Unlock Your Financial Potential: How To Achieve An Experian Credit Boost?

Are you looking to improve your financial standing and unlock better opportunities for loans, credit cards, or even lower interest rates? Achieving an Experian credit boost could be the game-changer you need. Your credit score is more than just a number—it’s a reflection of your financial health and responsibility. Experian, one of the three major credit bureaus in the United States, offers tools and resources designed to help individuals improve their credit scores. A higher score can open doors to better financial products and services, making it essential to understand how to boost your credit effectively.

In this article, we’ll explore everything you need to know about an Experian credit boost, from understanding the factors that influence your credit score to actionable steps you can take to improve it. Whether you're recovering from financial setbacks or simply aiming to optimize your credit profile, this guide will provide you with practical insights and strategies. We’ll also answer some of the most common questions people have about credit boosting and highlight tools like Experian Boost™ that can make a significant difference.

By the end of this article, you'll be equipped with the knowledge and tools to take control of your credit score. Let’s dive into the details and discover how you can achieve an Experian credit boost and secure a brighter financial future.

Read also:Mastering Remote Iot Vpc Ssh A Comprehensive Guide To Secure Connectivity

Table of Contents

- What Is Experian Credit Boost and How Does It Work?

- Why Does Your Credit Score Matter So Much?

- How to Improve Your Credit Score: A Step-by-Step Guide

- Tools and Resources to Achieve an Experian Credit Boost

- Is Experian Boost™ Right for You?

- What Are the Common Mistakes to Avoid When Trying to Boost Your Credit?

- Long-Term Strategies for Maintaining Credit Health

- Frequently Asked Questions About Experian Credit Boost

What Is Experian Credit Boost and How Does It Work?

