Maximizing Your Savings: Comprehensive Fidelity Retirement Advice For A Secure Future

With decades of experience in financial services, Fidelity has become a trusted name for individuals seeking to build a secure future. Whether you're just starting your career or nearing retirement, understanding how to maximize your savings is crucial. Fidelity’s tailored advice helps you navigate the complexities of retirement planning, from choosing the right investment options to optimizing your Social Security benefits. One of the standout features of Fidelity retirement advice is its focus on personalized strategies. Retirement isn’t a one-size-fits-all journey, and Fidelity understands this better than most. By leveraging advanced tools and insights, they help you create a plan that aligns with your unique financial goals and lifestyle aspirations. For instance, their retirement planning calculators allow you to project future expenses, estimate Social Security payouts, and determine how much you’ll need to save monthly to achieve your desired retirement lifestyle. Additionally, their team of experts is always available to provide guidance, ensuring that you’re making informed decisions every step of the way. Beyond just numbers and projections, Fidelity retirement advice emphasizes the importance of staying adaptable. Life is unpredictable, and your retirement plan should be flexible enough to accommodate changes. Whether it’s an unexpected medical expense or a shift in your retirement timeline, Fidelity’s strategies ensure you’re prepared for whatever comes your way. With their support, you can confidently take charge of your financial future and enjoy peace of mind knowing that your retirement is in capable hands.

Table of Contents

- What is Fidelity Retirement Advice?

- Why is Retirement Planning Important for Your Future?

- How Can You Start Saving for Retirement Today?

- What Are the Best Investment Options for Retirement?

- How Does Fidelity Support Your Retirement Goals?

- What Are the Common Mistakes to Avoid in Retirement Planning?

- How Can You Optimize Your Social Security Benefits?

- Frequently Asked Questions About Fidelity Retirement Advice

What is Fidelity Retirement Advice?

Fidelity retirement advice is a suite of financial planning services designed to help individuals prepare for a secure and comfortable retirement. From personalized consultations to advanced digital tools, Fidelity offers a wide range of resources to guide you through every stage of your retirement journey. Whether you're a beginner looking to understand the basics of retirement savings or a seasoned investor seeking to fine-tune your portfolio, Fidelity’s expertise can make a significant difference.

One of the key components of Fidelity retirement advice is its accessibility. You don’t need to be a financial expert to benefit from their services. Their user-friendly platforms and educational materials break down complex financial concepts into easy-to-understand language. For example, their retirement planning workshops cover topics like asset allocation, tax-efficient withdrawals, and estate planning, ensuring you have a holistic understanding of what it takes to retire successfully. Additionally, Fidelity’s advisors are available to provide one-on-one support, tailoring their recommendations to your specific needs and circumstances.

Read also:Discovering The Wild A Journey Through Timothy Treadwell Audio

How Fidelity Retirement Advice Works

Fidelity’s approach to retirement advice is rooted in simplicity and effectiveness. They begin by assessing your current financial situation, including your income, expenses, savings, and existing investments. This initial evaluation helps them create a customized plan that aligns with your retirement goals. For instance, if you’re aiming to retire early, they might recommend aggressive investment strategies to accelerate your savings. On the other hand, if you’re closer to retirement age, they’ll focus on preserving your wealth and generating steady income streams.

Another standout feature is Fidelity’s commitment to ongoing support. Retirement planning isn’t a one-time event; it requires regular adjustments to stay on track. Fidelity’s advisors continuously monitor your progress and suggest changes as needed. This proactive approach ensures that you’re always prepared for life’s uncertainties, whether it’s a sudden market downturn or a change in your personal circumstances.

Why is Retirement Planning Important for Your Future?

Retirement planning is more than just a financial exercise; it’s a critical step toward securing your long-term well-being. Without a solid plan in place, you risk outliving your savings or facing financial hardships during your golden years. Fidelity retirement advice emphasizes the importance of starting early and staying consistent. The earlier you begin saving, the more time your investments have to grow, thanks to the power of compound interest.

Consider this: if you start saving $500 per month at age 25, assuming a 7% annual return, you could accumulate over $1 million by age 65. However, if you delay until age 35, you’d need to save nearly double that amount to reach the same goal. This example underscores why retirement planning is essential for building a comfortable future. Fidelity’s tools and resources make it easier to set realistic goals and track your progress over time.

What Happens if You Ignore Retirement Planning?

Ignoring retirement planning can lead to severe consequences, both financially and emotionally. Without a clear roadmap, you may find yourself unprepared for unexpected expenses, such as medical bills or home repairs. Additionally, you might be forced to delay retirement or rely on family members for financial support, which can strain relationships and diminish your independence.

Fidelity retirement advice helps mitigate these risks by providing a structured framework for saving and investing. Their advisors can also help you navigate complex decisions, such as when to claim Social Security or how to minimize taxes on your retirement income. By addressing these issues proactively, you can enjoy a stress-free retirement and focus on what truly matters—spending time with loved ones and pursuing your passions.

Read also:Unlock The Fun Infinite Craft Unblocked Ndash The Ultimate Guide

How Can You Start Saving for Retirement Today?

