring transparency and accuracy. Additionally, Experian adheres to strict privacy policies and regulations, such as the Fair Credit Reporting Act (FCRA), to protect your rights as a consumer.

While no online service is entirely risk-free, Experian Boost’s combination of encryption, transparency, and regulatory compliance makes it a safe and reliable tool for improving your credit score.

How to Set Up Experian Boost

Setting up Experian Boost is a straightforward process that can be completed in just a few minutes. Follow these steps to get started:

- Create an Experian Account: Visit Experian’s website and sign up for a free account. You’ll need to provide some basic personal information, such as your name, address, and Social Security number.

- Link Your Bank Account: Once your account is created, you’ll be prompted to link your bank account. Experian uses secure authentication to verify your identity and access your transaction history.

- Review Eligible Payments: After linking your account, Experian will analyze your transaction history to identify eligible payments, such as utility bills, phone bills, and streaming services.

- Verify and Confirm Payments: Review the list of identified payments and confirm which ones you’d like to add to your credit report. You can exclude any payments you don’t want to include.

- Check Your Updated Credit Score: Once you’ve confirmed your payments, Experian will update your credit report and recalculate your credit score in real-time. You’ll be able to see the impact immediately.

By following these steps, you can quickly and easily enhance your credit profile with Experian Boost. The process is user-friendly and designed to be accessible for individuals of all technical skill levels.

What Are the Limitations of Experian Boost?

While Experian Boost offers significant benefits, it’s important to be aware of its limitations to set realistic expectations.

Why Doesn’t Experian Boost Work for Everyone?

Experian Boost only affects your Experian credit report, meaning it won’t impact your credit scores from other bureaus like Equifax or TransUnion. Additionally, the tool is most effective for individuals who consistently pay their utility and telecom bills on time. If your payment history is inconsistent, the impact on your credit score may be minimal.

Other Limitations to Consider

- Limited Payment Types: Experian Boost only includes utility, phone, and streaming service payments. Rent and other recurring expenses are not eligible unless reported by your landlord or service provider.

- Dependent on Lender Usage: Not all lenders use Experian credit reports, so the benefits of Experian Boost may not be reflected in all credit applications.

How Does Experian Boost Affect Your Credit Score?

Experian Boost can have a positive impact on your credit score by adding positive payment history to your credit report. However, the extent of the impact depends on your unique financial situation. For individuals with thin or limited credit files, the boost can be significant, potentially increasing their score by 10 to 20 points or more. For those with established credit histories, the impact may be less dramatic but still beneficial.

Alternatives to Experian Boost

If Experian Boost isn’t the right fit for you, there are other strategies to improve your credit score. These include:

- Secured credit cards

- Credit-builder loans

- Becoming an authorized user on someone else’s credit card

Frequently Asked Questions About Experian Boost

Does Experian Boost Work for All Credit Scores?

Experian Boost is most effective for individuals with thin or limited credit files, but it can benefit users across all credit score ranges.

Is Experian Boost Really Free?

Yes, Experian Boost is completely free to use. There are no hidden fees or charges.

Can Experian Boost Hurt My Credit Score?

No, Experian Boost cannot hurt your credit score. It only adds positive payment history to your credit report.

Conclusion

Experian Boost is a powerful tool that can help you improve your credit score by leveraging everyday payments. Whether you’re new to credit, rebuilding your financial profile, or simply looking to enhance your credit score, Experian Boost offers a simple and effective solution. By understanding how it works, who can benefit, and its limitations, you can make an informed decision about whether it’s the right choice for you.

For more information on credit scores and financial health, check out this external resource.

What Are The Names Of Elon Musk's Children: A Complete Guide

Unlocking Remote Access: A Comprehensive Guide To RemoteIoT Web SSH Raspberry Pi Free

Who Is Elaine Chappelle? Discover Her Inspiring Journey And Legacy

Starting Today, Consumers Can Benefit From Having Their Credit Score

Experian Boost Makes Fast Company’s List of 2022 World Changing Ideas