Bitcoin Countdown: The Ultimate Guide To Understanding The Phenomenon

The term "Bitcoin Countdown" has gained traction as it represents a pivotal moment in the cryptocurrency ecosystem. With Bitcoin's halving events and other key milestones, the countdown acts as a beacon for traders, analysts, and enthusiasts alike. In this article, we’ll explore everything you need to know about Bitcoin Countdown, from its origins to its potential implications for the future of digital currency. As the world becomes increasingly digital, Bitcoin continues to dominate the conversation around decentralized finance. The Bitcoin Countdown serves as a metaphorical clock, ticking down to major events that could influence the price, adoption, and perception of this groundbreaking asset. These countdowns are often tied to halving events, where the reward for mining new blocks is reduced by half, creating scarcity and potentially driving up demand. Beyond the technical aspects, the countdown also symbolizes the anticipation and excitement surrounding Bitcoin's journey toward mainstream acceptance. In this guide, we’ll break down the key components of Bitcoin Countdown, answer your burning questions, and provide actionable insights to help you navigate this dynamic space. To ensure you don’t miss any crucial details, we’ve structured this article into comprehensive sections that cover all aspects of Bitcoin Countdown. From its historical significance to its impact on investment strategies, we’ll leave no stone unturned. By the end of this guide, you’ll have a clear understanding of what Bitcoin Countdown means, how it affects the market, and why it matters to you. So, buckle up and get ready to explore the fascinating world of Bitcoin Countdown in a way that’s both informative and engaging.

Table of Contents

- What is Bitcoin Countdown and Why Should You Care?

- The Historical Significance of Bitcoin Countdown Events

- How Does Bitcoin Countdown Work? A Step-by-Step Breakdown

- What Are the Best Investment Strategies During Bitcoin Countdown?

- How Does Bitcoin Countdown Impact the Cryptocurrency Market?

- What Does the Future Hold for Bitcoin Countdown?

- Are There Any Common Misconceptions About Bitcoin Countdown?

- Frequently Asked Questions About Bitcoin Countdown

What is Bitcoin Countdown and Why Should You Care?

Bitcoin Countdown is more than just a buzzword—it’s a concept that encapsulates the anticipation and preparation for key milestones in Bitcoin’s lifecycle. At its core, Bitcoin Countdown refers to the period leading up to significant events like halving, which occurs approximately every four years. During these events, the reward for mining new blocks is reduced by half, effectively slowing the rate at which new Bitcoins are introduced into circulation. This creates a sense of urgency and excitement among investors, as the reduced supply often leads to increased demand and, potentially, a surge in price. But why should you care about Bitcoin Countdown? For starters, understanding this concept can help you make informed decisions about your cryptocurrency investments. The countdown serves as a reminder to stay vigilant and proactive in monitoring market trends. For instance, many traders use the countdown as an opportunity to reassess their portfolios, adjust their strategies, and capitalize on potential price movements. Additionally, the countdown highlights Bitcoin’s unique deflationary model, which sets it apart from traditional fiat currencies. By reducing the supply over time, Bitcoin aims to maintain its value and resist inflation—a feature that appeals to both investors and everyday users. Beyond the financial implications, Bitcoin Countdown also reflects the broader cultural and technological shifts driven by cryptocurrency. It symbolizes the ongoing evolution of decentralized finance and the growing acceptance of digital assets in mainstream society. Whether you’re interested in Bitcoin as an investment, a technological innovation, or a cultural phenomenon, the countdown is a crucial element to understand. By staying informed about upcoming events and their potential impact, you can position yourself to take advantage of opportunities and mitigate risks in the ever-changing world of cryptocurrency.

