Does Experian Boost Cost Money? Exploring The Benefits And Costs

Are you wondering if Experian Boost comes with a price tag? This innovative financial tool has gained significant attention for its ability to help individuals improve their credit scores by incorporating utility and streaming service payments. However, many people hesitate to use it, fearing hidden costs or subscription fees. In this article, we will delve into the specifics of Experian Boost, addressing whether it truly costs money and exploring its potential benefits for your financial health. By the end, you’ll have a clear understanding of how this tool works and whether it’s the right choice for you.

Experian Boost is a free service offered by Experian, one of the three major credit bureaus in the United States. It allows users to include positive payment history from utility bills, phone bills, and streaming services like Netflix or Hulu in their credit reports. This can be particularly advantageous for individuals with limited credit history or those looking to enhance their credit scores. While the service itself is free, it’s essential to understand how it works, its potential impact on your credit score, and whether there are any indirect costs associated with its use.

In today’s world, maintaining a healthy credit score is crucial for accessing loans, credit cards, and even rental opportunities. Many people are unaware that traditional credit scoring models often overlook regular payments like utility bills, which can leave a gap in their credit history. Experian Boost aims to bridge this gap, but does it come with strings attached? Let’s dive deeper into the details to uncover the truth about Experian Boost and whether it’s worth your time and effort.

Read also:Unlock The Fun Infinite Craft Unblocked Ndash The Ultimate Guide

Table of Contents

- What is Experian Boost and How Does It Work?

- Does Experian Boost Cost Money?

- What Are the Benefits of Using Experian Boost?

- Are There Any Potential Drawbacks of Experian Boost?

- How to Use Experian Boost Effectively

- How Much Can Experian Boost Improve Your Credit Score?

- What Are Some Alternatives to Experian Boost?

- Frequently Asked Questions About Experian Boost

What is Experian Boost and How Does It Work?

Experian Boost is a service designed to help individuals improve their credit scores by incorporating alternative payment data into their credit reports. Traditionally, credit scores are calculated based on factors like credit card payments, loans, and mortgages. However, many people regularly pay utility bills, phone bills, and streaming services on time, yet these payments are not typically included in credit reports. Experian Boost addresses this gap by allowing users to link their bank accounts and select which payments they want to include in their credit history.

Here’s how it works:

- Link Your Bank Account: You’ll need to connect your bank account to Experian’s platform securely. This allows Experian to access your transaction history and identify qualifying payments.

- Select Payments to Include: Once your account is linked, you can choose which utility, phone, or streaming service payments you want to add to your credit report.

- Update Your Credit Report: After selecting the payments, Experian updates your credit report to reflect this additional positive payment history.

By incorporating these payments, Experian Boost provides a more comprehensive view of your financial responsibility, potentially boosting your credit score. This is especially beneficial for individuals with thin credit files or those who are new to credit. However, it’s important to note that not all payments qualify, and the impact on your credit score may vary depending on your unique financial situation.

Does Experian Boost Cost Money?

One of the most common questions people ask is, “Does Experian Boost cost money?” The short answer is no. Experian Boost is a free service provided by Experian. There are no subscription fees, hidden charges, or costs associated with using this tool. This makes it an accessible option for individuals looking to improve their credit scores without financial strain.

However, while the service itself is free, there are a few indirect considerations to keep in mind:

- Bank Account Linking: You’ll need to link your bank account to Experian Boost, which requires sharing sensitive financial information. While Experian uses encryption and security measures to protect your data, some users may feel uncomfortable with this process.

- Credit Monitoring Services: While Experian Boost is free, Experian also offers paid credit monitoring services. These services are optional and not required to use Experian Boost, but they may be promoted during the setup process.

Overall, Experian Boost is a cost-free way to potentially improve your credit score. However, it’s essential to weigh the benefits against any concerns you may have about data security or additional services being marketed to you.

Read also:Mastering Remote Iot Vpc Ssh A Comprehensive Guide To Secure Connectivity

What Are the Benefits of Using Experian Boost?

Using Experian Boost can offer several advantages for individuals looking to enhance their credit profiles. Here are some of the key benefits:

- Improved Credit Score: By including positive payment history from utility bills, phone bills, and streaming services, Experian Boost can help increase your credit score. This is especially beneficial for individuals with limited credit history or those who have struggled to build credit through traditional means.

