Fidelity Retirement: Your Pathway To A Secure Financial Future

Planning for retirement is a crucial milestone in everyone’s financial journey, and Fidelity Retirement is a trusted name that can guide you through this process with confidence. Whether you’re just starting to think about retirement or are nearing the finish line, Fidelity Retirement offers a comprehensive suite of tools, resources, and personalized advice to help you achieve your financial goals. With decades of experience in the financial services industry, Fidelity has earned a reputation for reliability, innovation, and customer-centric solutions. Their retirement planning services are designed to simplify complex financial decisions, ensuring you can enjoy your golden years without stress.

Retirement planning is more than just saving money—it’s about creating a roadmap for your future that aligns with your lifestyle, dreams, and financial capabilities. Fidelity Retirement understands this, offering tailored solutions that cater to individuals at every stage of their retirement journey. From 401(k) plans and IRAs to investment strategies and estate planning, Fidelity equips you with the tools you need to build a robust financial foundation. Their expertise in navigating the intricacies of retirement planning makes them a go-to resource for anyone seeking financial security.

As retirement planning becomes increasingly complex, having a trusted partner like Fidelity Retirement can make all the difference. With their cutting-edge technology, educational resources, and team of financial experts, Fidelity empowers you to take control of your financial future. Whether you’re looking to maximize your savings, minimize taxes, or create a sustainable income stream during retirement, Fidelity Retirement has the experience and authority to help you succeed. Let’s explore how Fidelity Retirement can help you achieve peace of mind and financial independence.

Read also:Understanding Steve Dulcichs Illness A Comprehensive Guide

Table of Contents

- What is Fidelity Retirement and How Can It Help You Plan for the Future?

- The Benefits of Choosing Fidelity Retirement for Your Financial Goals

- How to Get Started with Fidelity Retirement Planning?

- Exploring the Investment Options Available Through Fidelity Retirement

- What Are the Common Mistakes to Avoid in Retirement Planning?

- What Tools and Resources Does Fidelity Retirement Offer?

- How Can Fidelity Retirement Help You Maximize Tax Advantages?

- Frequently Asked Questions About Fidelity Retirement

What is Fidelity Retirement and How Can It Help You Plan for the Future?

Fidelity Retirement is a division of Fidelity Investments, one of the largest and most respected financial services companies in the world. It specializes in providing retirement planning solutions that cater to individuals, employers, and financial advisors. Fidelity Retirement’s mission is simple: to help people live the lives they envision during their retirement years by offering personalized guidance, innovative tools, and a wide range of financial products. Whether you’re an individual looking to manage your retirement savings or an employer seeking to offer retirement benefits to your employees, Fidelity Retirement has the expertise to meet your needs.

One of the standout features of Fidelity Retirement is its holistic approach to financial planning. They don’t just focus on saving money; they help you create a comprehensive plan that considers your current financial situation, future goals, and potential challenges. For instance, Fidelity’s retirement planning tools allow you to estimate how much you’ll need to save for retirement based on your desired lifestyle, projected expenses, and life expectancy. These tools also factor in variables such as inflation, healthcare costs, and Social Security benefits, providing a realistic picture of your financial needs.

Another key aspect of Fidelity Retirement is its commitment to education. They offer a wealth of resources, including webinars, articles, and videos, to help you understand complex financial concepts like asset allocation, risk management, and estate planning. By empowering you with knowledge, Fidelity Retirement ensures that you can make informed decisions about your financial future. Whether you’re a seasoned investor or a beginner, Fidelity Retirement provides the support you need to navigate the path to retirement with confidence.

The Benefits of Choosing Fidelity Retirement for Your Financial Goals

When it comes to retirement planning, choosing the right partner can make all the difference. Fidelity Retirement offers a host of benefits that set it apart from other financial services providers. One of the most significant advantages is its extensive range of retirement accounts. From traditional IRAs and Roth IRAs to 401(k) plans and SEP IRAs, Fidelity provides a variety of options to suit different financial needs and goals. These accounts come with competitive fees, low minimum investment requirements, and access to a wide range of investment choices, making it easier for you to build a diversified portfolio.

