Why Choose A Noble Bank Checking Account For Your Financial Needs?

Are you looking for a reliable and feature-rich checking account that meets your everyday banking needs? A noble bank checking account might be exactly what you're searching for. Whether you're managing your personal finances, running a small business, or planning for the future, this account offers a blend of convenience, flexibility, and security. With competitive perks, low fees, and user-friendly digital tools, it’s designed to make banking effortless. In this article, we’ll explore the ins and outs of a noble bank checking account, helping you understand why it stands out in the crowded world of financial services.

Choosing the right checking account is more important than ever. A noble bank checking account is tailored to cater to a wide range of customers, from students and young professionals to seasoned investors. It provides access to advanced online banking features, cashback rewards, and a robust network of ATMs, ensuring that your money is always within reach. Plus, its commitment to customer service ensures that any questions or concerns are addressed promptly and professionally. Let’s dive deeper into what makes this account a top choice for modern banking.

As we unpack the benefits and features of a noble bank checking account, you’ll discover how it aligns with your financial goals. From its competitive interest rates to its seamless integration with mobile apps, this account is designed to simplify your financial life. Whether you’re opening your first checking account or switching from another bank, this guide will provide you with all the information you need to make an informed decision. Let’s explore why this account deserves a spot in your financial toolkit.

Read also:Scarlett Johansson Height And Weight A Comprehensive Guide To Her Life And Career

Table of Contents

- What Makes a Noble Bank Checking Account Unique?

- Is a Noble Bank Checking Account Right for You?

- Key Features and Benefits of a Noble Bank Checking Account

- How Does a Noble Bank Checking Account Compare to Others?

- What Are the Eligibility Requirements for a Noble Bank Checking Account?

- How to Open a Noble Bank Checking Account: Step by Step

- Frequently Asked Questions About Noble Bank Checking Accounts

- Conclusion: Why a Noble Bank Checking Account Is Worth Considering

What Makes a Noble Bank Checking Account Unique?

A noble bank checking account is more than just a place to store your money; it’s a comprehensive financial solution designed to meet the needs of modern consumers. One of its standout features is its commitment to customer-centric innovation. Unlike traditional checking accounts, this offering provides users with a seamless blend of technology and personalized service. For instance, the account integrates advanced budgeting tools that help you track your spending, set savings goals, and monitor your financial health—all from your smartphone.

Another factor that sets a noble bank checking account apart is its focus on accessibility. With a vast network of fee-free ATMs and partnerships with major retailers, you can access your funds without worrying about additional charges. This is particularly beneficial for frequent travelers or those who live in areas with limited banking options. Additionally, the account offers competitive interest rates, which can help your balance grow over time. While many checking accounts provide minimal or no interest, a noble bank checking account ensures that your money works for you, even in a low-interest-rate environment.

Finally, the account’s emphasis on security and transparency is unmatched. It employs cutting-edge encryption and fraud detection technologies to safeguard your information. Moreover, the bank’s straightforward fee structure eliminates hidden charges, allowing you to manage your finances with confidence. Whether you’re a tech-savvy millennial or a retiree seeking simplicity, a noble bank checking account offers something for everyone.

Is a Noble Bank Checking Account Right for You?

Before committing to any financial product, it’s essential to evaluate whether it aligns with your unique needs and lifestyle. A noble bank checking account is particularly well-suited for individuals who prioritize convenience, flexibility, and value. If you frequently use online banking services, appreciate cashback rewards, or want to avoid unnecessary fees, this account could be a perfect match. But how do you know if it’s the right choice for you?

First, consider your banking habits. Do you rely on mobile apps to manage your finances? A noble bank checking account offers a robust digital platform that allows you to deposit checks, pay bills, and transfer funds with ease. Its intuitive interface ensures that even those who aren’t tech experts can navigate the system effortlessly. Additionally, if you’re someone who values rewards programs, the account’s cashback feature can help you earn money on everyday purchases, adding extra value to your banking experience.

Second, think about your financial goals. Are you looking to save more, reduce fees, or grow your balance through interest? A noble bank checking account provides tools to help you achieve these objectives. For example, its automated savings feature rounds up your transactions to the nearest dollar and deposits the difference into a linked savings account. This small but effective strategy can help you build a nest egg over time. Ultimately, if these features resonate with your priorities, a noble bank checking account is likely a great fit.