- No Cost to Use: As mentioned earlier, Experian Boost is entirely free. There are no fees or charges associated with linking your accounts or updating your credit report.

- Quick Results: Many users see an immediate improvement in their credit scores after using Experian Boost. The process is straightforward and can be completed in a matter of minutes.

- Increased Financial Inclusion: Experian Boost helps individuals who may not have access to traditional credit products, such as credit cards or loans, by recognizing their regular bill payments as a form of financial responsibility.

These benefits make Experian Boost an attractive option for anyone looking to improve their credit score without incurring additional costs. However, it’s important to understand that the impact on your credit score may vary depending on your financial situation and the types of payments you include.

Are There Any Potential Drawbacks of Experian Boost?

While Experian Boost offers numerous benefits, it’s essential to consider potential drawbacks before using the service. Here are some factors to keep in mind:

- Limited to Experian: Experian Boost only affects your Experian credit report. If lenders or creditors rely on credit reports from other bureaus like Equifax or TransUnion, the impact of Experian Boost may not be reflected in those reports.

- Not All Payments Qualify: Only specific types of payments, such as utility bills, phone bills, and streaming services, are eligible. Rent payments, for example, are not included unless you use a third-party service to report them.

- Data Privacy Concerns: Linking your bank account to Experian Boost requires sharing sensitive financial information. While Experian employs robust security measures, some users may feel uneasy about this process.

Despite these drawbacks, many people find that the benefits of Experian Boost outweigh the potential risks. It’s a valuable tool for individuals looking to improve their credit scores without incurring additional costs.

How to Use Experian Boost Effectively

Using Experian Boost effectively can help you maximize its benefits and achieve the best possible results. Here’s a step-by-step guide to getting started:

Step-by-Step Guide to Setting Up Experian Boost

- Create an Experian Account: Visit Experian’s website and sign up for a free account. This will give you access to Experian Boost and other credit-related services.

- Link Your Bank Account: Follow the prompts to securely connect your bank account to Experian Boost. You’ll need to provide your login credentials, but rest assured that Experian uses encryption to protect your data.

- Select Payments to Include: Once your account is linked, Experian will identify qualifying payments. Review the list and select the payments you want to add to your credit report.

- Confirm and Update: After selecting your payments, confirm your choices and allow Experian to update your credit report. This process is typically quick and can result in an immediate improvement in your credit score.

Tips for Maximizing Your Results

- Include Consistent Payments: Focus on payments that you consistently make on time, as these will have the most positive impact on your credit score.

- Monitor Your Credit Report: Regularly check your credit report to ensure that your payments are being accurately reflected. This will also help you identify any errors or discrepancies.

- Combine with Other Credit-Building Strategies: While Experian Boost is a valuable tool, it’s most effective when combined with other credit-building strategies, such as paying down debt and keeping credit card balances low.

By following these steps and tips, you can make the most of Experian Boost and achieve a healthier credit score.

How Much Can Experian Boost Improve Your Credit Score?

