How To Boost Your Experian Credit Score: A Comprehensive Guide

Millions of people struggle to understand how credit scores work and how they can improve theirs. A strong Experian credit score is more than just a number—it’s a gateway to better financial opportunities, including lower interest rates on loans, higher chances of loan approvals, and even better terms on credit cards. In this guide, we’ll explore everything you need to know about boosting your Experian credit score, from understanding the factors that influence it to actionable strategies you can implement today. Whether you’re rebuilding your credit or aiming for perfection, this article has got you covered.

Boosting your Experian credit score isn’t an overnight process, but with the right approach, it’s entirely achievable. Your credit score is calculated based on several key factors, including payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. Understanding how these factors interact can help you make informed decisions about your financial habits. For example, consistently paying your bills on time can significantly improve your score, while maxing out your credit cards can have the opposite effect. By breaking down these components and offering practical tips, this guide aims to empower you to take control of your credit health.

Why is an Experian credit score boost so important? Simply put, it can transform your financial future. A higher credit score opens doors to better financial products and services, which can save you thousands of dollars in interest payments over time. Additionally, a strong credit score can improve your chances of renting an apartment, securing a job, or even getting approved for utilities without a deposit. In this article, we’ll dive deep into actionable strategies, tools, and resources to help you achieve a credit score boost while adhering to best practices. Let’s get started on your journey to financial success!

Read also:Discover Robie Uniacke A Journey Into His Life And Achievements

Table of Contents

- What is an Experian Credit Score and Why Does It Matter?

- What Are the Key Factors Affecting Your Experian Credit Score?

- Practical Tips to Boost Your Experian Credit Score

- What Are the Most Common Mistakes That Hurt Your Credit Score?

- Tools and Resources for Monitoring Your Credit Score

- How Can You Build Long-Term Credit Health?

