How To Maximize Your Savings With A Retirement Planner Fidelity Account?

Planning for retirement is one of the most critical financial decisions you’ll ever make, and partnering with a trusted provider like Fidelity can make all the difference. A retirement planner fidelity account offers a range of tools and resources to help you create a personalized roadmap for your golden years. Whether you’re just starting to save or nearing retirement, understanding how to maximize your savings is essential for financial security. Fidelity’s expertise in retirement planning ensures that you have access to cutting-edge tools, expert advice, and investment options tailored to your needs.

With the rising cost of living and increasing life expectancy, having a well-thought-out retirement plan is more important than ever. Fidelity’s retirement planner tools allow you to assess your current financial situation, project future expenses, and identify potential gaps in your savings. By leveraging these resources, you can make informed decisions about your investments, contributions, and withdrawals. This ensures that your retirement fund grows steadily while minimizing risks.

But how do you get started with a retirement planner fidelity account, and what makes it stand out from other retirement planning services? From tax-efficient strategies to personalized advice, Fidelity offers a comprehensive suite of services designed to help you achieve your retirement goals. In this article, we’ll explore everything you need to know about using a retirement planner fidelity account, including actionable tips, frequently asked questions, and expert insights to guide you along the way.

Read also:Discover Robie Uniacke A Journey Into His Life And Achievements

Table of Contents

- What Makes Retirement Planner Fidelity Unique?

- How Can You Get Started with Retirement Planner Fidelity?

- What Are the Key Features of Fidelity’s Retirement Planning Tools?

- How to Optimize Your Retirement Savings with Fidelity?

- Why Is Tax Efficiency Important in Retirement Planning?

- What Are the Common Mistakes to Avoid in Retirement Planning?

- How Can You Monitor and Adjust Your Retirement Plan?

- Frequently Asked Questions about Retirement Planner Fidelity

What Makes Retirement Planner Fidelity Unique?

Fidelity Investments has long been a leader in the financial services industry, and its retirement planning offerings are no exception. What sets a retirement planner fidelity account apart from other providers is its combination of advanced technology, personalized advice, and a wide range of investment options. Whether you’re a hands-on investor or someone who prefers professional guidance, Fidelity caters to all types of retirement savers.

One of the standout features of Fidelity’s retirement planner is its user-friendly interface. The platform provides easy-to-understand dashboards and tools that allow you to track your progress, set goals, and adjust your strategy as needed. Additionally, Fidelity offers access to a team of certified financial planners who can provide tailored advice based on your unique financial situation. This personalized approach ensures that your retirement plan aligns with your goals, whether you’re saving for a modest lifestyle or planning for a luxurious retirement.

Another key advantage of using a retirement planner fidelity account is the availability of low-cost investment options. Fidelity offers a wide range of mutual funds, ETFs, and target-date funds, many of which have no management fees. This helps you maximize your returns while keeping costs low. Furthermore, Fidelity’s commitment to innovation means you’ll have access to cutting-edge tools like retirement income planners and Social Security optimizers, which can help you make the most of your retirement savings.

How Can You Get Started with Retirement Planner Fidelity?

Getting started with a retirement planner fidelity account is a straightforward process, but it’s important to approach it with a clear plan. The first step is to assess your current financial situation, including your income, expenses, and existing retirement savings. This will give you a baseline to work from and help you set realistic goals for your retirement.

Step 1: Create an Account and Explore Tools

To begin, visit Fidelity’s website and create an account. Once you’ve registered, you’ll gain access to a suite of retirement planning tools. These tools allow you to input your financial information, project future expenses, and estimate how much you’ll need to save to meet your retirement goals. For example, Fidelity’s Retirement Score tool provides a snapshot of your retirement readiness based on your current savings and spending habits.

Step 2: Consult with a Financial Advisor

If you’re unsure where to start or need personalized advice, consider scheduling a consultation with one of Fidelity’s certified financial planners. These experts can help you create a customized retirement plan that takes into account your risk tolerance, time horizon, and financial goals. They can also guide you on how to allocate your investments for optimal growth and security.

Read also:Exploring The Unique Bond Of Colin Jost And Michael Che Friendship A Closer Look

Step 3: Choose the Right Investment Options

Once you’ve set your goals and consulted with an advisor, it’s time to choose the right investment options for your retirement planner fidelity account. Fidelity offers a variety of choices, including mutual funds, index funds, and target-date funds. Target-date funds are particularly popular among retirement savers because they automatically adjust your asset allocation as you approach retirement age.

What Are the Key Features of Fidelity’s Retirement Planning Tools?

Fidelity’s retirement planning tools are designed to simplify the process of saving for retirement while providing you with the insights you need to make informed decisions. These tools are packed with features that cater to both novice investors and seasoned financial experts.

Retirement Score Tool: How Does It Work?