Read also:Exploring The Legacy Of Norma Strait A Journey Through Time

Key Features and Benefits of a Noble Bank Checking Account

A noble bank checking account is packed with features that cater to a wide range of banking needs. Below, we’ll explore some of its most notable benefits, including its digital tools, low fees, and customer support.

Digital Tools and Mobile Banking

In today’s fast-paced world, having access to your finances at your fingertips is crucial. A noble bank checking account offers an array of digital tools that make banking more convenient than ever. Its mobile app allows you to check your balance, view transaction history, and even deposit checks using your smartphone’s camera. Additionally, the app includes budgeting features that categorize your spending, helping you identify areas where you can cut back. For those who prefer online banking, the account’s web platform is equally robust, offering secure access to your account from any device.

Low Fees and Transparent Pricing

One of the most frustrating aspects of traditional checking accounts is the prevalence of hidden fees. A noble bank checking account eliminates this concern by offering a transparent fee structure. For example, there are no monthly maintenance fees, and overdraft fees are significantly lower than industry standards. Furthermore, the account provides access to a large network of fee-free ATMs, saving you money on withdrawals. This commitment to affordability ensures that your hard-earned money stays in your pocket.

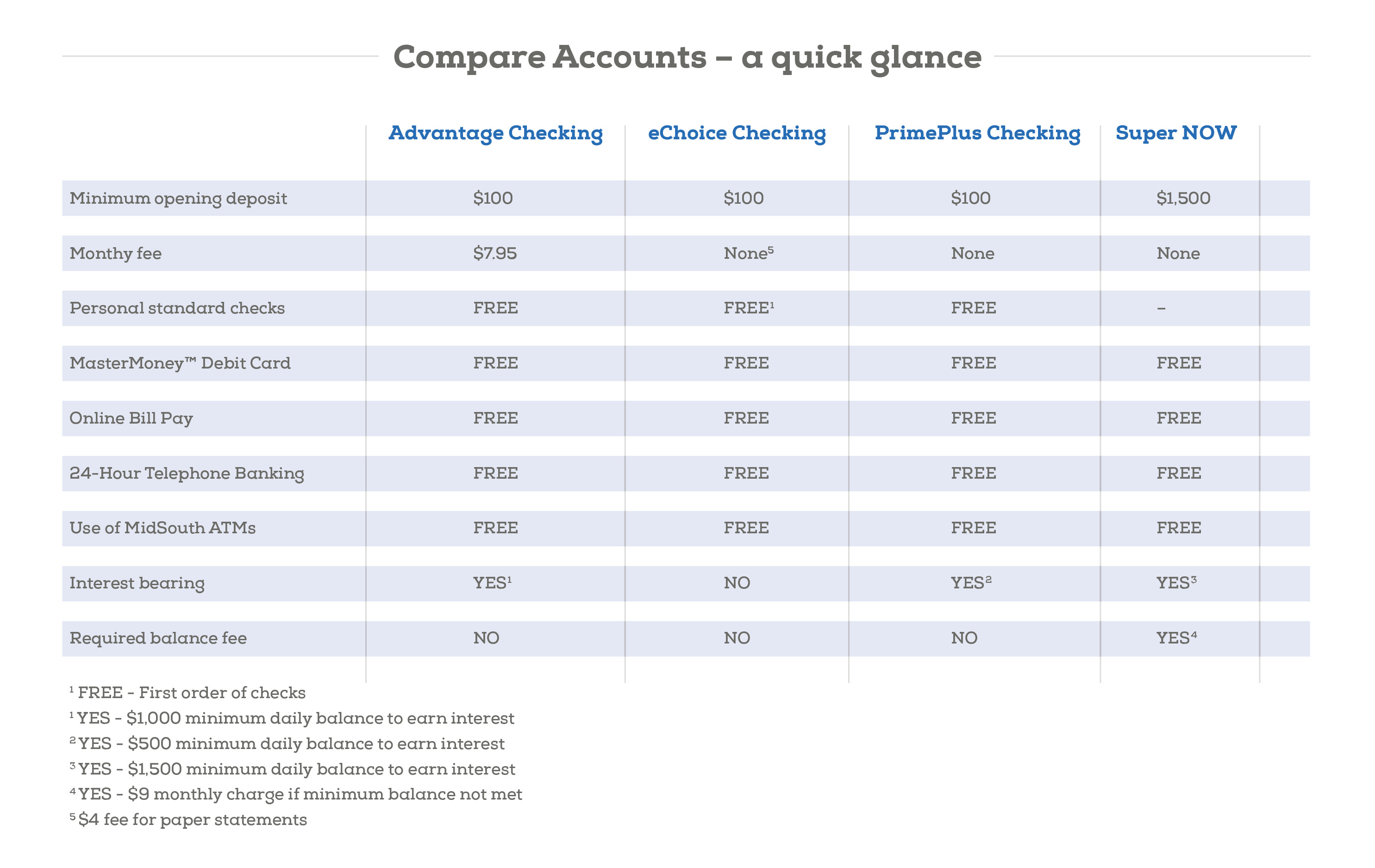

How Does a Noble Bank Checking Account Compare to Others?

When evaluating checking accounts, it’s important to compare them side by side to determine which one offers the best value. A noble bank checking account excels in several areas, particularly when compared to other leading options. For instance, while many banks charge monthly maintenance fees, a noble bank checking account waives these fees entirely, making it an attractive choice for cost-conscious consumers.

Additionally, the account’s interest rates are competitive, especially when compared to other checking accounts that offer little to no interest. This is particularly beneficial for those who maintain higher balances, as the interest earned can add up over time. Another advantage is the account’s cashback rewards program, which is not commonly found in traditional checking accounts. By earning cashback on qualifying purchases, you can offset everyday expenses and maximize your financial benefits.

What Are the Eligibility Requirements for a Noble Bank Checking Account?

Opening a noble bank checking account is straightforward, but it’s important to understand the eligibility requirements beforehand. Generally, you must be at least 18 years old and a legal resident of the country where the bank operates. You’ll also need to provide proof of identity, such as a government-issued ID, and proof of address, such as a utility bill or lease agreement. These requirements ensure compliance with banking regulations and help prevent fraud.

