How To Master Your Financial Future With The Fidelity Retirement Income Planner

The Fidelity Retirement Income Planner is one such tool designed to simplify the complex process of retirement planning. Whether you're just starting to think about retirement or are already preparing for your golden years, this planner offers a comprehensive approach to help you create a roadmap for financial security. By analyzing your current savings, expected expenses, and potential income streams, the Fidelity Retirement Income Planner ensures you're on the right track to achieving your retirement goals. Retirement planning isn’t just about saving money—it’s about creating a sustainable income stream that can support your lifestyle for decades. The Fidelity Retirement Income Planner provides personalized insights into how much you’ll need to save, how to allocate your investments, and how to manage withdrawals during retirement. It also considers factors like inflation, healthcare costs, and Social Security benefits, giving you a holistic view of your financial situation. With its user-friendly interface and actionable recommendations, the planner empowers you to make informed decisions about your retirement strategy. In today’s uncertain economic climate, having a reliable retirement income plan is more important than ever. The Fidelity Retirement Income Planner stands out as a trusted resource because of its ability to adapt to individual needs. Whether you’re looking to maximize your 401(k), explore annuities, or balance your portfolio, this tool provides the guidance you need. By leveraging its features, you can ensure that your retirement years are not only financially secure but also fulfilling and stress-free.

Table of Contents

- What is the Fidelity Retirement Income Planner and How Does It Work?

- Key Features and Benefits of the Fidelity Retirement Income Planner

- Is the Fidelity Retirement Income Planner Right for You?

- How to Get Started with the Fidelity Retirement Income Planner

- What Are the Common Mistakes to Avoid When Using the Fidelity Retirement Income Planner?

- How Can You Maximize Your Retirement Income Using the Fidelity Planner?

- How Does the Fidelity Retirement Income Planner Compare to Other Tools?

- Frequently Asked Questions About the Fidelity Retirement Income Planner

What is the Fidelity Retirement Income Planner and How Does It Work?

The Fidelity Retirement Income Planner is a robust digital tool designed to help individuals create a personalized retirement income strategy. At its core, the planner aims to bridge the gap between your current financial situation and your desired retirement lifestyle. By inputting details such as your age, current savings, expected retirement age, and anticipated expenses, the tool generates a detailed analysis of your financial readiness. This analysis includes projections of how long your savings will last, potential income streams, and recommendations for adjustments to ensure you meet your retirement goals. One of the standout features of the Fidelity Retirement Income Planner is its ability to incorporate various income sources. For instance, it considers Social Security benefits, pensions, annuities, and other investments to provide a comprehensive view of your retirement income. The planner also factors in inflation, healthcare costs, and market volatility, ensuring that your plan remains realistic and adaptable to changing circumstances. Additionally, it offers actionable insights, such as how much you need to save monthly or annually to stay on track, and suggests investment strategies to maximize your returns. Another key aspect of the Fidelity Retirement Income Planner is its user-friendly interface. The tool is designed to be accessible to individuals with varying levels of financial knowledge. Whether you’re a seasoned investor or someone just starting to think about retirement, the planner’s step-by-step process makes it easy to navigate. It also provides visual aids, such as charts and graphs, to help you better understand your financial projections. By combining advanced analytics with intuitive design, the Fidelity Retirement Income Planner empowers users to take control of their retirement planning with confidence.

Key Features and Benefits of the Fidelity Retirement Income Planner

The Fidelity Retirement Income Planner offers a range of features that make it a standout tool for retirement planning. One of its most significant advantages is its customization capabilities. The planner allows users to input specific details about their financial situation, such as current savings, expected retirement age, and anticipated expenses. This level of personalization ensures that the recommendations provided are tailored to your unique needs, rather than offering generic advice that may not apply to your circumstances. Another key feature is its ability to simulate different retirement scenarios. For example, you can adjust variables such as your retirement age, investment returns, and spending habits to see how these changes impact your financial projections. This "what-if" analysis is invaluable for making informed decisions about your retirement strategy. Additionally, the planner provides detailed insights into how your savings will be depleted over time, helping you identify potential shortfalls and take corrective action early. The benefits of using the Fidelity Retirement Income Planner extend beyond just financial projections. It also offers educational resources to help users better understand retirement planning concepts. For instance, the tool provides explanations of terms like annuities, Social Security benefits, and required minimum distributions (RMDs). These resources empower users to make smarter financial decisions and feel more confident about their retirement plans. Furthermore, the planner’s integration with other Fidelity tools, such as investment accounts and retirement calculators, creates a seamless experience for managing all aspects of your financial future.