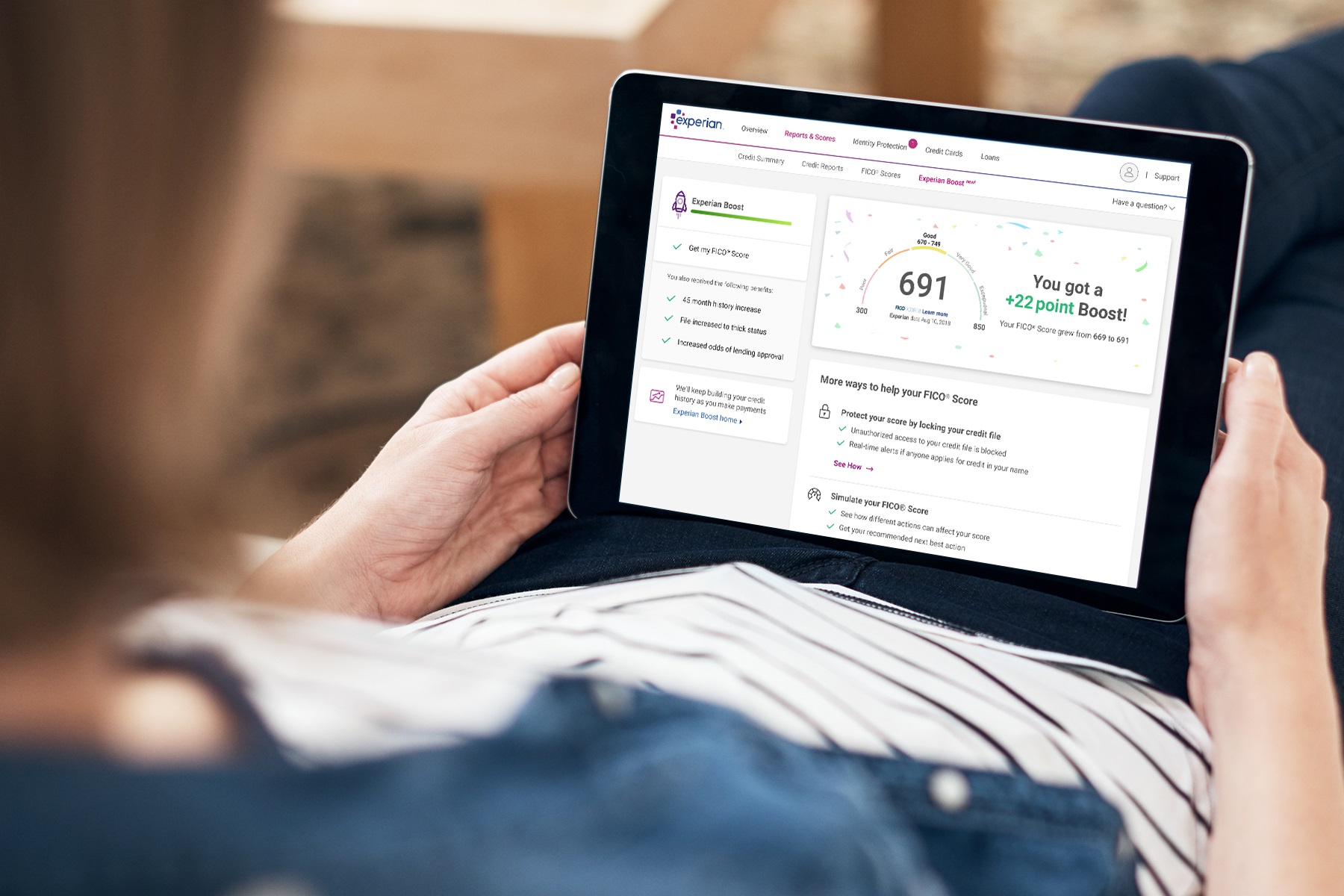

Experian Credit Boost is a free tool offered by Experian that allows individuals to include positive payment history from utility bills, phone bills, and even streaming services in their credit reports. These payments are typically not reported to credit bureaus, but Experian Boost™ changes that by giving you credit for paying these bills on time. This innovative tool can help people with thin credit files or those looking to improve their scores quickly.

Here’s how it works: First, you link your bank accounts to Experian Boost™ through a secure platform. The tool then scans your transaction history to identify qualifying payments, such as your monthly electricity bill or Netflix subscription. Once you verify these payments, they are added to your Experian credit report, potentially increasing your credit score instantly. It’s a simple yet effective way to demonstrate financial responsibility beyond traditional credit accounts.

Many users have reported significant improvements in their credit scores after using Experian Boost™. For example, someone with a limited credit history might see their score jump by 10 to 20 points, which could make a big difference when applying for a loan or credit card. However, it’s important to note that Experian Boost™ only impacts your Experian credit report, not reports from other bureaus like Equifax or TransUnion.

Why Should You Consider Using Experian Boost™?

Experian Boost™ is particularly beneficial for individuals who may not have extensive credit histories but consistently pay their bills on time. This includes young adults, immigrants, or anyone who hasn’t had the opportunity to build a robust credit profile. By incorporating non-traditional payment data, Experian Boost™ provides a more holistic view of your financial behavior.

What Are the Limitations of Experian Boost™?

While Experian Boost™ is a powerful tool, it’s not a magic solution. It won’t erase negative marks like late payments or collections from your credit report. Additionally, since it only affects your Experian credit score, lenders who rely on other bureaus might not see the same improvements. It’s also worth noting that not all bills qualify, so you’ll need to review the tool’s criteria carefully.

Why Does Your Credit Score Matter So Much?

Your credit score is a critical factor in determining your financial opportunities. Lenders, landlords, and even employers often use credit scores to assess your reliability and trustworthiness. A high credit score can lead to lower interest rates on loans, better credit card offers, and even improved chances of renting your dream apartment.

Read also:Baryshnikov The Legendary Dancer Who Redefined Ballet

But why does your credit score carry so much weight? For lenders, a good credit score indicates that you’re likely to repay your debts on time. This reduces their risk and makes them more willing to offer favorable terms. Conversely, a low credit score can signal potential red flags, leading to higher interest rates or even loan denials.

Beyond loans and credit cards, your credit score can also impact your insurance premiums, utility deposits, and job prospects. Employers in certain industries, such as finance or government, may review credit reports as part of the hiring process. A strong credit score reflects positively on your ability to manage responsibilities, making it a key component of your overall financial health.

How to Improve Your Credit Score: A Step-by-Step Guide

Improving your credit score requires a combination of short-term actions and long-term strategies. Here are some practical steps you can take to achieve an Experian credit boost and improve your overall credit health:

- Pay Your Bills on Time: Payment history is the most significant factor in your credit score. Missing even a single payment can have a negative impact, so set up reminders or automatic payments to stay on track.

- Reduce Your Credit Utilization: Aim to keep your credit card balances below 30% of your available credit limit. Lower utilization signals responsible credit management.

- Check Your Credit Report for Errors: Mistakes on your credit report can drag down your score. Regularly review your reports from all three bureaus and dispute any inaccuracies.

- Avoid Opening Too Many New Accounts: Each new account inquiry can slightly lower your score. Only apply for credit when necessary.

- Build a Mix of Credit Types: Having a diverse credit portfolio, such as credit cards, installment loans, and mortgages, can positively influence your score.

What Role Does Credit Utilization Play in Your Score?

Credit utilization refers to the percentage of your available credit that you’re currently using. For example, if you have a credit limit of $10,000 and a balance of $3,000, your utilization rate is 30%. Keeping this rate low is crucial because it demonstrates that you’re not overly reliant on credit, which can be a red flag for lenders.

