What Is Experian Boost And How Can It Improve Your Credit Score?

Unlike traditional credit scoring models that rely solely on credit card payments, loans, and mortgages, Experian Boost incorporates alternative financial data into your credit report. This means that even if you’ve been diligent about paying your utility bills on time, those payments can now count toward your credit score. For millions of people who may not have a robust credit history, this tool provides a lifeline to financial inclusion and better credit opportunities. The concept behind Experian Boost is simple yet impactful. By connecting your bank accounts to the Experian platform, the tool scans your transaction history for qualifying payments such as electricity, gas, water, and even Netflix subscriptions. Once verified, these payments are added to your credit file, giving credit bureaus a more comprehensive view of your financial responsibility. This can be particularly beneficial for individuals who are new to credit or have limited credit history, as it allows them to showcase their financial habits in a way that traditional credit scoring models overlook. The result? A potentially higher credit score that opens doors to better loan terms, credit card approvals, and more. As we dive deeper into this article, we’ll explore the ins and outs of Experian Boost, answering critical questions like how it works, who can benefit from it, and whether it’s worth the effort. We’ll also provide practical tips for maximizing its impact and address common concerns users may have. Whether you’re looking to improve your credit score or simply curious about this innovative tool, this guide will equip you with the knowledge you need to make informed decisions about your financial future.

Table of Contents

- What is Experian Boost and How Does It Work?

- Is Experian Boost Safe to Use?

- Who Can Benefit from Experian Boost?

- How to Use Experian Boost Effectively

- Does Experian Boost Really Work?

- Are There Alternatives to Experian Boost?

- What Are the Common Misconceptions About Experian Boost?

- Frequently Asked Questions About Experian Boost

What is Experian Boost and How Does It Work?

