How To Cash Personal Checks: A Complete Guide

Whether you’ve received a check from a friend, family member, or employer, knowing how to cash it efficiently is essential for accessing your funds quickly. Personal checks are a widely used payment method, but without proper guidance, navigating the process can leave you confused. This guide will walk you through everything you need to know, from where to cash a personal check to the fees involved and alternative methods for depositing your funds. By the end of this article, you’ll have a clear understanding of how to cash personal checks and make informed decisions about your finances. Cashing personal checks is more than just a routine financial transaction; it’s a process that requires awareness of your options and the associated costs. While banks and credit unions remain the most common places to cash checks, other alternatives like check-cashing services and mobile banking apps are gaining popularity. Each method has its own set of advantages and drawbacks, from convenience to fees. Understanding these nuances will help you choose the best option for your situation. Whether you’re looking for a quick solution or a long-term strategy, this article will provide actionable insights tailored to your needs. In today’s digital age, the ways to cash personal checks have evolved significantly. With advancements in mobile banking and financial technology, you can now deposit checks from the comfort of your home using a smartphone. However, traditional methods like visiting a bank or check-cashing store still hold their ground for those who prefer face-to-face transactions. This article will explore all these avenues, ensuring you’re equipped with the knowledge to make the best decision. Let’s dive into the details and uncover the most effective ways to cash personal checks while avoiding unnecessary fees and delays.

Table of Contents

- Where Can I Cash a Personal Check?

- How Do I Prepare to Cash a Personal Check?

- What Are the Fees Associated with Cashing Personal Checks?

- Is It Better to Deposit or Cash a Personal Check?

- How to Cash Personal Checks Using Mobile Banking

- Can I Cash a Personal Check Without a Bank Account?

- What Are the Security Tips for Cashing Personal Checks?

- Frequently Asked Questions About Cashing Personal Checks

Where Can I Cash a Personal Check?

One of the first questions that comes to mind when you receive a personal check is, “Where can I cash it?” Fortunately, there are multiple options available, each catering to different needs and preferences. The most common place to cash a personal check is your bank or credit union. If you have an account with the institution, they will typically cash your check for free or at a minimal cost. This is often the most secure and reliable option, as banks verify the authenticity of the check and ensure that the funds are available.

Check-Cashing Stores and Retailers

For those without a bank account, check-cashing stores and select retailers like Walmart or grocery chains can be viable alternatives. These establishments often charge a fee, which can range from a flat rate to a percentage of the check’s value. While this option is convenient, especially for those in a hurry, it’s important to compare fees and ensure you’re not overpaying. Some retailers may also have restrictions on the types of checks they accept, so it’s wise to confirm their policies beforehand.

Read also:Ant Anstead Net Worth Unveiling The Life Career And Financial Success Of A Renowned Car Expert

Mobile Banking and ATMs

Another modern solution is using mobile banking apps or ATMs to deposit or cash personal checks. Many banks now offer mobile check deposit services, allowing you to snap a photo of the check and submit it electronically. This method is not only convenient but also eliminates the need to visit a physical location. However, it’s worth noting that some banks may place a hold on the funds until the check clears, so plan accordingly if you need immediate access to the money.

How Do I Prepare to Cash a Personal Check?

Before heading out to cash a personal check, it’s crucial to prepare adequately to ensure a smooth transaction. One of the first steps is to verify that the check contains all the necessary information. This includes the payee’s name, the date, the amount in both numerical and written form, the payer’s signature, and the bank’s routing and account numbers. Any missing or incorrect details could lead to delays or the check being rejected.

Gather Required Identification

Most institutions require valid identification to cash a personal check. This typically includes a government-issued ID such as a driver’s license, passport, or state ID card. Some places may also request a second form of ID, such as a utility bill or bank statement, to confirm your identity. It’s a good idea to carry multiple forms of identification to avoid any issues during the process.

Understand the Check’s Value and Limits

Knowing the value of the check and the institution’s policies is equally important. Some banks and check-cashing services impose daily or transaction limits, which could affect how much you can cash at once. Additionally, be aware of any fees or holds that may apply, as these can impact the amount of money you receive upfront. By preparing in advance, you can ensure a hassle-free experience when cashing your personal check.

What Are the Fees Associated with Cashing Personal Checks?

When it comes to cashing personal checks, fees can vary significantly depending on the method and institution you choose. Understanding these costs is essential to avoid unexpected deductions from your funds. Traditional banks often offer the most cost-effective solution, especially if you’re an account holder. In many cases, they waive fees entirely or charge a nominal amount for check-cashing services.