Another major benefit of Fidelity Retirement is its personalized advice. Fidelity offers access to professional financial advisors who can provide tailored recommendations based on your unique circumstances. Whether you’re looking to optimize your savings strategy, minimize taxes, or create a sustainable income stream during retirement, Fidelity’s advisors can help you develop a plan that aligns with your goals. Additionally, Fidelity’s digital tools allow you to track your progress and make adjustments as needed, ensuring that you stay on course to meet your retirement objectives.

Fidelity Retirement also stands out for its commitment to innovation. Their mobile app and online platform are user-friendly and packed with features that make retirement planning easier than ever. For example, the Fidelity Retirement Score is a unique tool that provides a quick snapshot of your retirement readiness, helping you identify areas where you may need to improve. With Fidelity Retirement, you can enjoy the peace of mind that comes from knowing you have a trusted partner by your side, guiding you every step of the way.

Read also:Dawn Wells Measurements A Complete Guide To Her Life And Career

How to Get Started with Fidelity Retirement Planning?

Getting started with Fidelity Retirement planning is easier than you might think. The first step is to assess your current financial situation and retirement goals. Fidelity offers a variety of tools and resources to help you with this process, including retirement calculators and goal-setting worksheets. These tools can help you estimate how much you’ll need to save for retirement and create a timeline for achieving your goals. Once you have a clear picture of your financial needs, you can begin exploring the retirement accounts and investment options available through Fidelity.

Next, consider opening a retirement account that aligns with your goals. Fidelity offers a range of options, including traditional IRAs, Roth IRAs, and 401(k) plans. Each account type has its own benefits and tax advantages, so it’s important to choose the one that best suits your needs. For example, a Roth IRA may be ideal if you’re looking for tax-free withdrawals during retirement, while a traditional IRA may be better if you want to reduce your taxable income now. Fidelity’s customer support team can help you navigate these options and make an informed decision.

Finally, take advantage of Fidelity’s educational resources and personalized advice to optimize your retirement strategy. Whether you’re a DIY investor or prefer working with a financial advisor, Fidelity offers the tools and support you need to succeed. By starting early and staying consistent with your savings, you can build a secure financial future and enjoy the retirement you’ve always dreamed of.

What Are the Steps to Open a Fidelity Retirement Account?

Opening a Fidelity Retirement account is a straightforward process. Here are the steps you need to follow:

- Choose the Right Account: Decide whether you want to open a traditional IRA, Roth IRA, or another type of retirement account based on your financial goals and tax preferences.

- Complete the Application: Visit Fidelity’s website and fill out the online application form. You’ll need to provide personal information, such as your Social Security number and employment details.

- Fund Your Account: Once your account is open, you can fund it by transferring money from an existing account or setting up automatic contributions.

- Select Investments: Choose from a wide range of investment options, including stocks, bonds, mutual funds, and ETFs, to build a diversified portfolio.

- Monitor and Adjust: Regularly review your account and make adjustments as needed to stay on track with your retirement goals.

Exploring the Investment Options Available Through Fidelity Retirement

One of the key advantages of Fidelity Retirement is its extensive range of investment options. Whether you’re a conservative investor looking for stability or an aggressive investor seeking growth, Fidelity offers a variety of choices to suit your risk tolerance and financial goals. Their investment lineup includes stocks, bonds, mutual funds, exchange-traded funds (ETFs), and target-date funds, providing you with the flexibility to create a diversified portfolio that aligns with your retirement strategy.