Read also:Unlock The Fun Infinite Craft Unblocked Ndash The Ultimate Guide

Is the Fidelity Retirement Income Planner Right for You?

When considering retirement planning tools, it’s essential to evaluate whether the Fidelity Retirement Income Planner aligns with your specific needs. This tool is particularly well-suited for individuals who are proactive about their financial future and are looking for a comprehensive solution to manage their retirement income. If you already have a Fidelity account or are considering opening one, the planner’s seamless integration with Fidelity’s suite of financial services makes it a convenient choice. However, the Fidelity Retirement Income Planner may not be the best fit for everyone. For instance, if you prefer working directly with a financial advisor rather than using a digital tool, you might find the planner’s self-service model limiting. Similarly, individuals with highly complex financial situations, such as multiple income streams or significant tax considerations, may benefit more from personalized advice. That said, the planner does offer the option to consult with a Fidelity advisor for additional guidance, which can be a valuable middle ground for those who want both autonomy and expert support. Ultimately, the decision to use the Fidelity Retirement Income Planner depends on your comfort level with digital tools and your specific retirement goals. If you’re looking for a user-friendly, customizable solution that provides actionable insights, this planner is worth exploring. However, it’s always a good idea to compare it with other retirement planning tools to ensure it meets your expectations.

What Are the Alternatives to the Fidelity Retirement Income Planner?

If you’re considering the Fidelity Retirement Income Planner but want to explore other options, several alternatives are worth examining. Tools like Vanguard’s Retirement Nest Egg Calculator and Charles Schwab’s Retirement Income Planner offer similar functionalities, such as personalized projections and scenario analysis. These tools are particularly appealing if you already have accounts with these institutions, as they integrate seamlessly with your existing investments. Another alternative is using a robo-advisor like Betterment or Wealthfront, which offers retirement planning as part of its broader financial management services. These platforms use algorithms to create and manage a diversified portfolio, often incorporating retirement goals into their recommendations. While they may lack the depth of customization offered by the Fidelity planner, they provide a hands-off approach that appeals to many users.

How to Get Started with the Fidelity Retirement Income Planner

Getting started with the Fidelity Retirement Income Planner is a straightforward process, but taking the right steps can make a significant difference in the quality of your retirement plan. The first step is to gather all the necessary financial information, such as your current savings, expected retirement age, and anticipated expenses. This data will form the foundation of your retirement projections, so accuracy is crucial. Once you have this information, you can create a Fidelity account or log in to your existing one to access the planner. After logging in, you’ll be guided through a series of questions designed to assess your financial situation and retirement goals. These questions cover topics like your income sources, investment portfolio, and expected lifestyle during retirement. The planner uses this information to generate a detailed analysis of your financial readiness, including projections of how long your savings will last and recommendations for adjustments. It’s important to review these projections carefully and consider any suggested changes to your savings or investment strategy. To maximize the benefits of the Fidelity Retirement Income Planner, take advantage of its educational resources and scenario analysis features. For example, you can experiment with different retirement ages or spending levels to see how these changes impact your financial projections. Additionally, consider scheduling a consultation with a Fidelity advisor to get personalized advice based on your planner results. By combining the planner’s insights with expert guidance, you can create a robust retirement income strategy that aligns with your goals.

What Information Do You Need to Provide for Accurate Results?