One of the most popular tools offered by Fidelity is the Retirement Score tool. This feature evaluates your current financial situation and provides a score that indicates how prepared you are for retirement. The tool takes into account factors such as your age, income, savings, and expected retirement age to generate a personalized score. It also offers actionable recommendations to improve your score, such as increasing your contributions or adjusting your investment strategy.

Social Security Optimizer: Why Is It Important?

Another standout feature is the Social Security optimizer. This tool helps you determine the best time to start claiming Social Security benefits based on your financial needs and life expectancy. By delaying benefits, you can increase your monthly payments, which can significantly boost your retirement income. The optimizer provides a detailed analysis of the potential outcomes, helping you make an informed decision.

Retirement Income Planner: How Can It Help?

The Retirement Income Planner is another valuable tool that helps you create a sustainable income strategy for retirement. It allows you to input your expected expenses and income sources, such as pensions, Social Security, and investments, to create a comprehensive plan. The tool also provides insights into how long your savings are likely to last and offers suggestions for adjusting your strategy to ensure financial security.

How to Optimize Your Retirement Savings with Fidelity?

Optimizing your retirement savings requires a combination of smart investment choices, disciplined saving habits, and regular monitoring of your progress. Fidelity offers several strategies to help you maximize your retirement planner fidelity account and achieve your financial goals.

Take Advantage of Employer Matching

If your employer offers a 401(k) plan with matching contributions, be sure to take full advantage of it. Employer matching is essentially free money that can significantly boost your retirement savings. For example, if your employer matches 50% of your contributions up to 6% of your salary, contributing the maximum amount ensures you’re not leaving money on the table.

Automate Your Contributions

One of the easiest ways to stay consistent with your savings is to automate your contributions. By setting up automatic transfers to your retirement planner fidelity account, you can ensure that you’re consistently adding to your savings without having to think about it. This approach helps you take advantage of dollar-cost averaging, which can reduce the impact of market volatility on your investments.

Rebalance Your Portfolio Regularly

As you approach retirement, it’s important to rebalance your portfolio to align with your changing risk tolerance. Fidelity’s tools can help you assess your asset allocation and make adjustments as needed. For example, you may want to shift from high-risk, high-reward investments to more conservative options as you near retirement age. Regular rebalancing ensures that your portfolio remains aligned with your goals and risk tolerance.

Why Is Tax Efficiency Important in Retirement Planning?

Tax efficiency is a critical component of retirement planning, as it can significantly impact the amount of money you have available during your golden years. A retirement planner fidelity account offers several strategies to help you minimize your tax burden and maximize your savings.

Utilize Tax-Advantaged Accounts

One of the best ways to optimize your tax efficiency is to take advantage of tax-advantaged accounts like IRAs and 401(k)s. Contributions to traditional IRAs and 401(k)s are tax-deductible, which can lower your taxable income in the year you make the contribution. Additionally, Roth IRAs offer tax-free withdrawals in retirement, making them an excellent option for long-term savings.

Consider Tax-Loss Harvesting

Tax-loss harvesting is another strategy that can help you reduce your tax liability. This involves selling investments that have lost value to offset gains in other parts of your portfolio. Fidelity’s tools can help you identify opportunities for tax-loss harvesting and ensure that you’re maximizing your tax savings.

Plan for Required Minimum Distributions

Once you reach age 73, you’ll be required to take minimum distributions from your retirement accounts. These distributions are subject to income tax, so it’s important to plan for them in advance. Fidelity’s retirement income planner can help you estimate your required minimum distributions and incorporate them into your overall retirement strategy.

What Are the Common Mistakes to Avoid in Retirement Planning?

While planning for retirement can be exciting, it’s easy to make mistakes that can derail your financial goals. Understanding these common pitfalls can help you avoid them and ensure a more secure retirement.

Underestimating Your Expenses

One of the biggest mistakes people make is underestimating their expenses in retirement. While some costs, like commuting and work-related expenses, may decrease, others, like healthcare and travel, are likely to increase. Fidelity’s retirement income planner can help you estimate your future expenses and create a realistic budget.

Not Saving Enough Early On

Another common mistake is waiting too long to start saving for retirement. The earlier you begin, the more time your money has to grow through compound interest. Even small contributions can add up over time, so it’s important to start as early as possible.

Ignoring Inflation

Inflation can erode the purchasing power of your savings over time, so it’s important to account for it in your retirement planning. Fidelity’s tools can help you estimate the impact of inflation on your savings and adjust your strategy accordingly.

How Can You Monitor and Adjust Your Retirement Plan?

Retirement planning is not a one-time event; it requires regular monitoring and adjustments to ensure that you stay on track. A retirement planner fidelity account offers several tools to help you stay informed and make necessary changes to your plan.

Review Your Progress Annually

At least once a year, review your retirement savings and assess your progress toward your goals. Fidelity’s dashboards and reports make it easy to track your performance and identify areas for improvement. If you’re falling behind, consider increasing your contributions or adjusting your investment strategy.

