Mastering Fidelity Financial Planning: Your Path To Long-Term Wealth And Stability

Fidelity financial planning is more than just a buzzword; it's a comprehensive approach to managing your finances for long-term success. Whether you're saving for retirement, planning for your child's education, or aiming to grow your wealth, fidelity financial planning offers tools and strategies to help you achieve your goals. With a focus on disciplined saving, smart investing, and personalized advice, this approach ensures that your financial decisions align with your life priorities. As more people seek stability in an uncertain economic climate, fidelity financial planning has become a cornerstone of modern financial wellness.

At its core, fidelity financial planning revolves around creating a roadmap tailored to your unique financial situation. It involves evaluating your current assets, understanding your risk tolerance, and identifying your financial objectives. By leveraging professional expertise and cutting-edge technology, fidelity financial planning helps you navigate complex financial landscapes. The process is designed to empower individuals and families to take control of their financial futures, ensuring they are prepared for both expected milestones and unexpected challenges.

In today’s fast-paced world, where financial markets are constantly evolving, having a reliable plan is essential. Fidelity financial planning stands out because it emphasizes adaptability, education, and personalized strategies. It’s not a one-size-fits-all solution but rather a dynamic framework that grows with you. Whether you’re a seasoned investor or just starting your financial journey, fidelity financial planning provides the tools and resources to build a secure and prosperous future. Let’s explore how this approach can transform your financial outlook and why it’s gaining traction among individuals seeking financial clarity.

Read also:Unlock The Fun Infinite Craft Unblocked Ndash The Ultimate Guide

Table of Contents

- What Is Fidelity Financial Planning and Why Is It Important?

- How Can You Get Started with Fidelity Financial Planning?

- Key Components of a Successful Financial Plan

- What Are the Benefits of Fidelity Financial Planning?

- Common Mistakes to Avoid in Financial Planning

- How Does Fidelity Financial Planning Differ from Other Approaches?

- Tools and Resources for Effective Financial Planning

- Frequently Asked Questions About Fidelity Financial Planning

What Is Fidelity Financial Planning and Why Is It Important?

Fidelity financial planning is a holistic approach to managing your finances, ensuring that your money works for you in the most efficient way possible. It involves creating a detailed plan that encompasses savings, investments, retirement strategies, and risk management. The importance of fidelity financial planning lies in its ability to provide clarity and direction, helping individuals make informed decisions that align with their long-term goals.

One of the key aspects of fidelity financial planning is its focus on personalized strategies. Unlike generic financial advice, this approach tailors solutions to your unique needs, taking into account factors like your income, expenses, family obligations, and future aspirations. By working with a financial advisor or using online tools, you can develop a plan that addresses your specific circumstances. For example, if you’re planning for retirement, fidelity financial planning can help you determine how much you need to save and the best investment vehicles to achieve your target.

Another reason why fidelity financial planning is crucial is its emphasis on long-term stability. Financial markets can be unpredictable, and without a solid plan, it’s easy to make impulsive decisions that may harm your financial health. By adhering to a well-structured plan, you can stay focused on your goals and avoid common pitfalls like emotional investing or overspending. This disciplined approach not only builds wealth but also provides peace of mind, knowing that you’re prepared for whatever the future holds.

How Can You Get Started with Fidelity Financial Planning?

Starting your journey with fidelity financial planning may seem daunting at first, but breaking it down into manageable steps can make the process much easier. The first step is to assess your current financial situation. This involves creating a detailed overview of your income, expenses, assets, and liabilities. By understanding where you stand financially, you can identify areas for improvement and set realistic goals.

Once you have a clear picture of your finances, the next step is to define your objectives. Are you saving for a down payment on a house? Planning for your child’s education? Or building a nest egg for retirement? Fidelity financial planning encourages you to prioritize your goals and create a timeline for achieving them. For instance, if you’re aiming to retire in 20 years, you can calculate how much you need to save annually to reach your target.