Can Paying Off Debt Boost Your Credit Score?

Absolutely! Paying off debt, especially credit card balances, can significantly improve your credit score. Not only does it reduce your credit utilization, but it also shows lenders that you’re actively managing and reducing your financial obligations.

Tools and Resources to Achieve an Experian Credit Boost

Beyond Experian Boost™, there are several other tools and resources available to help you improve your credit score. These include credit monitoring services, budgeting apps, and educational resources that provide insights into credit management.

For instance, credit monitoring services like Experian’s own CreditWorks℠ Basic offer real-time updates on your credit score and report. This allows you to track your progress and spot potential issues early. Budgeting apps like Mint or YNAB (You Need a Budget) can help you manage your finances more effectively, ensuring you have the funds to pay bills on time and reduce debt.

Additionally, educational resources such as Experian’s blog and credit score simulator can help you understand how different actions impact your score. These tools empower you to make informed decisions and take proactive steps toward achieving an Experian credit boost.

Is Experian Boost™ Right for You?

Experian Boost™ is a valuable tool, but it’s not a one-size-fits-all solution. To determine if it’s right for you, consider your current credit situation and goals. If you have a limited credit history or are looking to quickly improve your score, Experian Boost™ could be a great fit.

However, if your credit report already reflects a strong payment history or you’re focused on addressing negative marks, other strategies might be more effective. It’s also important to weigh the benefits against the potential limitations, such as the tool’s impact being limited to your Experian credit report.

Who Benefits Most from Experian Boost™?

Individuals with thin credit files, such as young adults or recent immigrants, often see the most significant improvements from Experian Boost™. By incorporating non-traditional payment data, the tool helps build a more comprehensive credit profile.

What Are the Alternatives to Experian Boost™?

If Experian Boost™ isn’t the right fit for you, consider alternatives like secured credit cards, credit-builder loans, or becoming an authorized user on someone else’s account. Each option has its own pros and cons, so choose the one that aligns with your financial goals.

What Are the Common Mistakes to Avoid When Trying to Boost Your Credit?

While improving your credit score is a worthwhile goal, there are several pitfalls to avoid. These mistakes can hinder your progress or even cause your score to drop further.

- Closing Old Credit Accounts: Closing accounts reduces your available credit, which can increase your credit utilization rate.

- Maxing Out Credit Cards: High balances signal financial strain and can negatively impact your score.

- Ignoring Credit Report Errors: Failing to dispute inaccuracies can leave negative marks on your report unnecessarily.

- Applying for Too Many Accounts at Once: Multiple inquiries in a short period can raise red flags for lenders.

Why Is Patience Important in Credit Building?

Building or repairing credit takes time, and there are no shortcuts. While tools like Experian Boost™ can provide quick wins, long-term success requires consistent, responsible financial behavior. Avoid the temptation to chase quick fixes, as they often come with hidden costs or risks.

Long-Term Strategies for Maintaining Credit Health

Achieving an Experian credit boost is just the beginning. To maintain and continue improving your credit score, adopt long-term strategies that promote financial stability. These include budgeting, saving for emergencies, and regularly reviewing your credit report.

One effective strategy is to automate your bill payments. This ensures you never miss a payment, which is crucial for maintaining a positive payment history. Additionally, building an emergency fund can help you avoid relying on credit during unexpected financial challenges.

Finally, stay informed about changes in credit scoring models and lending practices. The financial landscape is constantly evolving, and staying ahead of the curve can help you make smarter decisions about your credit and finances.

Frequently Asked Questions About Experian Credit Boost

How Long Does It Take to See Results from Experian Boost™?

Results from Experian Boost™ are typically instant. Once you link your accounts and verify qualifying payments, your Experian credit score may increase immediately. However, the extent of the boost depends on your unique financial situation.

Is Experian Boost™ Safe to Use?

Yes, Experian Boost™ is safe to use. The tool uses bank-level encryption to protect your financial data, and you retain full control over which payments are included in your credit report.

Can Experian Boost™ Help with Loan Approvals?

While Experian Boost™ can improve your Experian credit score, its impact on loan approvals depends on the lender. Some lenders only consider reports from other bureaus, so it’s important to understand their requirements before applying.

Conclusion

Achieving an Experian credit boost is a powerful step toward improving your financial future. By leveraging tools like Experian Boost™ and adopting responsible credit habits, you can take control of your credit score and unlock better opportunities. Remember, building credit is a journey,

Who Is Taraji P. Henson's Husband? Everything You Need To Know

Darla Little Rascals 2024: A Look Back And Ahead

Is Hobby Lobby Closing Stores In 2025? What You Need To Know

Starting Today, Consumers Can Benefit From Having Their Credit Score

This is How to Get the Most From Experian Boost Rent +More Credit