Fees at Check-Cashing Stores

Check-cashing stores, on the other hand, are notorious for higher fees. These establishments typically charge a percentage of the check’s value, which can range from 1% to 10% or more. While they provide a convenient option for those without a bank account, the costs can add up quickly. To minimize expenses, compare rates from different providers and consider negotiating the fee if possible.

Read also:Understanding Steve Dulcichs Illness A Comprehensive Guide

Mobile Banking and ATM Fees

Mobile banking apps and ATMs generally offer a fee-free experience for depositing checks. However, if you’re withdrawing the funds immediately after depositing, you may incur ATM fees, especially if you use an out-of-network machine. Some banks also place a hold on a portion of the check’s value, which can delay access to your money. Understanding these nuances will help you make an informed decision and avoid unnecessary charges.

Is It Better to Deposit or Cash a Personal Check?

When deciding between depositing and cashing a personal check, it’s important to weigh the pros and cons of each option. Depositing the check into your bank account is often the safer and more practical choice, especially if you don’t need immediate access to the funds. This method allows you to avoid cash-cashing fees and provides a record of the transaction in your account history.

Advantages of Cashing a Personal Check

Cashing a personal check, on the other hand, provides instant access to the funds, which can be beneficial in emergencies or when you need cash on hand. However, this convenience often comes at a cost, particularly if you use a check-cashing service or an out-of-network ATM. Additionally, carrying large amounts of cash can pose security risks, making it less ideal for some individuals.

Factors to Consider

Ultimately, the decision depends on your financial needs and circumstances. If you value convenience and security, depositing the check is likely the better option. However, if you require immediate cash and are willing to pay a fee, cashing the check may be more suitable. By evaluating your priorities and understanding the implications of each choice, you can make the best decision for your situation.

How to Cash Personal Checks Using Mobile Banking

Mobile banking has revolutionized the way we handle financial transactions, including how to cash personal checks. With just a few taps on your smartphone, you can deposit a check without ever stepping foot inside a bank. This method is not only convenient but also saves time and reduces the need for physical interactions. Most major banks offer mobile check deposit services through their apps, making it accessible to a wide range of users.

Steps to Deposit a Check Using Mobile Banking

To deposit a personal check using mobile banking, start by logging into your bank’s app and navigating to the “Deposit” or “Check Deposit” section. Follow the prompts to enter the check amount and take clear photos of both the front and back of the check. Ensure that the images are legible and include all required endorsements. Once submitted, the bank will process the deposit, and the funds will typically be available within a few business days.

Tips for a Smooth Mobile Deposit

For a seamless experience, double-check that your check meets the bank’s requirements, such as being signed and endorsed correctly. It’s also a good idea to retain the physical check for a short period after depositing, in case the bank requests it for verification. While mobile banking is a convenient option, be mindful of any deposit limits or holds that may apply, as these can vary by institution.

Can I Cash a Personal Check Without a Bank Account?

Not everyone has access to a bank account, but that doesn’t mean you’re out of options when it comes to cashing personal checks. There are several alternatives available for individuals without traditional banking services. Check-cashing stores, retail locations like Walmart, and prepaid debit card services are popular choices for those seeking to cash checks without an account.

Using Check-Cashing Services

Check-cashing services provide a straightforward solution, though they often charge higher fees compared to banks. These establishments typically require valid identification and may have additional requirements, such as proof of residency. While the fees can be steep, the convenience of immediate cash access makes this option appealing to many.

Prepaid Debit Cards

Another alternative is using a prepaid debit card that offers check-cashing services. Some cards allow you to deposit checks directly onto the card, which you can then use for purchases or withdraw cash from ATMs. This method combines convenience with flexibility, though it’s important to review the card’s fees and terms to avoid unexpected charges.

What Are the Security Tips for Cashing Personal Checks?

Cashing personal checks involves handling sensitive financial information, making security a top priority. To protect yourself from fraud or theft, it’s essential to follow best practices at every step of the process. One of the most important tips is to endorse the check immediately after receiving it. This prevents unauthorized individuals from cashing it in your name.

Verify the Check’s Authenticity

Before cashing a personal check, take a moment to verify its authenticity. Look for signs of tampering, such as altered amounts or mismatched signatures. If anything seems suspicious, contact the payer or your bank for clarification. Additionally, always cash checks at reputable institutions to minimize the risk of encountering counterfeit checks.

Keep Personal Information Private

Avoid sharing unnecessary personal details when cashing a check, as this information could be used for identity theft. Use secure methods for storing and transporting checks, and never leave them unattended. By prioritizing security, you can safeguard your finances and enjoy peace of mind throughout the process.

Frequently Asked Questions About Cashing Personal Checks

Can I Cash a Personal Check at Any Bank?

While many banks allow non-account holders to cash checks, policies vary widely. Some banks may charge a fee or require additional identification. It’s best to call ahead and confirm their requirements before visiting.