Finally, consider leveraging professional guidance or digital tools to implement your plan. Fidelity offers a range of resources, including financial advisors, online calculators, and investment platforms, to help you stay on track. Whether you prefer hands-on support or a self-directed approach, fidelity financial planning provides the flexibility to suit your preferences. By taking these steps, you can lay a strong foundation for your financial future.

Read also:Discovering Kevin Beets A Journey Through His Life And Achievements

Key Components of a Successful Financial Plan

Creating a Budget That Works for You

A budget is the cornerstone of any successful financial plan, and fidelity financial planning places a strong emphasis on creating a realistic and sustainable budget. Start by tracking your income and expenses to understand your spending habits. This will help you identify areas where you can cut back and allocate more funds toward your financial goals. For example, reducing discretionary spending on dining out or entertainment can free up money for savings or investments.

Once you’ve analyzed your expenses, categorize them into essential and non-essential items. Essential expenses include housing, utilities, groceries, and healthcare, while non-essential expenses might include hobbies or luxury purchases. By prioritizing essential expenses and setting limits on non-essential spending, you can ensure that your budget aligns with your financial priorities. Fidelity financial planning tools can help you automate this process, making it easier to stick to your budget over time.

Investing for Long-Term Growth

Investing is a critical component of fidelity financial planning, as it allows your money to grow over time. The key is to choose investments that match your risk tolerance and time horizon. For example, younger investors may opt for higher-risk investments like stocks, while those nearing retirement might prefer more stable options like bonds or mutual funds.

One of the advantages of fidelity financial planning is its access to a wide range of investment products. From individual retirement accounts (IRAs) to exchange-traded funds (ETFs), you can build a diversified portfolio that suits your needs. Diversification is essential because it spreads risk across different asset classes, reducing the impact of market volatility on your investments. By working with a financial advisor or using online tools, you can create an investment strategy that supports your long-term goals.

What Are the Benefits of Fidelity Financial Planning?

Fidelity financial planning offers numerous benefits that make it an attractive option for individuals seeking financial stability. One of the most significant advantages is its focus on personalized solutions. Unlike generic financial advice, fidelity financial planning takes into account your unique circumstances, ensuring that your plan is tailored to your needs. This personalized approach increases the likelihood of success, as it addresses your specific goals and challenges.

Another benefit is the emphasis on education and empowerment. Fidelity provides a wealth of resources, including articles, webinars, and workshops, to help you make informed decisions. By understanding the principles of financial planning, you can take control of your finances and avoid common mistakes. For example, learning about the power of compound interest can motivate you to start saving early, maximizing your long-term returns.

Finally, fidelity financial planning offers flexibility and adaptability. Life is full of unexpected changes, and your financial plan should be able to evolve with you. Whether you experience a career change, a growing family, or a shift in your financial goals, fidelity financial planning allows you to adjust your strategy accordingly. This adaptability ensures that your plan remains relevant and effective, no matter what life throws your way.

Common Mistakes to Avoid in Financial Planning

While fidelity financial planning provides a solid framework for success, there are common mistakes that individuals often make. One of the most frequent errors is failing to set clear goals. Without a clear vision of what you want to achieve, it’s easy to lose focus and make inconsistent decisions. To avoid this, take the time to define your objectives and create a roadmap for achieving them.

Another mistake is neglecting to review and update your plan regularly. Financial markets and personal circumstances can change rapidly, and failing to adapt your plan can lead to missed opportunities or increased risk. Fidelity financial planning encourages regular reviews to ensure that your strategy remains aligned with your goals. For example, if you receive a raise or inherit money, you may need to adjust your savings or investment contributions.

Finally, many people make the mistake of trying to time the market. Attempting to predict market movements is a risky strategy that often leads to poor outcomes. Instead, fidelity financial planning advocates for a disciplined approach, such as dollar-cost averaging, which involves investing a fixed amount regularly regardless of market conditions. This strategy reduces the impact of market volatility and promotes long-term growth.