For those who prefer a hands-off approach, Fidelity’s target-date funds are an excellent option. These funds automatically adjust their asset allocation as you approach retirement, becoming more conservative over time to protect your savings. This makes them ideal for individuals who want a simple, low-maintenance investment strategy. On the other hand, if you prefer a more hands-on approach, Fidelity offers a wide selection of individual stocks and bonds, allowing you to build a customized portfolio tailored to your preferences.

Fidelity also offers access to professional investment management services for those who want expert guidance. Their managed accounts provide personalized investment strategies based on your financial goals, risk tolerance, and time horizon. These services are particularly beneficial for individuals who lack the time or expertise to manage their investments on their own. With Fidelity Retirement, you can rest assured that your investments are in capable hands, giving you the freedom to focus on enjoying life.

What Are the Best Investment Strategies for Fidelity Retirement Accounts?

When it comes to investing in your Fidelity Retirement account, it’s important to adopt a strategy that aligns with your goals and risk tolerance. Here are some tips to help you get started:

- Diversify Your Portfolio: Spread your investments across different asset classes, such as stocks, bonds, and mutual funds, to reduce risk and increase potential returns.

- Focus on Long-Term Growth: Retirement planning is a long-term endeavor, so prioritize investments that have the potential to grow over time, such as stocks and equity funds.

- Rebalance Regularly: Periodically review your portfolio and make adjustments to ensure it remains aligned with your goals and risk tolerance.

- Take Advantage of Tax Benefits: Use tax-advantaged accounts like IRAs and 401(k)s to maximize your savings and minimize your tax liability.

- Seek Professional Advice: If you’re unsure about how to allocate your investments, consider consulting a financial advisor for personalized guidance.

What Are the Common Mistakes to Avoid in Retirement Planning?

Retirement planning is a complex process, and even the most well-intentioned individuals can make mistakes that jeopardize their financial future. One common mistake is underestimating how much money you’ll need for retirement. Many people fail to account for factors like inflation, healthcare costs, and longer life expectancy, leading to a shortfall in their savings. Fidelity Retirement’s planning tools can help you avoid this pitfall by providing a realistic estimate of your retirement needs.

Another frequent error is starting too late. The earlier you begin saving for retirement, the more time your money has to grow through compound interest. Delaying your savings can significantly reduce the size of your nest egg, forcing you to save more aggressively later in life. Fidelity Retirement encourages individuals to start early, even if it’s with small contributions, to take advantage of the power of compounding.

Finally, many people overlook the importance of diversification. Putting all your eggs in one basket can expose your savings to unnecessary risk. Fidelity Retirement emphasizes the importance of building a diversified portfolio that balances growth and stability. By spreading your investments across different asset classes, you can protect your savings from market volatility and increase your chances of achieving long-term success.

What Tools and Resources Does Fidelity Retirement Offer?

Fidelity Retirement is renowned for its comprehensive suite of tools and resources designed to simplify the retirement planning process. One of their most popular tools is the Fidelity Retirement Score, which provides a quick assessment of your retirement readiness. This tool evaluates factors such as your current savings, expected Social Security benefits, and projected expenses to give you a score out of 100. It also offers personalized recommendations to help you improve your score and achieve your retirement goals.

In addition to the Retirement Score, Fidelity offers a variety of calculators and planning tools to help you make informed decisions. For example, their Retirement Income Planner allows you to estimate how much income you’ll need during retirement and explore different withdrawal strategies. Their Tax-Smart Withdrawal tool helps you minimize taxes by optimizing the order in which you withdraw funds from your accounts. These tools are designed to empower you with the knowledge and insights you need to make the most of your retirement savings.