The Historical Significance of Bitcoin Countdown Events

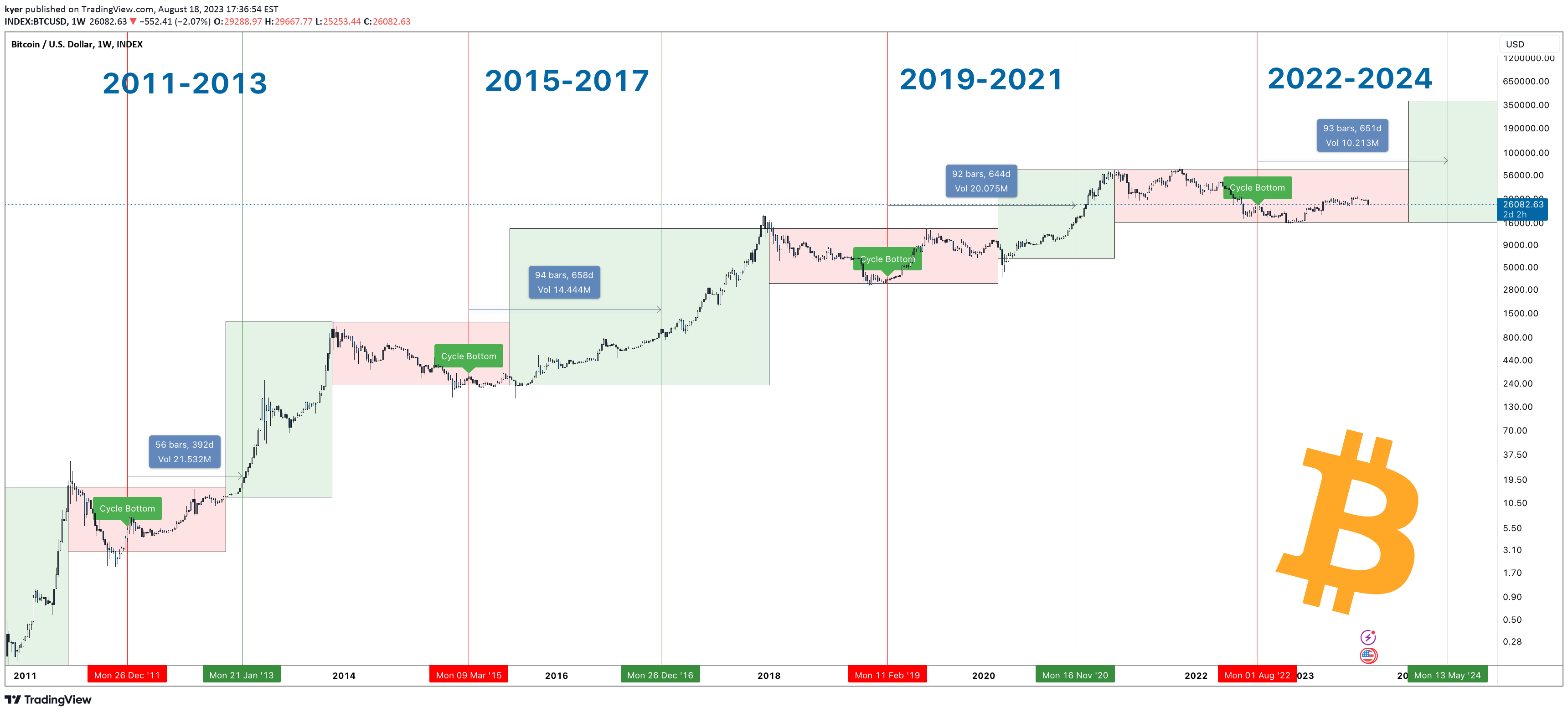

To fully appreciate the importance of Bitcoin Countdown, it’s essential to look back at its historical context. Since Bitcoin’s inception in 2009, there have been three major halving events, each of which has had a profound impact on the cryptocurrency market. The first halving occurred in November 2012, reducing the block reward from 50 BTC to 25 BTC. This event marked the beginning of Bitcoin’s transition from a niche experiment to a legitimate asset class. Following the halving, Bitcoin’s price experienced a significant uptrend, rising from around $12 to over $1,000 within a year. The second halving took place in July 2016, further reducing the block reward to 12.5 BTC. This event coincided with growing institutional interest in Bitcoin, as more investors began to recognize its potential as a store of value. The period following the 2016 halving was marked by unprecedented price volatility, with Bitcoin reaching an all-time high of nearly $20,000 in December 2017. The third halving, which occurred in May 2020, reduced the reward to 6.25 BTC and set the stage for another bull run. By late 2020 and early 2021, Bitcoin’s price soared to new heights, surpassing $60,000 for the first time. These historical events underscore the cyclical nature of Bitcoin Countdown and its influence on market behavior. Each halving event has been followed by a period of increased demand and price appreciation, reinforcing the idea that scarcity drives value. However, it’s important to note that past performance is not always indicative of future results. While the historical data provides valuable insights, it’s crucial to approach Bitcoin Countdown with a balanced perspective, considering both the opportunities and risks involved.