How Does Fidelity Financial Planning Differ from Other Approaches?

What Sets Fidelity Financial Planning Apart?

Fidelity financial planning stands out from other approaches due to its comprehensive and personalized nature. While many financial services focus solely on investments, fidelity financial planning takes a holistic view, addressing all aspects of your financial life. This includes savings, insurance, tax planning, and estate planning, ensuring that every area is covered.

Another distinguishing feature is the emphasis on technology and innovation. Fidelity offers cutting-edge tools and platforms that make financial planning more accessible and efficient. For example, their mobile app allows you to track your progress, manage your investments, and access educational resources from anywhere. This integration of technology enhances the user experience and makes it easier to stay on top of your financial goals.

Why Choose Fidelity Over Competitors?

When comparing fidelity financial planning to other providers, several factors make it a preferred choice for many individuals. One of the key advantages is its reputation for trust and reliability. With decades of experience in the financial industry, Fidelity has built a strong track record of helping clients achieve their goals. This reputation for excellence instills confidence and reassures clients that they are in good hands.

Additionally, Fidelity offers competitive pricing and a wide range of services, making it a cost-effective option for individuals at all stages of their financial journey. Whether you’re just starting out or have complex financial needs, fidelity financial planning provides the tools and resources to support your growth. By combining expertise, innovation, and affordability, Fidelity sets itself apart as a leader in the financial planning space.