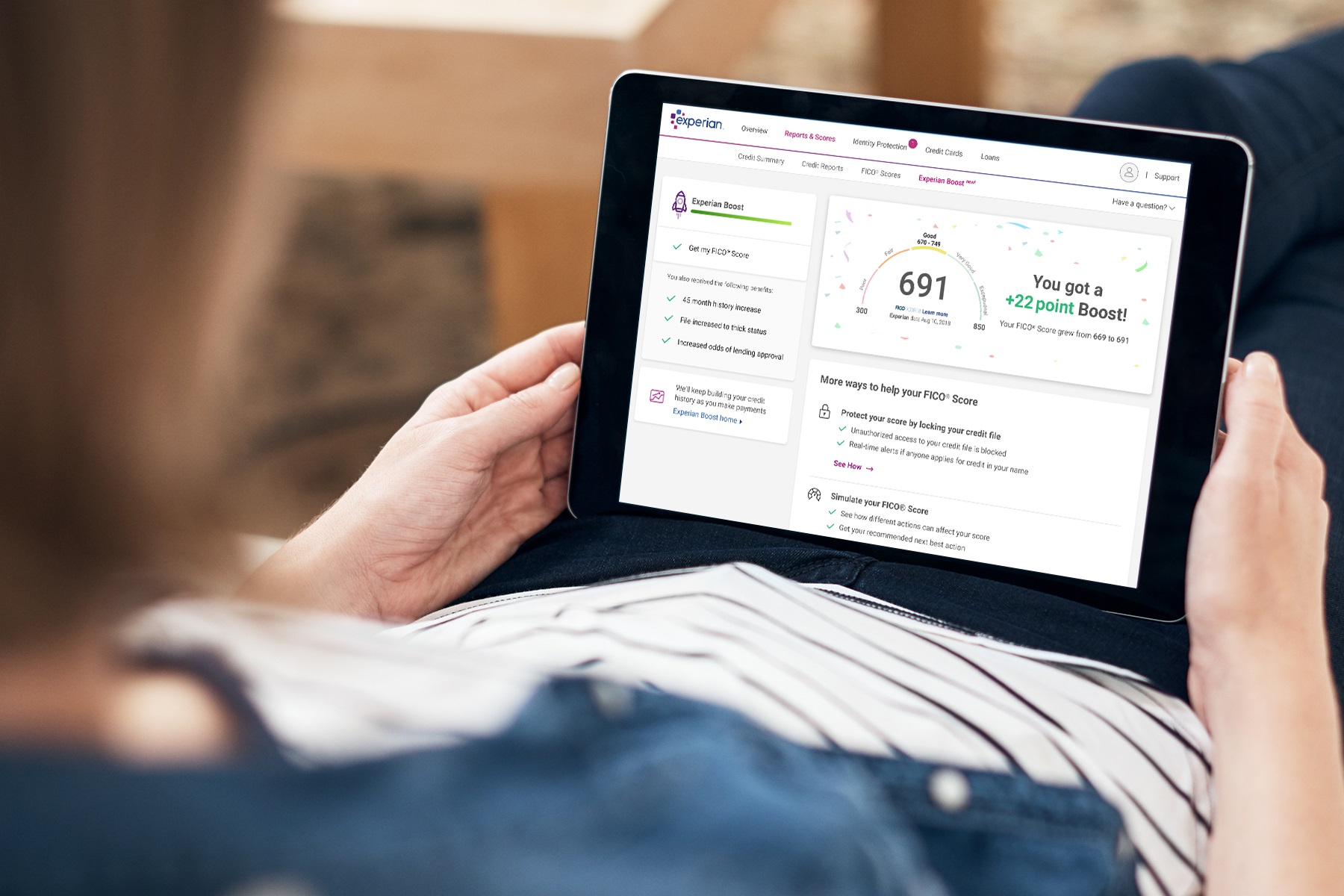

Experian Boost is a free service offered by Experian, one of the three major credit bureaus in the United States, aimed at helping consumers improve their credit scores by incorporating non-traditional financial data into their credit reports. Traditionally, credit scores are calculated based on factors such as credit card payments, loans, and mortgages. However, Experian Boost broadens the scope by including recurring payments like utility bills, phone bills, and streaming service subscriptions, which are typically not considered in credit scoring models. This innovative approach allows individuals to demonstrate their financial responsibility in a way that traditional credit scoring systems often overlook. So, how exactly does Experian Boost work? The process begins when you sign up for the service and connect your bank accounts to the Experian platform. Once connected, Experian scans your transaction history for qualifying payments, such as utility bills, rent, or subscription services like Netflix or Hulu. After identifying these payments, Experian verifies them and adds them to your credit file. This updated information is then reflected in your FICO® Score, which is one of the most widely used credit scoring models. It’s important to note that only on-time payments are included, meaning late or missed payments won’t negatively impact your score. One of the standout features of Experian Boost is its user-friendly interface. The entire process can be completed online in just a few minutes, making it accessible even for individuals who may not be tech-savvy. Moreover, the service is entirely free, which sets it apart from other credit-building tools that often come with fees or hidden costs. By leveraging Experian Boost, users can potentially see an immediate improvement in their credit scores, especially if they have a history of consistent, on-time payments for utilities and subscriptions. This makes it an invaluable tool for anyone looking to build or rebuild their credit profile.

Why Is Experian Boost a Game-Changer for Credit Scoring?

Experian Boost has been hailed as a game-changer in the world of credit scoring because it addresses a long-standing issue: the exclusion of non-traditional financial data from credit reports. For years, credit scoring models have relied heavily on credit card payments, loans, and mortgages, leaving out other forms of financial responsibility. This narrow focus has disproportionately affected individuals who may not have access to traditional credit products but are otherwise financially responsible. Experian Boost bridges this gap by incorporating payments that reflect real-world financial behavior, such as utility bills and streaming subscriptions. The impact of Experian Boost is particularly significant for younger consumers and those new to credit. Many of these individuals may not have a long credit history, making it challenging to qualify for loans or credit cards. By allowing them to include recurring payments in their credit reports, Experian Boost provides a more accurate representation of their financial habits. This can lead to higher credit scores, which in turn can open doors to better financial opportunities, such as lower interest rates and improved loan terms.

Read also:Who Is Lakiha Spicer Discover The Inspiring Story Of A Rising Star

Is Experian Boost Safe to Use?

When it comes to sharing financial information, safety is a top concern for most users. Experian Boost addresses these concerns by employing robust security measures to protect your data. The platform uses bank-level encryption to ensure that your financial information is secure during the connection process. Additionally, Experian does not store your bank login credentials, which means your sensitive information remains in your hands. This level of security is crucial for maintaining trust and ensuring that users feel comfortable using the service.

What Are the Privacy Concerns with Experian Boost?

Despite its security features, some users may still have privacy concerns about connecting their bank accounts to Experian Boost. It’s important to note that the service only accesses transaction data and does not interfere with your account balances or make any changes to your accounts. Furthermore, Experian adheres to strict privacy policies and complies with regulations such as the Fair Credit Reporting Act (FCRA), which governs how consumer credit information is collected and used. These measures help mitigate risks and ensure that your data is handled responsibly.

How Does Experian Boost Protect Your Data?

Experian Boost employs several layers of protection to safeguard your information. For instance, the platform uses multi-factor authentication to verify your identity before allowing access to your transaction data. Additionally, all data transmissions are encrypted using advanced protocols, ensuring that your information remains confidential. These security measures make Experian Boost a reliable option for individuals looking to improve their credit scores without compromising their privacy.

Who Can Benefit from Experian Boost?