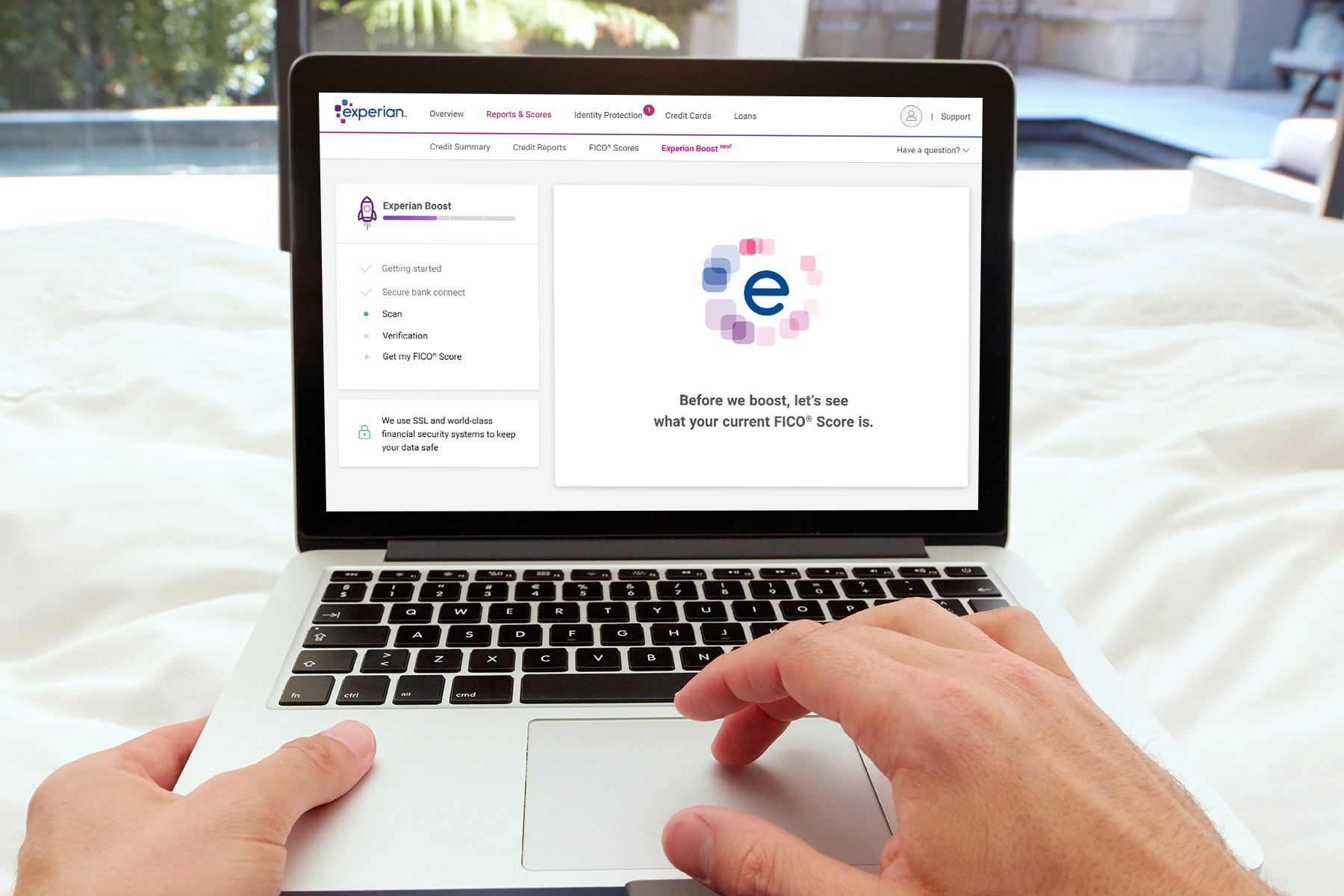

- What is Experian Boost and How Can It Help?

- Frequently Asked Questions About Experian Credit Score Boost

What is an Experian Credit Score and Why Does It Matter?

Before diving into strategies for boosting your Experian credit score, it’s essential to understand what it is and why it holds such importance. Experian is one of the three major credit bureaus in the United States, alongside Equifax and TransUnion. These bureaus collect and analyze financial data about consumers to generate credit reports, which are then used to calculate credit scores. Your Experian credit score is a numerical representation of your creditworthiness, ranging from 300 to 850. A higher score indicates to lenders that you’re a low-risk borrower, making you more likely to qualify for favorable financial products.

Why does your Experian credit score matter so much? For starters, it plays a pivotal role in determining your eligibility for loans, credit cards, and even rental agreements. Lenders rely on your credit score to assess the likelihood of you repaying borrowed money on time. A low score can result in higher interest rates or outright rejections, while a high score can save you money and provide access to premium financial services. For example, someone with a credit score above 750 might qualify for a mortgage with a 3% interest rate, whereas someone with a score below 600 might face rates as high as 6% or more. That difference can translate into tens of thousands of dollars over the life of a loan.

Beyond loans and credit cards, your Experian credit score can also impact other areas of your life. Landlords often check credit scores to evaluate potential tenants, and some employers review credit reports as part of the hiring process. Utility companies may require deposits for individuals with poor credit scores, and even insurance premiums can be influenced by your credit health. In short, your Experian credit score is a critical component of your financial identity, and boosting it can lead to significant benefits across various aspects of your life.

What Are the Key Factors Affecting Your Experian Credit Score?

Your Experian credit score is influenced by several key factors, each contributing a specific percentage to your overall score. Understanding these factors can help you identify areas for improvement and develop targeted strategies to boost your score. Here’s a breakdown of the five primary components:

Payment History (35%)

Payment history is the most significant factor affecting your Experian credit score, accounting for 35% of the total. This metric evaluates whether you’ve paid your bills on time. Late payments, defaults, and bankruptcies can severely damage your score, while consistent, on-time payments can significantly improve it. To maintain a strong payment history, set up automatic payments or reminders to ensure you never miss a due date.

Credit Utilization (30%)

Credit utilization measures how much of your available credit you’re using at any given time. Ideally, you should aim to keep your credit utilization below 30%. For example, if you have a credit limit of $10,000, try not to carry a balance higher than $3,000. High credit utilization can signal to lenders that you’re over-reliant on credit, which may lower your score. Reducing your balances and increasing your credit limits can help improve this metric.

Read also:Discovering The Impact Of Fox Lisa Boothe A Comprehensive Guide

Length of Credit History (15%)

The length of your credit history accounts for 15% of your score. This factor considers the age of your oldest account, the average age of all your accounts, and how recently you’ve used them. A longer credit history generally reflects positively on your score, as it provides more data for lenders to assess your financial behavior. Avoid closing old accounts unless absolutely necessary, as this can shorten your credit history and negatively impact your score.

Credit Mix (10%)

Your credit mix, which makes up 10% of your score, refers to the variety of credit accounts you have, such as credit cards, mortgages, auto loans, and personal loans. Having a diverse mix of credit can demonstrate your ability to manage different types of financial obligations. However, it’s important not to open new accounts solely to improve your credit mix, as this can lead to unnecessary debt and inquiries.

New Credit Inquiries (10%)

Finally, new credit inquiries account for the remaining 10% of your score. Each time you apply for credit, a hard inquiry is recorded on your credit report, which can temporarily lower your score. While occasional inquiries are normal, applying for multiple credit accounts in a short period can raise red flags for lenders. To minimize the impact, space out your credit applications and only apply when necessary.

Practical Tips to Boost Your Experian Credit Score

Now that you understand the factors influencing your Experian credit score, let’s explore actionable strategies to improve it. These tips are designed to address each component of your score, helping you achieve a credit score boost over time.