Read also:Understanding The Connection Between Melania Trump And Vladimir Putin A Comprehensive Insight

How Does Bitcoin Countdown Work? A Step-by-Step Breakdown

Understanding how Bitcoin Countdown works requires a closer look at the underlying mechanics of Bitcoin’s blockchain and its halving mechanism. At its core, Bitcoin Countdown is tied to the concept of block rewards, which are issued to miners for validating transactions and securing the network. Every 10 minutes, a new block is added to the blockchain, and miners receive a predetermined amount of Bitcoin as a reward for their efforts. However, this reward is not fixed—it decreases by half approximately every four years, a process known as "halving." Here’s a step-by-step breakdown of how Bitcoin Countdown operates: 1. **Block Creation and Mining**: Bitcoin’s blockchain is maintained by a decentralized network of miners who use powerful computers to solve complex mathematical puzzles. When a miner successfully solves a puzzle, they add a new block to the chain and receive a block reward in return. 2. **Halving Events**: The block reward is halved after every 210,000 blocks are mined, which takes roughly four years. This reduction is hardcoded into Bitcoin’s protocol and ensures that the total supply of Bitcoin will never exceed 21 million. 3. **Countdown to Halving**: As the block count approaches the next halving milestone, the Bitcoin community begins to track the countdown. This is often done through online tools and platforms that display the estimated time remaining until the event. 4. **Market Anticipation**: The countdown generates significant buzz and speculation within the cryptocurrency community. Traders and investors closely monitor the event, as it often leads to increased volatility and potential price movements. 5. **Post-Halving Dynamics**: After the halving occurs, the reduced block reward creates a supply shock, which can drive up demand and price. However, the market’s response is influenced by a variety of factors, including macroeconomic conditions and investor sentiment. By understanding these steps, you can gain a deeper appreciation for the intricacies of Bitcoin Countdown and its role in shaping the cryptocurrency ecosystem. Whether you’re a miner, investor, or enthusiast, staying informed about these dynamics can help you navigate the ever-evolving world of Bitcoin.

What Are the Best Investment Strategies During Bitcoin Countdown?

The Bitcoin Countdown is not just a technical event—it’s a golden opportunity for investors to refine their strategies and maximize their returns. But what are the best investment strategies to adopt during this period? The key lies in balancing risk and reward while staying informed about market trends. Here are some actionable strategies to consider: 1. **Diversification**: While Bitcoin is often referred to as "digital gold," it’s important not to put all your eggs in one basket. Diversifying your portfolio with other cryptocurrencies, stocks, or traditional assets can help mitigate risks. This approach ensures that you’re not overly exposed to Bitcoin’s price volatility during the countdown. 2. **Dollar-Cost Averaging (DCA)**: Instead of making a lump-sum investment, consider using the DCA strategy. This involves investing a fixed amount of money at regular intervals, regardless of Bitcoin’s price. DCA can help you avoid the pitfalls of market timing and reduce the impact of short-term volatility. 3. **Technical Analysis**: During the Bitcoin Countdown, technical analysis becomes even more critical. By studying price charts, trading volumes, and key indicators like moving averages and relative strength index (RSI), you can identify potential entry and exit points. This data-driven approach can enhance your decision-making process. 4. **Long-Term Holding (HODLing)**: If you believe in Bitcoin’s long-term potential, consider adopting a "HODLing" strategy. This involves holding onto your Bitcoin through market fluctuations, with the expectation that its value will appreciate over time. Historical data from previous halving events supports this approach, as Bitcoin’s price has generally trended upward in the long run. 5. **Stay Informed**: Knowledge is power, especially during the Bitcoin Countdown. Follow reputable news sources, join online communities, and participate in discussions to stay updated on market developments. Being well-informed can help you anticipate trends and make smarter investment decisions. By incorporating these strategies into your investment plan, you can navigate the Bitcoin Countdown with confidence and position yourself for success. Remember, the countdown is not just about short-term gains—it’s about understanding the bigger picture and making decisions that align with your financial goals.