Experian Boost is a versatile tool that can benefit a wide range of individuals, particularly those who may not have a strong credit history or are looking to improve their credit scores. For example, young adults who are just starting to build their credit profiles can use Experian Boost to include their utility and subscription payments in their credit reports. This can help them establish a credit history more quickly and qualify for better financial products in the future. Another group that can benefit from Experian Boost is individuals with thin credit files. These are people who have limited credit activity, making it difficult for traditional credit scoring models to assess their creditworthiness. By incorporating alternative data like utility payments, Experian Boost provides a more comprehensive view of their financial responsibility. This can lead to higher credit scores and improved access to credit.

Can Experian Boost Help Renters Improve Their Credit Scores?

Yes, renters can also benefit from Experian Boost, especially if they consistently pay their rent on time. While rent payments are not typically included in credit reports, Experian Boost allows users to add these payments to their credit files. This can be particularly advantageous for renters who want to demonstrate their financial responsibility to lenders and landlords. By including rent payments in their credit reports, renters can potentially see a significant improvement in their credit scores.

What About Individuals with Poor Credit Histories?

Even individuals with poor credit histories can benefit from Experian Boost. By incorporating positive payment data from utility bills and subscriptions, these users can offset some of the negative marks on their credit reports. This can help them rebuild their credit scores over time and improve their financial standing. While Experian Boost is not a cure-all for poor credit, it can serve as a valuable tool in the credit repair process.

Read also:Dawn Wells Measurements A Complete Guide To Her Life And Career

How to Use Experian Boost Effectively

Using Experian Boost effectively requires a strategic approach to ensure you maximize its benefits. The first step is to connect your bank accounts to the Experian platform. This process is straightforward and involves logging into your bank account through Experian’s secure interface. Once connected, Experian will scan your transaction history for qualifying payments, such as utility bills, phone bills, and subscription services. It’s important to review these payments carefully to ensure they are accurate and reflect your financial habits. After verifying the payments, Experian will update your credit file to include this information. This update is typically reflected in your credit score within a few days. To make the most of Experian Boost, it’s essential to maintain consistent, on-time payments for the qualifying expenses. This will ensure that your credit score continues to improve over time. Additionally, you can periodically check your credit report to monitor the impact of Experian Boost and make adjustments as needed.

What Are Some Tips for Maximizing the Impact of Experian Boost?

To maximize the impact of Experian Boost, consider the following tips:

- Ensure all your utility and subscription payments are made on time. Late payments will not be included in your credit file.

- Connect multiple bank accounts if you have recurring payments spread across different accounts.

- Regularly review your credit report to track the impact of Experian Boost and identify areas for improvement.

How Often Should You Update Your Experian Boost Information?

While Experian Boost automatically updates your credit file with new qualifying payments, it’s a good idea to review your information periodically. This ensures that all relevant payments are included and that your credit file remains accurate. Additionally, if you change banks or add new recurring payments, you should update your Experian Boost account to reflect these changes.

Does Experian Boost Really Work?

The effectiveness of Experian Boost has been validated by numerous user testimonials and studies. According to Experian, users who have utilized the service have seen an average increase of 13 points in their FICO® Scores. This improvement can be significant, especially for individuals who are close to qualifying for better loan terms or credit card approvals. The key to Experian Boost’s success lies in its ability to incorporate alternative data into credit reports, providing a more holistic view of a user’s financial responsibility.

What Do Experts Say About Experian Boost?

Financial experts have praised Experian Boost for its innovative approach to credit scoring. By including non-traditional financial data, the tool addresses a critical gap in the credit reporting system. Experts note that Experian Boost is particularly beneficial for individuals who may not have access to traditional credit products but are otherwise financially responsible. This makes it a valuable tool for promoting financial inclusion and helping users improve their credit scores.

Are There Any Limitations to Experian Boost?

While Experian Boost is a powerful tool, it does have some limitations. For example, it only affects your Experian credit report and does not impact reports from other credit bureaus like Equifax or TransUnion. Additionally, the service only includes on-time payments, meaning late or missed payments will not be reflected in your credit file. Despite these limitations, Experian Boost remains a valuable resource for improving your credit score.

Are There Alternatives to Experian Boost?

While Experian Boost is a popular option for improving credit scores, there are other alternatives available. One such alternative is UltraFICO, which allows users to include their banking activity, such as savings and checking account balances, in their credit reports. This can be particularly beneficial for individuals with thin credit files or those looking to demonstrate financial responsibility through their banking habits. Another option is RentTrack, which reports rent payments to credit bureaus, helping renters build their credit scores.

What Are the Pros and Cons of Alternatives to Experian Boost?

Each alternative to Experian Boost has its own set of pros

Unveiling The Mysteries Of Zodiac 1996: Insights, Traits, And More

Unraveling The Mystery: Maine Cabin Masters Death – What Really Happened?

Sarah Lancashire Weight Increase: A Comprehensive Look At Her Journey

Starting Today, Consumers Can Benefit From Having Their Credit Score

Experian Boost Makes Fast Company’s List of 2022 World Changing Ideas