How Long Does It Take for a Personal Check to Clear?

The clearing time for a personal check depends on the bank and the check’s amount. Typically, funds become available within 1-3 business days, though larger checks may take longer to process.

What Should I Do If a Personal Check Bounces?

If a personal check bounces, contact the payer to resolve the issue. You may also need to notify your bank and explore options for recovering the funds, such as charging a returned check fee.

For more information on banking services, you can visit

Exploring All Types Of Hair: A Comprehensive Guide To Hair Types And Care

Maximizing Your Fidelity Retirement Income: A Comprehensive Guide

Exploring The LAX To Honolulu Delta: A Complete Travel Guide

NeoGov Payroll Software MICR Checks

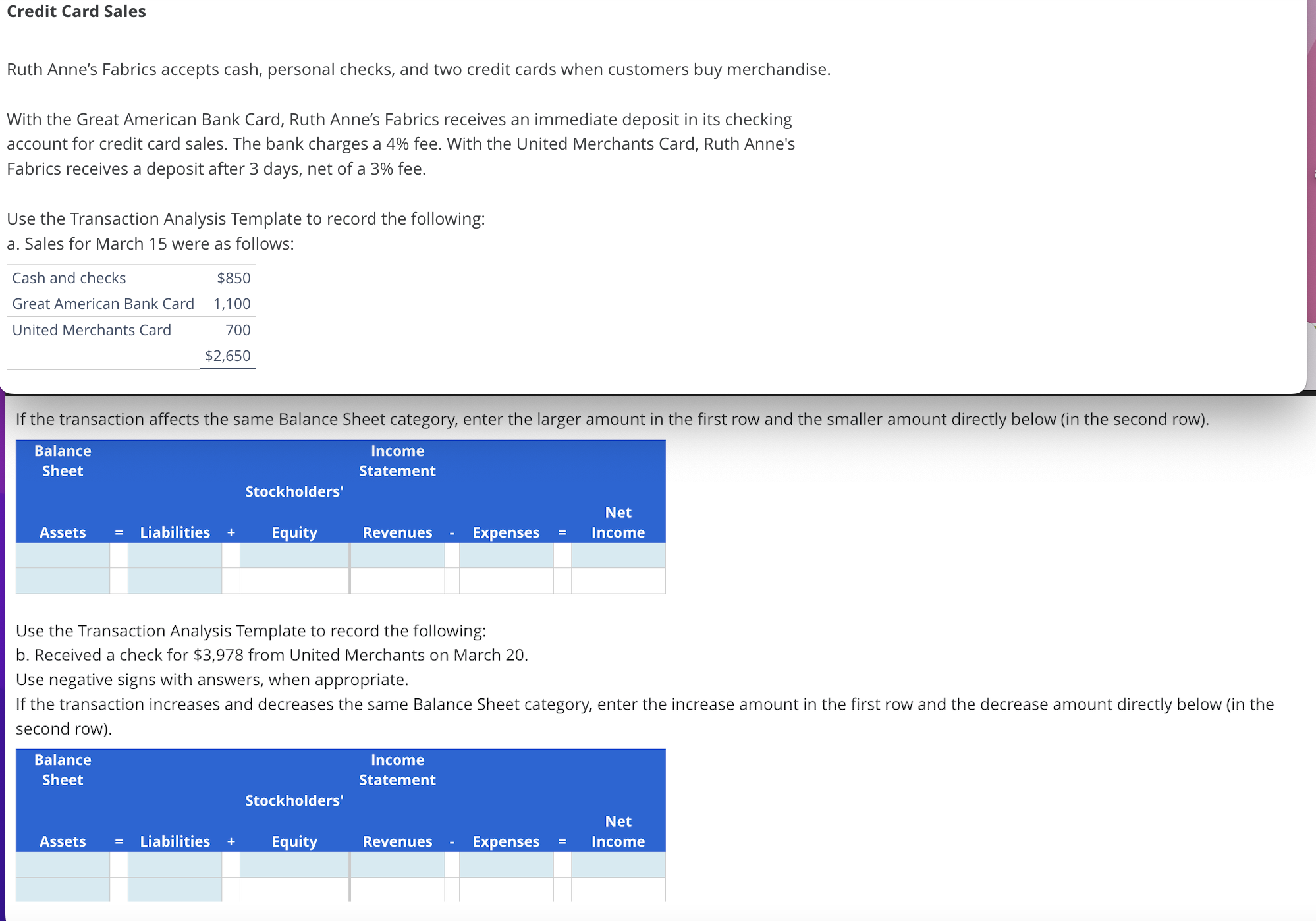

Solved Credit Card Sales Ruth Anne's Fabrics accepts cash,