Fidelity Retirement Advisor: Your Guide To A Secure Financial Future

A Fidelity Retirement Advisor offers personalized strategies and expert insights to help you navigate the complexities of retirement planning. Whether you're just starting to save or nearing retirement age, Fidelity's advisors are equipped to tailor solutions that align with your unique goals. With a reputation for excellence and decades of experience, Fidelity Retirement Advisor stands out as a trusted partner in securing your financial future. Retirement planning is not just about saving money; it's about creating a roadmap that ensures financial stability and peace of mind. A Fidelity Retirement Advisor helps you understand the nuances of investment options, tax implications, and withdrawal strategies. By leveraging their expertise, you can make informed decisions that maximize your savings while minimizing risks. With access to cutting-edge tools and resources, Fidelity's advisors empower you to take control of your retirement journey, ensuring that your golden years are as fulfilling as they are secure. In today's ever-changing economic landscape, having a trusted advisor by your side is more important than ever. Fidelity Retirement Advisor not only provides tailored financial advice but also helps you adapt to market fluctuations and evolving personal circumstances. From understanding the intricacies of 401(k) plans to exploring annuities and Social Security benefits, Fidelity ensures that no stone is left unturned in your retirement planning. This article dives deep into how Fidelity Retirement Advisor can be your ultimate ally in achieving a worry-free retirement.

Table of Contents

- What Makes Fidelity Retirement Advisor Unique?

- How Can a Fidelity Retirement Advisor Help You Plan for Retirement?

- What Are the Benefits of Working with a Fidelity Retirement Advisor?

- How Does Fidelity Retirement Advisor Use Technology to Enhance Your Experience?

- Is a Fidelity Retirement Advisor Right for You?

- What Are the Common Mistakes to Avoid in Retirement Planning?

- How to Get Started with a Fidelity Retirement Advisor?

- Frequently Asked Questions About Fidelity Retirement Advisor

What Makes Fidelity Retirement Advisor Unique?

When it comes to retirement planning, not all advisors are created equal. Fidelity Retirement Advisor stands out for its comprehensive approach, combining personalized service with cutting-edge technology. Unlike many competitors, Fidelity offers a holistic view of your financial situation, ensuring that every aspect of your retirement plan is optimized for success. Their advisors are not just financial experts; they are dedicated partners committed to helping you achieve your long-term goals.

One of the key differentiators of Fidelity Retirement Advisor is their access to a wide array of investment options. From traditional 401(k) plans to Roth IRAs and annuities, Fidelity provides a diverse portfolio to suit every investor's needs. Additionally, their advisors are trained to help you navigate complex tax implications, ensuring that your retirement savings grow efficiently. This level of expertise is complemented by Fidelity's robust research and analytics tools, which allow advisors to make data-driven recommendations tailored to your unique situation.

Read also:Discover The Best Remote Iot Vpc Solutions For Your Business Needs

Another standout feature of Fidelity Retirement Advisor is their commitment to education and transparency. They offer a wealth of resources, including webinars, workshops, and one-on-one consultations, to empower clients with the knowledge they need to make informed decisions. By fostering a collaborative relationship with clients, Fidelity ensures that you are always in the driver's seat of your retirement journey. This client-centric approach has earned Fidelity a reputation as a trusted leader in the retirement planning industry.

How Can a Fidelity Retirement Advisor Help You Plan for Retirement?

Planning for retirement is a multifaceted process that requires careful consideration of various factors, including your current financial situation, future goals, and market conditions. A Fidelity Retirement Advisor serves as your guide through this intricate journey, offering expert advice and tailored strategies to help you achieve a secure financial future. Here's how they can assist you:

Personalized Retirement Strategies

Every individual's retirement needs are unique, and a one-size-fits-all approach simply won't suffice. A Fidelity Retirement Advisor takes the time to understand your specific goals, whether it's traveling the world, buying a vacation home, or leaving a legacy for your loved ones. Based on this information, they craft a personalized retirement strategy that aligns with your aspirations. This may include setting up a diversified investment portfolio, optimizing Social Security benefits, and creating a withdrawal plan that ensures your savings last throughout retirement.

Investment Options and Tax Planning

Investing wisely is a cornerstone of successful retirement planning, and Fidelity Retirement Advisor excels in this area. They provide access to a wide range of investment options, from stocks and bonds to mutual funds and ETFs, ensuring that your portfolio is diversified and aligned with your risk tolerance. Additionally, they offer expert guidance on tax-efficient strategies, helping you minimize liabilities and maximize your retirement income. By staying informed about changes in tax laws and regulations, Fidelity ensures that your financial plan remains optimized year after year.

Furthermore, Fidelity Retirement Advisor helps you navigate the complexities of retirement accounts, such as IRAs, 401(k)s, and annuities. They explain the pros and cons of each option, helping you choose the best vehicles for your savings. This level of personalized attention ensures that your retirement plan is not only comprehensive but also adaptable to your evolving needs.