To ensure accurate results from the Fidelity Retirement Income Planner, it’s essential to provide detailed and up-to-date financial information. Start by listing your current savings, including retirement accounts like 401(k)s and IRAs, as well as any other investments or assets. Next, estimate your expected retirement age and anticipated expenses, such as housing, healthcare, and leisure activities. The planner also requires information about your income sources, such as Social Security benefits, pensions, and annuities.

What Are the Common Mistakes to Avoid When Using the Fidelity Retirement Income Planner?

While the Fidelity Retirement Income Planner is a powerful tool, there are several common mistakes users should avoid to ensure accurate and effective results. One frequent error is underestimating expenses during retirement. Many people fail to account for rising healthcare costs, inflation, or unexpected expenses, which can lead to an overly optimistic financial projection. To avoid this, it’s crucial to be realistic about your anticipated expenses and build in a margin for unexpected costs. Another mistake is overestimating investment returns. While it’s tempting to assume high returns on your investments, this can create unrealistic expectations about your financial readiness. Instead, use conservative estimates based on historical market performance to ensure your projections are grounded in reality. Additionally, avoid ignoring tax implications, as taxes can significantly impact your retirement income. The planner provides options to factor in taxes, so be sure to include this information for a more accurate assessment.

How Can You Avoid Overlooking Important Details?

To avoid overlooking important details, take the time to thoroughly review the planner’s recommendations and projections. Pay close attention to areas like required minimum distributions (RMDs) and Social Security benefits, as these can have a substantial impact on your retirement income. Additionally, consider consulting with a financial advisor to ensure you haven’t missed any critical factors in your planning process.

Read also:Discover Robie Uniacke A Journey Into His Life And Achievements

How Can You Maximize Your Retirement Income Using the Fidelity Planner?

Maximizing your retirement income with the Fidelity Retirement Income Planner involves a combination of strategic planning and proactive adjustments. One effective strategy is to optimize your Social Security benefits by delaying your claim until full retirement age or later. The planner can help you analyze the impact of different claiming strategies on your overall retirement income, allowing you to make an informed decision. Another way to maximize your income is by diversifying your investment portfolio. The planner provides insights into how different asset allocations can affect your returns, helping you strike a balance between risk and reward. Additionally, consider incorporating annuities or other guaranteed income sources into your plan to ensure a steady cash flow during retirement. The Fidelity Retirement Income Planner can help you evaluate these options and determine whether they align with your financial goals.

What Are the Best Practices for Adjusting Your Plan Over Time?

As your financial situation and retirement goals evolve, it’s essential to regularly update your retirement plan. Use the planner’s scenario analysis feature to test how changes in your savings, investments, or spending habits impact your projections. Additionally, revisit your plan annually to account for factors like market performance, inflation, and changes in your personal circumstances. By staying proactive and adaptable, you can ensure your retirement income strategy remains robust and effective.

How Does the Fidelity Retirement Income Planner Compare to Other Tools?

When comparing the Fidelity Retirement Income Planner to other retirement planning tools, several factors stand out. One of the planner’s key advantages is its integration with Fidelity’s suite of financial services, which provides a seamless experience for users with Fidelity accounts. This integration allows for real-time updates and synchronization with your investment portfolio, ensuring your projections are always based on the most current data. Another distinguishing feature is the planner’s educational resources. Unlike some tools that focus solely on financial projections, the Fidelity planner offers detailed explanations of retirement planning concepts, empowering users to make informed decisions. Additionally, its scenario analysis capabilities are more robust than many competitors, allowing users to explore a wide range of "what-if" scenarios.

What Are the Limitations of the Fidelity Retirement Income Planner?

While the Fidelity Retirement Income Planner offers many benefits, it’s not without limitations. For example, users with highly complex financial situations may find the tool’s self-service model insufficient for their needs. In such cases, personalized advice from a financial advisor may be necessary

Understanding The Average Humidity In The US: A Comprehensive Guide

What Is Dishwater Blonde Hair And Why Is It Trending?