Stay Flexible and Adapt to Changes

Life is full of surprises, and your retirement plan should be flexible enough to adapt to changes in your circumstances. Whether it’s a job change, health issue, or unexpected expense, Fidelity’s tools can help you adjust your plan to accommodate these changes and keep you on track.

Seek Professional Guidance When Needed

If you’re unsure how to adjust your plan or need help navigating a major life change, don’t hesitate to seek professional guidance. Fidelity’s certified financial planners can provide expert advice and help you make informed decisions about your retirement savings.

Frequently Asked Questions about Retirement Planner Fidelity

Unbeatable Six Flags Fiesta Texas Deals: Save Big On Your Next Adventure!

Where Do Florida Panthers Play: A Comprehensive Guide To Their Home Arena And More

Maximizing Security With Cisco Cloud Security Solutions: A Comprehensive Guide

Fidelity retirement calculator Early Retirement

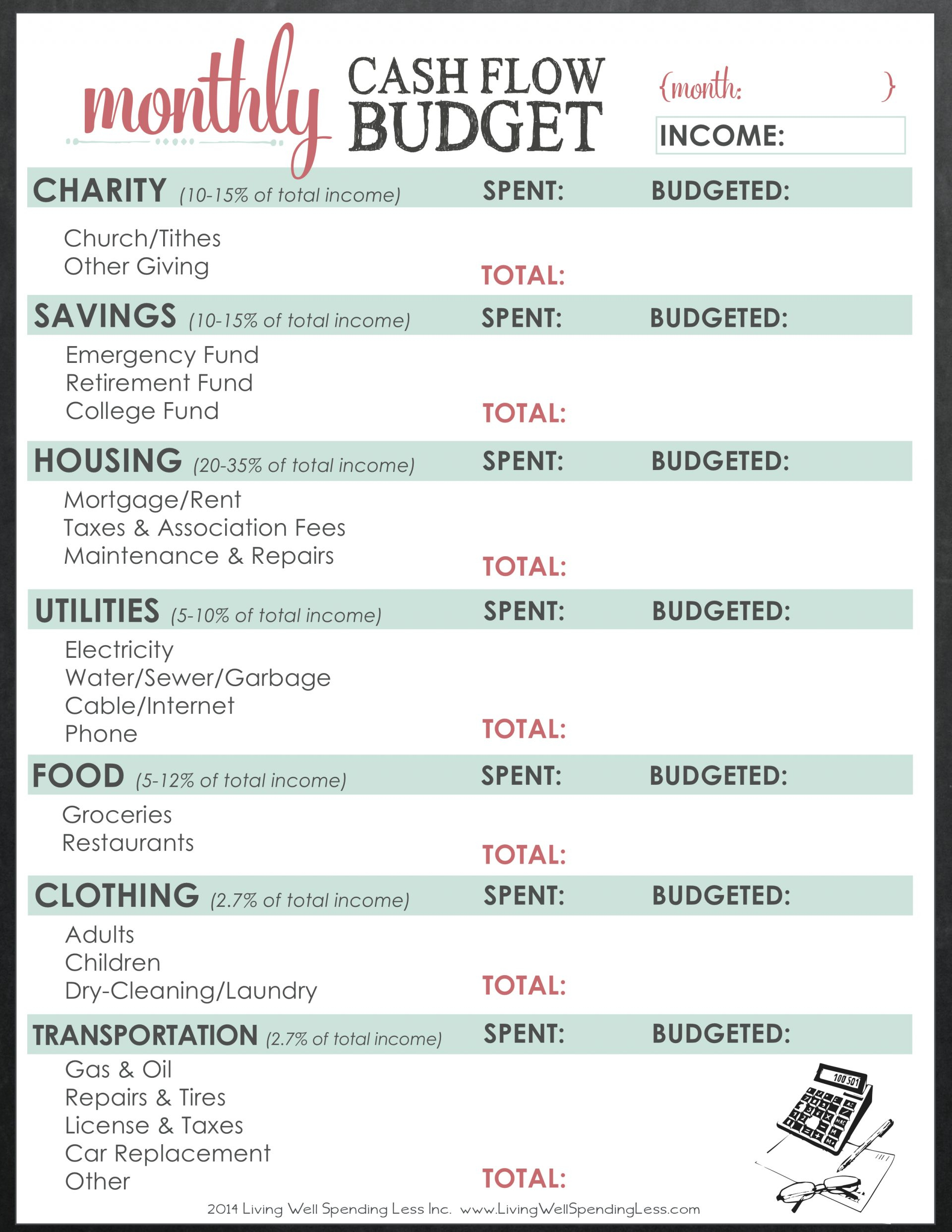

Retirement Budget Planner Spreadsheet Spreadsheet Downloa retirement