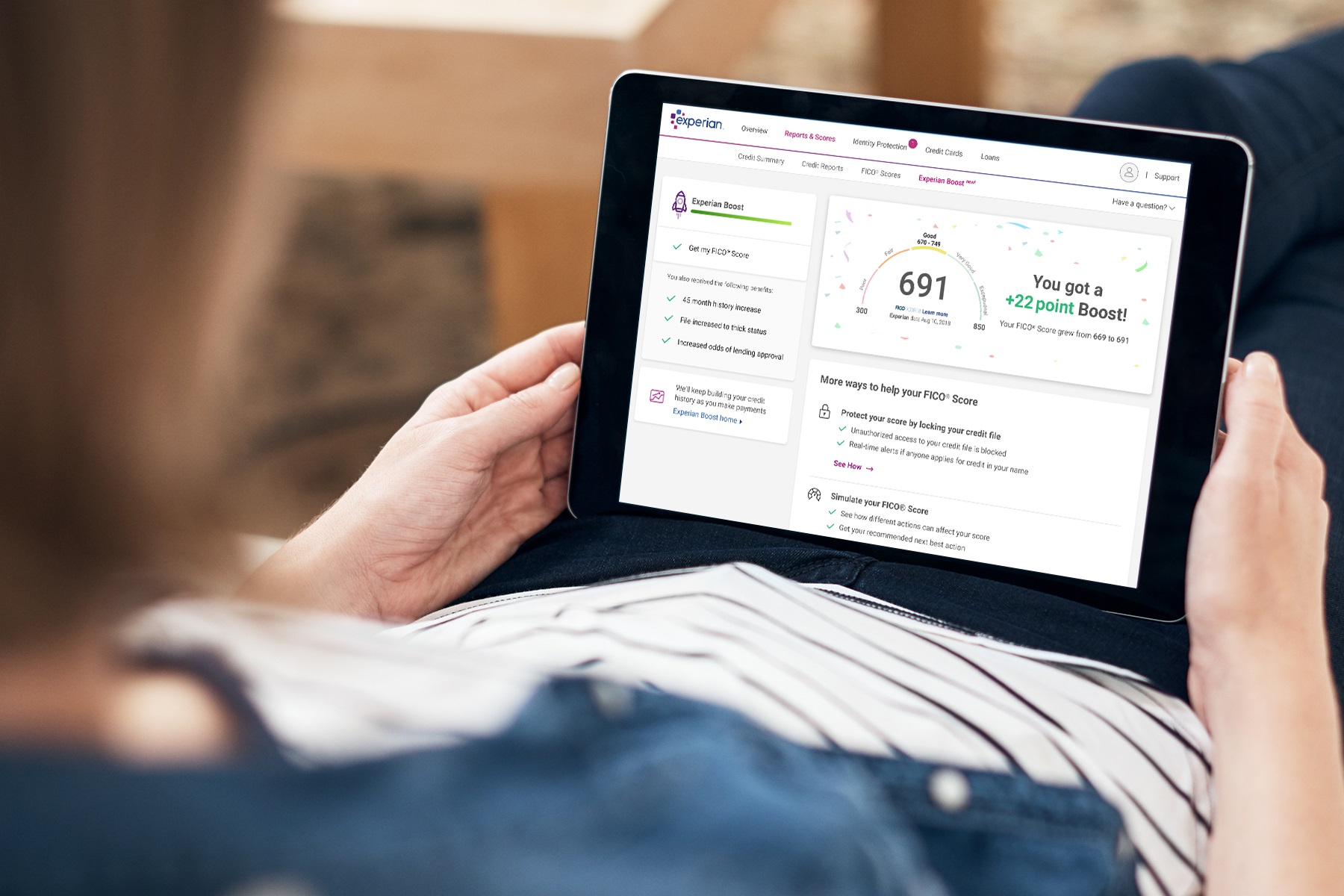

The impact of Experian Boost on your credit score can vary depending on your unique financial situation. For individuals with thin credit files or limited credit history, the improvement can be significant. Some users have reported increases of 10 to 20 points or more after using Experian Boost. However, for those with established credit histories, the impact may be less pronounced.

Several factors influence how much Experian Boost can improve your credit score:

- Payment History: The more consistent and positive your payment history, the greater the potential impact on your credit score.

- Credit Utilization: If your credit utilization ratio is high, the impact of Experian Boost may be less noticeable. It’s important to address high utilization alongside using Experian Boost.

- Credit Mix: Adding alternative payment data can diversify your credit mix, which may positively affect your credit score.

While Experian Boost can provide a helpful boost to your credit score, it’s important to manage your finances responsibly and address other factors that may be impacting your credit.

What Are Some Alternatives to Experian Boost?

If Experian Boost doesn’t meet your needs or you’re looking for additional ways to improve your credit score, there are several alternatives to consider:

- Secured Credit Cards: These cards require a security deposit and are an excellent option for individuals with limited or poor credit history.

- Credit-Builder Loans: These loans are designed to help individuals build credit by making regular payments over time.

- Rent Reporting Services: Some services allow you to report your rent payments to credit bureaus, which can help improve your credit score.

Each of these alternatives has its own benefits and drawbacks, so it’s important to choose the option that best aligns with your financial goals.

Frequently Asked Questions About Experian Boost

Does Experian Boost Really Work?

Yes, Experian Boost can be effective in improving your credit score by incorporating positive payment history from utility bills, phone bills,

Matthew Hussey Wife Audrey Age: A Complete Guide To Their Love Story

Jocko Sims Wife: A Comprehensive Look At Their Life Together

Doraemon The Movies Movies: A Timeless Journey Through Adventure And Friendship

Starting Today, Consumers Can Benefit From Having Their Credit Score

Experian Boost Makes Fast Company’s List of 2022 World Changing Ideas