Tools and Resources for Effective Financial Planning

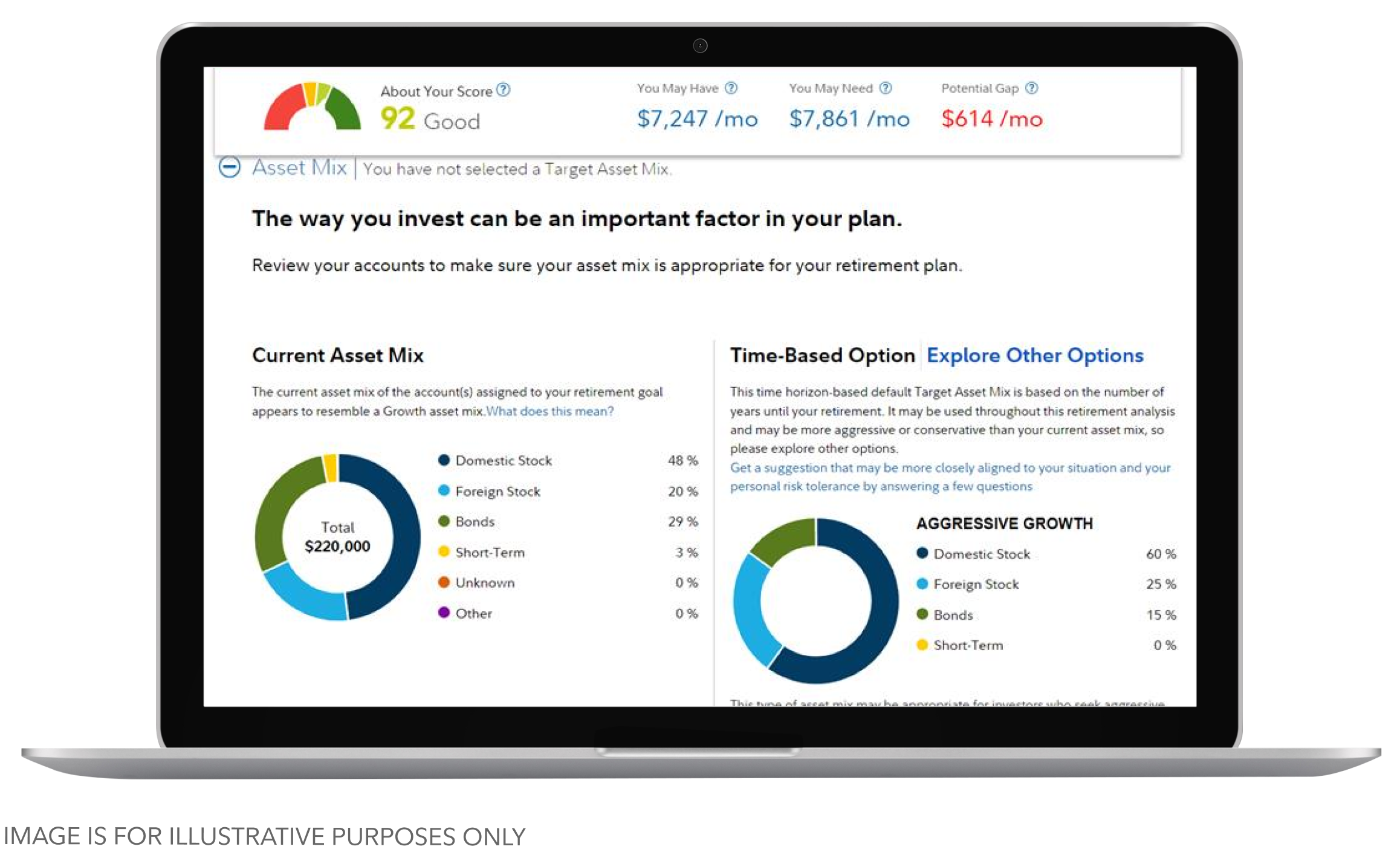

Fidelity financial planning provides a variety of tools and resources to help you succeed. One of the most valuable resources is their online platform, which offers a comprehensive suite of tools for budgeting, investing, and tracking your progress. These tools are designed to be user-friendly, making it easy for individuals of all experience levels to manage their finances effectively.

In addition to digital tools, Fidelity offers educational resources to enhance your financial literacy. From articles and videos to live webinars, these resources cover a wide range of topics, including retirement planning, tax strategies, and investment basics. By expanding your knowledge, you can make more informed decisions and take greater control of your financial future.

Finally, Fidelity’s team of financial advisors is available to provide personalized guidance and support. Whether you need help creating a financial plan or navigating a major life event, their advisors can offer expert advice tailored to your needs. This combination of tools, resources, and professional support makes fidelity financial planning a comprehensive solution for achieving financial success.

Frequently Asked Questions About Fidelity Financial Planning

What Services Does Fidelity Financial Planning Offer?

Fidelity financial planning offers a wide range of services, including retirement planning, investment management, tax optimization, and estate planning. These services are designed to address all aspects of your financial life, ensuring that you have a comprehensive plan in place.

Is Fidelity Financial Planning Suitable for Beginners?

Yes, fidelity financial planning is suitable for individuals at all stages of their financial journey. Whether you’re just starting out or have complex financial needs, Fidelity provides the tools and resources to support your growth.

How Much Does Fidelity Financial Planning Cost?

The cost of fidelity financial planning varies depending on the services you choose. Fidelity offers competitive pricing and transparent fee structures, making it an affordable option for many individuals.

In conclusion, fidelity financial planning is a powerful tool for achieving financial stability and long-term success. By leveraging personalized strategies, cutting-edge technology, and expert guidance, you can take control of your financial future and build a secure foundation for yourself and your family. Whether you’re saving for retirement, planning for major life events, or simply looking to grow your wealth, fidelity financial planning provides the resources and support you need to succeed.