What Are the Benefits of Working with a Fidelity Retirement Advisor?

Choosing the right retirement advisor can make all the difference in achieving your financial goals. A Fidelity Retirement Advisor offers a host of benefits that set them apart from other financial professionals. Here are some of the key advantages of partnering with Fidelity:

Read also:Barry Weiss The Visionary Leader Transforming Industries

Expert Guidance: Fidelity's advisors are highly trained professionals with extensive knowledge of retirement planning. They stay up-to-date on the latest market trends, tax laws, and investment strategies, ensuring that you receive the most relevant and accurate advice. Their expertise allows you to make informed decisions that align with your long-term objectives.

Comprehensive Planning: Unlike some advisors who focus solely on investments, Fidelity takes a holistic approach to retirement planning. They consider all aspects of your financial life, including insurance, estate planning, and healthcare costs, to create a well-rounded strategy. This ensures that your retirement plan is not only robust but also adaptable to life's unexpected twists and turns.

Access to Cutting-Edge Tools: Fidelity leverages advanced technology to enhance your retirement planning experience. Their digital platforms provide real-time insights into your portfolio performance, retirement projections, and market trends. These tools empower you to stay informed and engaged in the planning process, giving you peace of mind that your future is in good hands.

Personalized Service: Fidelity Retirement Advisor prides itself on building strong, long-lasting relationships with clients. They take the time to understand your unique needs and preferences, offering personalized recommendations that reflect your goals. Whether you're just starting to save or nearing retirement, Fidelity ensures that your plan evolves with you, providing ongoing support and guidance every step of the way.

How Does Fidelity Retirement Advisor Use Technology to Enhance Your Experience?

In today's digital age, technology plays a crucial role in simplifying and enhancing the retirement planning process. Fidelity Retirement Advisor leverages state-of-the-art tools and platforms to provide clients with a seamless and personalized experience. These technological innovations not only streamline communication but also empower clients to take an active role in managing their financial futures.

One of the standout features of Fidelity's technology is their online dashboard, which serves as a one-stop hub for all your retirement planning needs. The dashboard provides real-time updates on your portfolio performance, retirement projections, and market trends. This transparency allows you to stay informed and make data-driven decisions about your investments. Additionally, the platform offers interactive tools, such as retirement calculators and goal-setting features, that help you visualize your progress and adjust your strategy as needed.

Another key advantage of Fidelity's technology is its mobile accessibility. Through their app, you can manage your accounts, view investment options, and communicate with your advisor from anywhere in the world. This level of convenience ensures that you are always connected to your financial plan, even when life gets busy. Furthermore, Fidelity employs advanced security measures, such as encryption and multi-factor authentication, to protect your sensitive information and provide peace of mind.

Is a Fidelity Retirement Advisor Right for You?

Choosing the right retirement advisor is a decision that requires careful consideration. While Fidelity Retirement Advisor offers numerous benefits, it's essential to evaluate whether their services align with your needs and preferences. Here are some factors to consider when determining if Fidelity is the right fit for you:

Your Financial Goals: If your retirement goals are complex and require a tailored approach, Fidelity's personalized service may be ideal. Their advisors excel at crafting strategies that address unique objectives, whether it's maximizing Social Security benefits, creating a tax-efficient withdrawal plan, or leaving a legacy for your family. If you value a customized approach, Fidelity could be the perfect partner for your retirement journey.

Your Comfort with Technology: Fidelity's cutting-edge tools and platforms are designed to enhance the planning process, but they may not be suitable for everyone. If you prefer a hands-on approach and enjoy using digital tools to manage your finances, Fidelity's technology-driven solutions will likely appeal to you. However, if you prefer a more traditional, in-person experience, you may want to explore other options.

Your Budget: While Fidelity offers a range of services to suit different budgets, it's important to consider whether their fees align with your financial situation. Fidelity provides transparent pricing and a variety of account options, but it's always wise to compare costs with other advisors to ensure you're getting the best value for your money.

What Are the Common Mistakes to Avoid in Retirement Planning?

Retirement planning is a complex process, and even the most diligent savers can fall into common pitfalls. Avoiding these mistakes is crucial to ensuring a secure and stress-free retirement. Here are some of the most frequent errors people make and how a Fidelity Retirement Advisor can help you steer clear of them:

Underestimating Expenses: Many individuals fail to account for the full cost of living in retirement, including healthcare, housing, and leisure activities. A Fidelity Retirement Advisor helps you create a realistic budget that considers all potential expenses, ensuring that your savings will last throughout your retirement years.

Overlooking Tax Implications: Taxes can significantly impact your retirement income, yet many people neglect to plan for them. Fidelity's advisors offer expert guidance on tax-efficient strategies, such as Roth conversions and strategic withdrawals, to minimize liabilities and maximize your retirement funds.

Starting Too Late: Procrastination is one of the biggest enemies of retirement planning. The earlier you start saving and investing, the more time your money has to grow. A Fidelity Retirement Advisor can help you create a timeline and set achievable goals, even if you're starting later in life.