Pay Your Bills on Time

Since payment history is the most significant factor affecting your score, prioritizing on-time payments is crucial. If you’ve struggled with this in the past, consider setting up automatic payments for recurring bills like credit cards, utilities, and loans. Alternatively, use calendar reminders or budgeting apps to ensure you never miss a due date. Even one late payment can have a lasting impact, so consistency is key.

Reduce Your Credit Utilization

Lowering your credit utilization can provide a quick boost to your score. Start by paying down existing balances and avoiding new purchases on credit cards. If possible, request a credit limit increase from your card issuer, as this can lower your utilization ratio without requiring additional payments. Just be cautious not to increase your spending in response to the higher limit.

Keep Old Accounts Open

While it might be tempting to close old or unused credit accounts, doing so can shorten your credit history and reduce your available credit, both of which can hurt your score. Instead, consider keeping these accounts open and using them occasionally to keep them active. For example, you could charge a small recurring expense, like a subscription service, and pay it off in full each month.

Limit New Credit Applications

Every time you apply for new credit, a hard inquiry is recorded on your report, which can lower your score. To minimize the impact, only apply for credit when absolutely necessary and avoid multiple applications in a short period. If you’re shopping for a loan, such as a mortgage or auto loan, try to complete all applications within a 14-45 day window, as multiple inquiries for the same type of loan are typically treated as a single inquiry.

Monitor Your Credit Report Regularly

Errors on your credit report can unfairly lower your score, so it’s essential to review your report regularly. You’re entitled to one free credit report from each bureau annually through AnnualCreditReport.com. If you spot any inaccuracies, dispute them with the bureau to have them corrected. This process can take time, but it’s worth the effort to ensure your report accurately reflects your financial behavior.

What Are the Most Common Mistakes That Hurt Your Credit Score?

While understanding what boosts your Experian credit score is essential, it’s equally important to recognize the mistakes that can hurt it. Many people inadvertently damage their credit by making common errors that are easy to avoid with the right knowledge. Let’s explore some of the most frequent pitfalls and how you can steer clear of them.

Maxing Out Credit Cards

One of the most damaging mistakes is maxing out your credit cards. This behavior not only increases your credit utilization but also signals to lenders that you may be financially overextended. To avoid this, aim to keep your balances well below your credit limits. For example, if your card has a $5,000 limit, try not to carry a balance higher than $1,500. If you’re already maxed out, focus on paying down your balances as quickly as possible.

Ignoring Credit Report Errors

Errors on your credit report can have a significant negative impact on your score. These mistakes might include incorrect account information, duplicate entries, or even fraudulent activity. Unfortunately, many people fail to review their reports regularly, allowing these errors to go uncorrected. To protect your score, make it a habit to check your report at least once a year and dispute any inaccuracies you find.

Closing Old Credit Accounts

As mentioned earlier, closing old credit accounts can shorten your credit history and reduce your available credit, both of which can lower your score. While it might seem like a good idea to close accounts you no longer use, doing so can have unintended consequences. Instead, consider keeping these accounts open and using them occasionally to keep them active.

Applying for Too Many Credit Accounts

Each time you apply for new credit, a hard inquiry is recorded on your report, which can temporarily lower your score. Applying for multiple accounts in a short period can raise red flags for lenders, as it may indicate financial instability. To avoid this, space out your credit applications and only apply when necessary. If you’re shopping for a loan, try to complete all applications within a 14-45 day window to minimize the impact.

Missing Payments

Missing even a single payment can have a significant negative impact on your credit score. Late payments are reported to the credit bureaus and can remain on your report for up to seven years. To avoid this, set up automatic payments or reminders to ensure you never miss a due date. If you do miss a payment, contact your lender immediately to discuss options for resolving the issue.

Tools and Resources for Monitoring Your Credit Score

Boosting your Experian credit score requires consistent effort and access to the right tools and resources. Fortunately, there are numerous options available to help you monitor your credit, track your progress, and identify areas for improvement. Here’s a look at some of the most effective tools and resources you can use to support your credit score boost journey.

Free Credit Monitoring Services

Several platforms offer free credit monitoring services, allowing you to keep an eye on your credit score and receive alerts about changes to your report. Popular options include Credit Karma, Experian’s own free credit monitoring service, and Mint. These services provide regular updates on your score, as well as insights into the factors influencing it. While they may not offer the full version of your credit report, they’re an excellent starting point for

Understanding What Causes Miscarriage: A Comprehensive Guide

Understanding Spotting Vs Miscarriage: Causes, Symptoms, And Key Differences

What's New In The Regular Show: A Complete Guide To The Latest Updates

This is How to Get the Most From Experian Boost Rent +More Credit

Consumers across America empowered to potentially boost their credit score