How Does Bitcoin Countdown Impact the Cryptocurrency Market?

The Bitcoin Countdown is more than just a milestone for Bitcoin—it has far-reaching implications for the entire cryptocurrency market. As the countdown progresses, it creates ripples that affect investor sentiment, market dynamics, and even regulatory discussions. Understanding these impacts can provide valuable insights into the broader trends shaping the digital asset ecosystem. One of the most immediate effects of Bitcoin Countdown is increased market volatility. As the halving event approaches, traders and investors become more active, leading to heightened price fluctuations. This volatility can present both opportunities and risks, depending on how you approach it. For instance, short-term traders may capitalize on price swings, while long-term investors might use the volatility to accumulate Bitcoin at lower prices. Another significant impact is the heightened attention Bitcoin receives during the countdown. Media coverage, social media discussions, and institutional interest all tend to spike as the event draws near. This increased visibility can drive adoption, as more people become aware of Bitcoin and its potential benefits. It can also attract new investors, further fueling demand and price appreciation. The countdown also influences other cryptocurrencies, often referred to as "altcoins." Bitcoin’s dominance in the market means that its performance can have a cascading effect on altcoins. For example, a bullish trend in Bitcoin can lead to increased investment in altcoins, as investors seek to diversify their portfolios. Conversely, a bearish trend can result in capital flowing out of altcoins and back into Bitcoin or traditional assets. Finally, the Bitcoin Countdown can prompt regulatory scrutiny and discussions about the future of cryptocurrency. As Bitcoin gains prominence, governments and financial institutions may take a closer look at its implications for monetary policy, taxation, and financial stability. While this can create uncertainty in the short term, it also underscores Bitcoin’s growing influence and its potential to reshape the global financial landscape.

What Does the Future Hold for Bitcoin Countdown?

As we look ahead, the future of Bitcoin Countdown is filled with both promise and uncertainty. What can we expect from the next halving event and beyond? While no one can predict the future with absolute certainty, several trends and factors suggest that Bitcoin Countdown will continue to play a pivotal role in shaping the cryptocurrency ecosystem. One key trend is the growing institutional adoption of Bitcoin. Over the past few years, major companies and financial institutions have begun to embrace Bitcoin as a legitimate asset class. This institutional interest is likely to intensify as the countdown progresses, potentially driving up demand and price. Additionally, the development of Bitcoin ETFs (Exchange-Traded Funds) and other financial products could make it easier for mainstream investors to gain exposure to Bitcoin, further boosting its adoption. Another factor to consider is the role of technological advancements. As Bitcoin’s network continues to evolve, innovations like the Lightning Network and improved scalability solutions could enhance its utility and appeal. These advancements could make Bitcoin more accessible and efficient, attracting a broader user base and reinforcing its position as a leading digital asset. However, challenges remain. Regulatory uncertainty, environmental concerns related to Bitcoin mining, and competition from other cryptocurrencies could pose obstacles to Bitcoin’s growth. Navigating these challenges will require collaboration between developers, regulators, and the broader community to ensure that Bitcoin remains a viable and sustainable asset. Ultimately, the future of Bitcoin Countdown will depend on a combination of technological innovation

Unlocking The Power Of Red Light Bed Therapy: Discover The Benefits Today!

Discover The Most Humid Cities In The US: A Comprehensive Guide

Unlocking The Tradition: What Is A Red Envelope And Why Does It Matter?

Next Bitcoin Halving Countdown 2028 Date & History

Bitcoin Halving 2024 Countdown Nelle Sophia