Fidelty Retirement: Your Path To Financial Freedom And Peace Of Mind

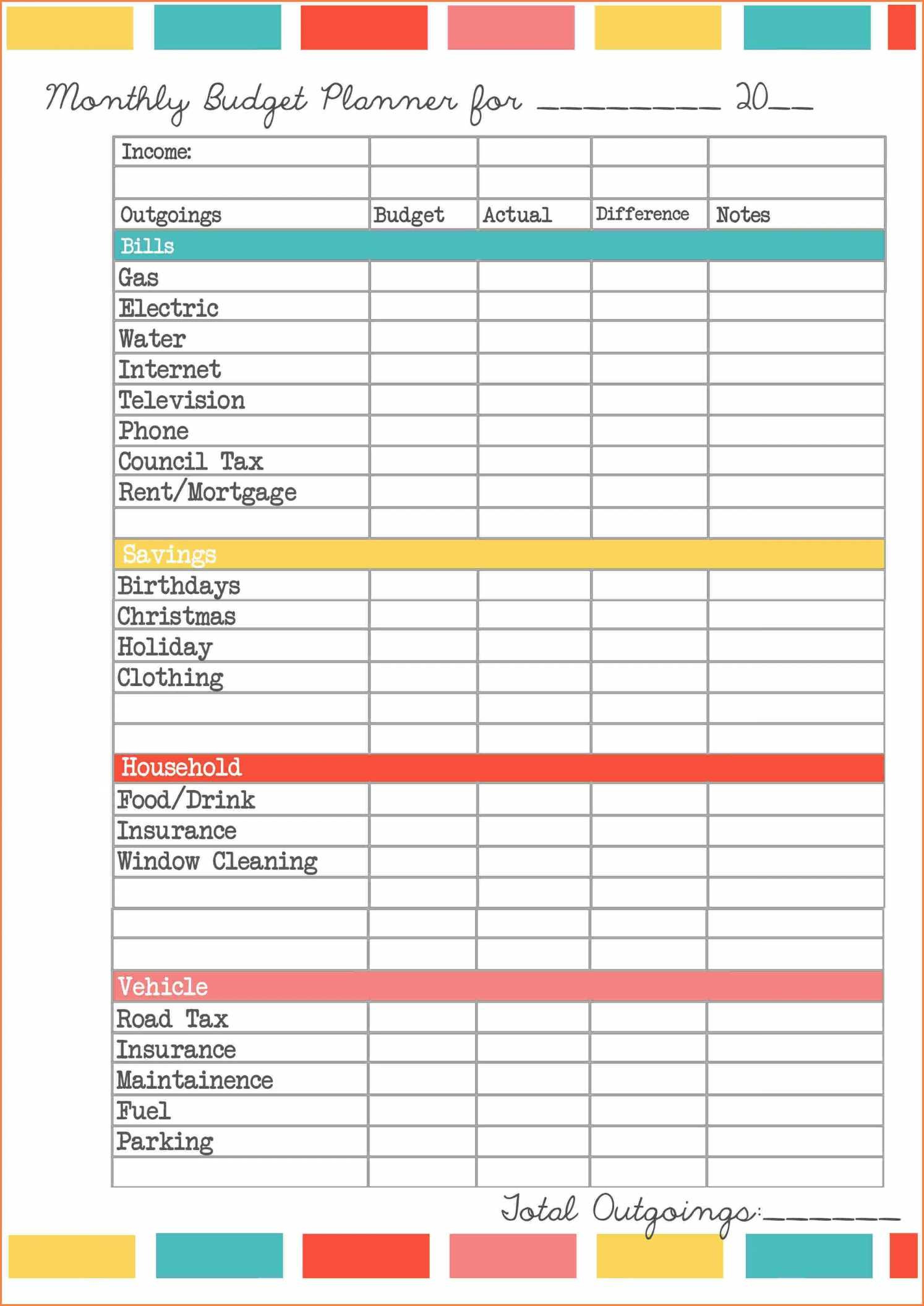