Fidelity also provides a wealth of educational resources to help you stay informed about retirement planning. Their website features articles, videos, and webinars on topics ranging from investment strategies to estate planning. Additionally, Fidelity’s customer support team is available to answer your questions

Unveiling The Mysteries Of Twin Flame Meaning: A Spiritual Connection Like No Other

Exploring Evansville: A Comprehensive Guide To The Heart Of The Midwest

How To Cash A Personal Check: A Comprehensive Guide

Fidelity Visual CRM Log in

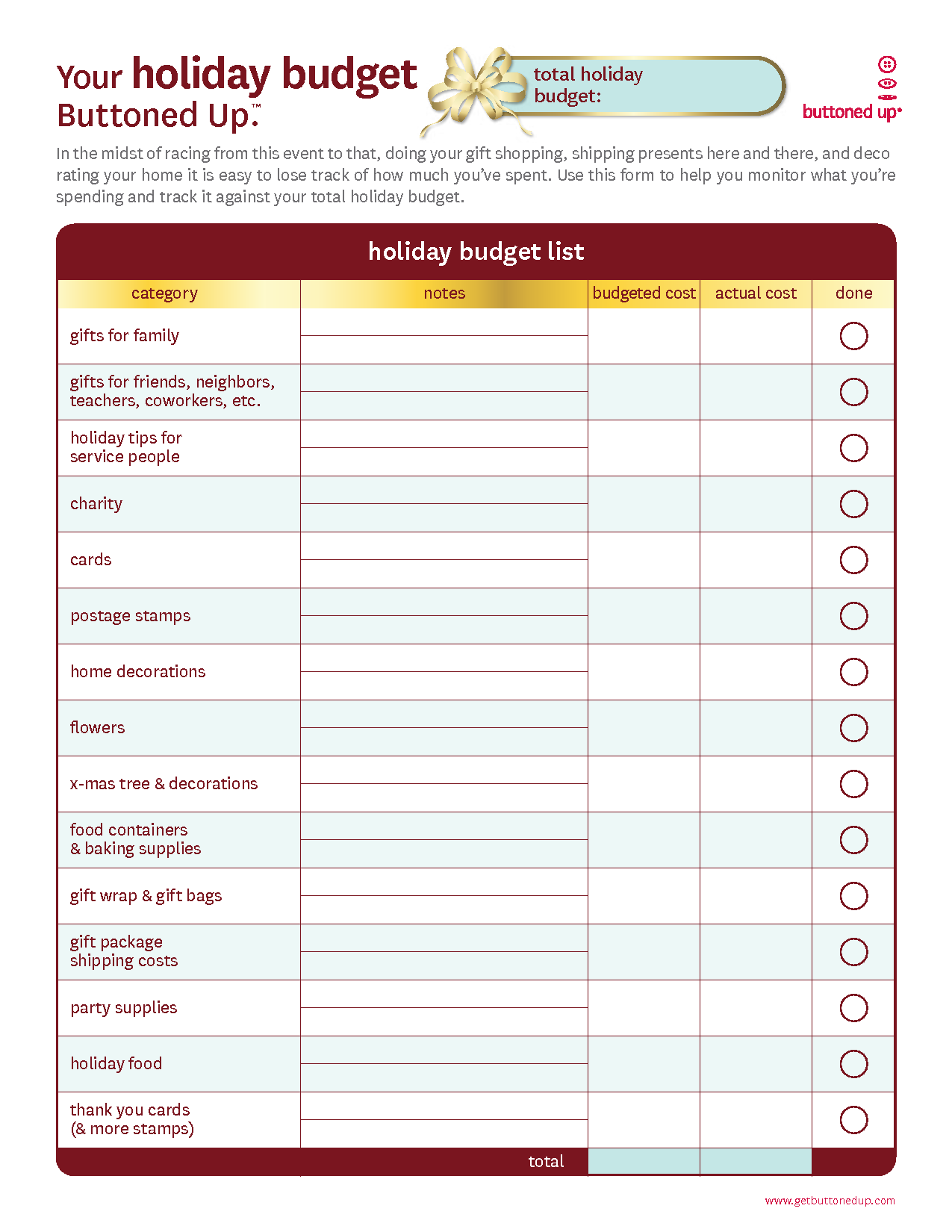

Fidelity Budget Worksheet Printout