For business owners interested in opening a noble bank checking account, additional documentation may be required. This typically includes your business license, tax identification number, and proof of business address. By meeting these requirements, you can enjoy all the benefits that come with this versatile account.

How to Open a Noble Bank Checking Account: Step by Step

Opening a noble bank checking account is a simple process, whether you choose to apply online or visit a branch. Below, we’ll outline the steps involved and highlight the key considerations for each method.

Required Documents

Before applying, gather the necessary documents to streamline the process. These typically include:

- A valid government-issued ID (e.g., passport, driver’s license)

- Proof of address (e.g., utility bill, bank statement)

- Social Security number or tax identification number

Online vs. In-Branch Application

Applying online is convenient and can be completed in minutes. Simply visit the bank’s website, fill out the application form, and upload the required documents. If you prefer a more personal touch, visiting a branch allows you to speak with a representative who can guide you through the process and answer any questions you may have.

Frequently Asked Questions About Noble Bank Checking Accounts

Can I Earn Interest with a Noble Bank Checking Account?

Yes, a noble bank checking account offers competitive interest rates, allowing your balance to grow over time. The exact rate depends on your account balance and the bank’s current terms.

Are There Any Hidden Fees?

No, the account features a transparent fee structure with no hidden charges. You’ll always know what to expect, ensuring peace of mind.

How Do I Access Customer Support?

Customer support is available 24/7 through the bank’s website, mobile app, or phone line. You can also visit a branch for in-person assistance.

Conclusion: Why a Noble Bank Checking Account Is Worth Considering

In conclusion, a noble bank checking account is a versatile and customer-focused solution that caters to a wide range of banking needs. With its innovative digital tools, low fees, and robust security measures, it stands out as a top choice for modern consumers. Whether you’re looking to simplify your finances, earn rewards, or grow your savings, this account offers the features and benefits to help you achieve your goals. By choosing a noble bank checking account, you’re investing in a reliable and rewarding banking experience.

Learn more about noble bank checking account features here.

Discover The Power Of Prayer To St. Anthony To Find Lost Things

Is Hobby Lobby Closing Stores In 2025? What You Need To Know

Girtmaster: Your Ultimate Guide To Success And Mastery

Best Bank For Checking Account 2024 Janith

Alabama & Florida Personal Checking MidSouth Bank