Exploring The World Of Boscovs Online Shopping: Your Ultimate Retail Experience

Understanding Eczema On Scalp Symptoms: Causes, Treatments, And More

Top Attractions: Best Places To Visit In Gig Harbor

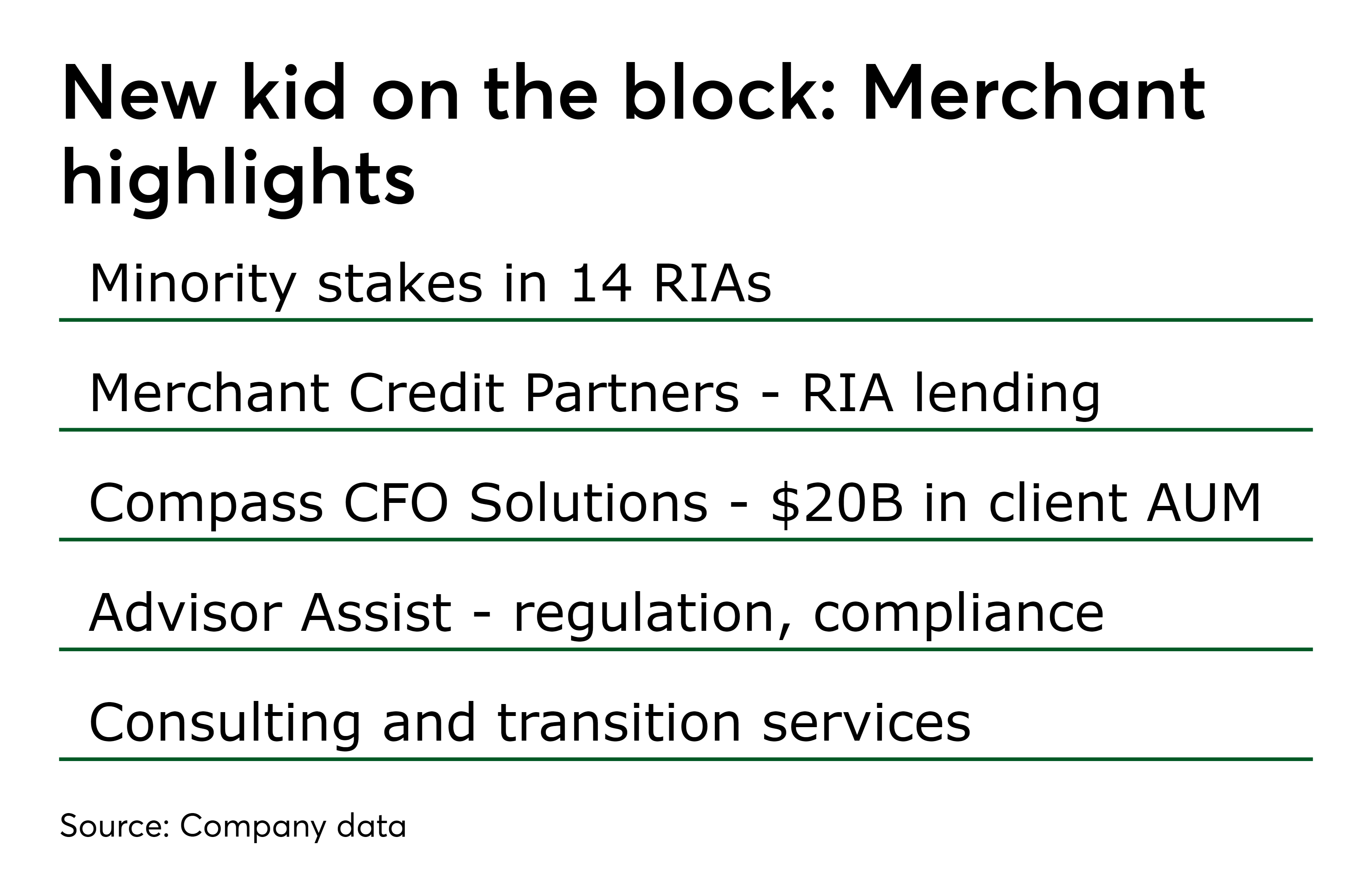

Fidelity program offers loans to RIAs Financial Planning

Financial planning Explore options and set goals Fidelity