How to Get Started with a Fidelity Retirement Advisor?

Embarking on your retirement planning journey with a Fidelity Retirement Advisor is a straightforward process designed to make the transition seamless and stress-free. The first step is to schedule a consultation, either in person or virtually, where you can discuss your financial goals and current situation. During this meeting, your advisor will take the time to understand your unique needs, assess your risk tolerance, and outline potential strategies to achieve your retirement objectives.

Once you've established a relationship with your advisor, the next step is to create a comprehensive retirement plan. This involves evaluating your current savings, investment portfolio, and anticipated expenses. Fidelity's advisors will work with you to identify gaps in your plan and recommend solutions to address them. Whether it's optimizing your 4

The Fascinating Journey Of Root Beer History: From Ancient Roots To Modern Delight

How To Cash A Check At A Bank: A Complete Guide

Maximizing Efficiency With PaycomOnline Employee Self-Service: A Complete Guide

Chicago Bulls statements on the retirement of Derrick Rose

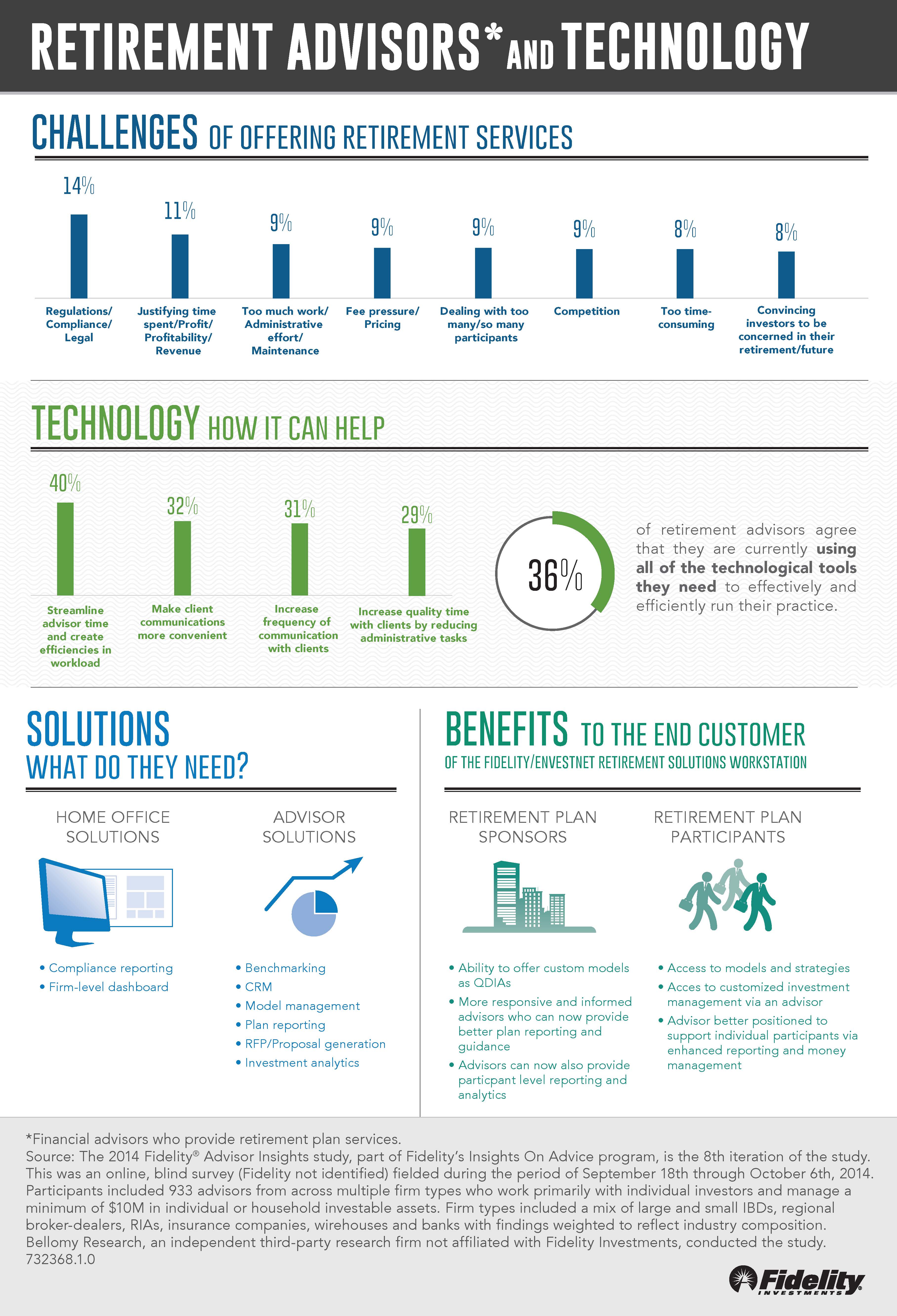

Fidelity to Offer Retirement Solutions Integrated Workstation