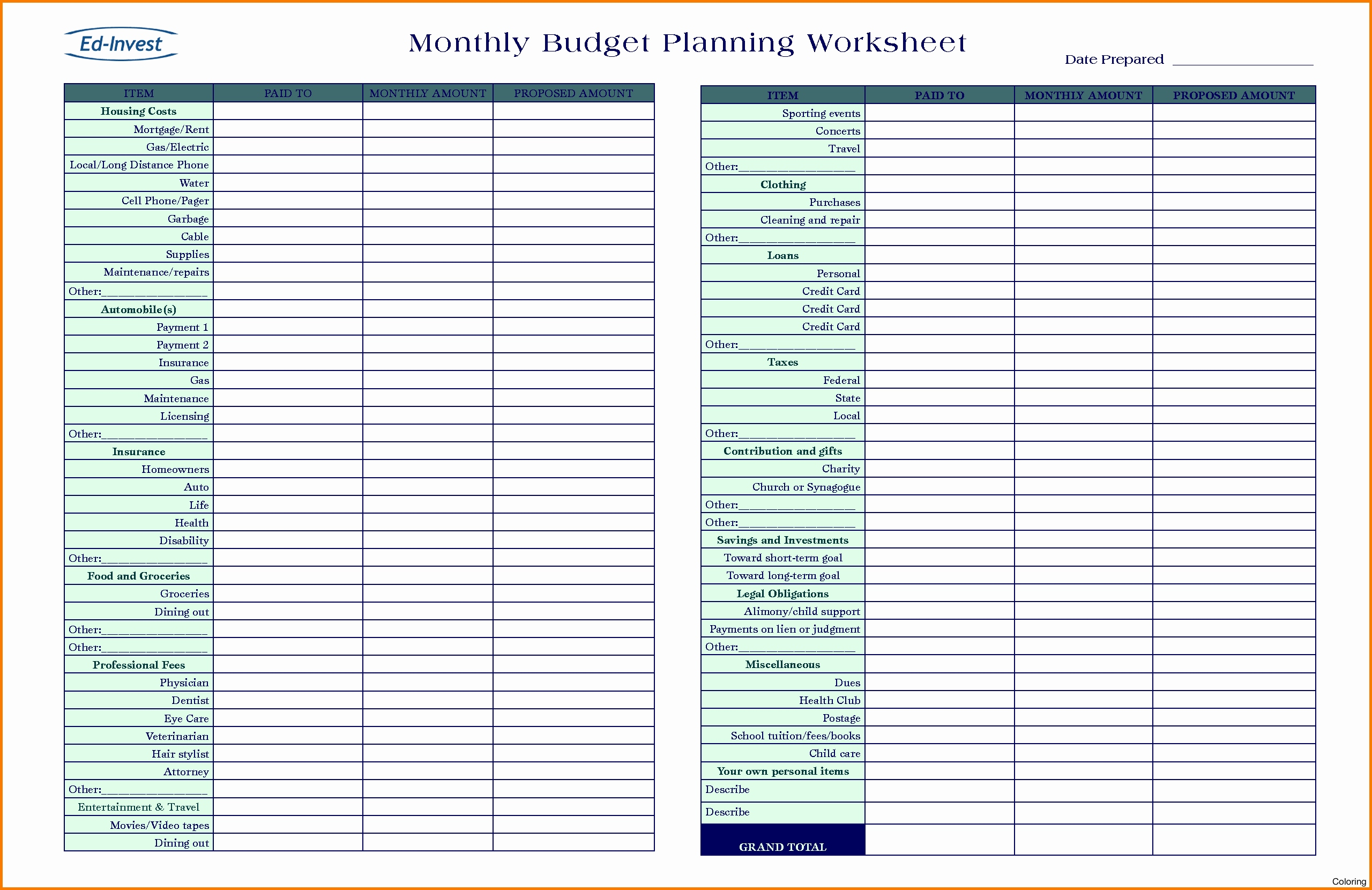

Fidelity Retirement Planner Worksheet —

Retirement Planning Worksheet Karaackerman —