Starting your retirement savings journey might seem overwhelming, but Fidelity retirement advice simplifies the process. The first step is to assess your current financial situation and determine how much you can afford to save each month. Even small contributions can add up over time, especially when invested wisely. Fidelity recommends automating your savings to ensure consistency and discipline.

One effective strategy is to take full advantage of employer-sponsored retirement plans, such as 401(k)s. Many employers offer matching contributions, which essentially provide free money to boost your savings. Fidelity’s advisors can help you understand your plan’s features and optimize your contributions to maximize these benefits. Additionally, they can guide you in selecting the right mix of investments within your plan to align with your risk tolerance and retirement timeline.

Why Should You Consider a Roth IRA?

A Roth IRA is another powerful tool for retirement savings, and Fidelity retirement advice often highlights its benefits. Unlike traditional IRAs, Roth IRAs allow your investments to grow tax-free, and qualified withdrawals in retirement are also tax-free. This can be particularly advantageous if you expect to be in a higher tax bracket during retirement. Fidelity’s experts can help you determine whether a Roth IRA is suitable for your financial situation and guide you through the setup process.

Another advantage of a Roth IRA is its flexibility. You can withdraw your contributions (but not earnings) at any time without penalties, making it a versatile option for both retirement and emergency savings. By incorporating a Roth IRA into your retirement plan, you can diversify your tax strategies and create a more resilient financial foundation.

What Are the Best Investment Options for Retirement?

Choosing the right investment options is a cornerstone of effective retirement planning, and Fidelity retirement advice excels in this area. Their advisors recommend a diversified portfolio that balances risk and reward based on your age, goals, and risk tolerance. For younger investors, growth-oriented assets like stocks and mutual funds are often recommended, as they have the potential for higher returns over the long term.

As you approach retirement, Fidelity suggests shifting toward more conservative investments, such as bonds and fixed-income securities. These options provide stability and predictable income streams, which are crucial for maintaining your lifestyle during retirement. Fidelity’s managed accounts and target-date funds are particularly popular among investors seeking a hands-off approach to portfolio management.

How Can You Avoid Overlooking Inflation?

One common mistake in retirement planning is underestimating the impact of inflation. Even a modest inflation rate can erode your purchasing power over time, making it essential to choose investments that outpace inflation. Fidelity retirement advice emphasizes the importance of including inflation-resistant assets, such as Treasury Inflation-Protected Securities (TIPS) and real estate investment trusts (REITs), in your portfolio.

By accounting for inflation, you can ensure that your retirement savings maintain their value and continue to support your lifestyle. Fidelity’s advisors can help you evaluate your current investments and make adjustments to mitigate inflation risks. This proactive approach is key to achieving long-term financial security.

How Does Fidelity Support Your Retirement Goals?

Fidelity’s support extends far beyond basic retirement advice. They offer a comprehensive suite of services, including financial planning, investment management, and estate planning. Their team of certified financial planners (CFPs) works closely with clients to develop personalized strategies that address every aspect of retirement. Whether you’re concerned about healthcare costs, legacy planning, or tax efficiency, Fidelity has the expertise to guide you.

In addition to personalized advice, Fidelity provides a wealth of educational resources. Their online library features articles, videos, and webinars on a wide range of retirement topics. These materials are designed to empower you with the knowledge and confidence to make informed financial decisions. Fidelity also hosts live events and workshops, where you can interact with experts and ask questions in real-time.

What Tools Does Fidelity Offer for Retirement Planning?

Fidelity’s digital tools are among the most advanced in the industry. Their retirement planning calculator, for instance, allows you to simulate different scenarios and see how various factors, such as contribution amounts and investment returns, impact your savings. This interactive tool helps you set realistic goals and adjust your strategy as needed.

Another standout feature is Fidelity’s retirement income planner, which projects your future income streams and expenses. This tool ensures that your savings will last throughout retirement and highlights potential shortfalls early on. By leveraging these resources, you can stay on top of your financial goals and make timely adjustments to your plan.

What Are the Common Mistakes to Avoid in Retirement Planning?

Even the most well-intentioned retirement plans can falter if common mistakes aren’t addressed. Fidelity retirement advice highlights several pitfalls to watch out for, starting with underestimating your life expectancy. Many people fail to account for the possibility of living into their 90s or beyond, which can lead to insufficient savings. Fidelity’s advisors recommend planning for a longer lifespan to ensure your money lasts.

Another frequent error is neglecting to create a withdrawal strategy. Without a clear plan for accessing your savings, you risk depleting your funds too quickly or incurring unnecessary taxes. Fidelity emphasizes the importance of a structured withdrawal approach, which balances tax efficiency with income needs. Their experts can help you design a strategy that minimizes taxes and maximizes your retirement income.

Why Is It Important to Reassess Your Plan Regularly?

Life is full of changes, and your retirement plan should reflect that. Fidelity retirement advice stresses the need for regular reassessments to ensure your plan remains relevant. Major life events, such as marriage, divorce, or the birth of a child, can significantly impact your financial situation. By reviewing your plan periodically, you can make necessary adjustments and stay on track toward your goals.

Fidelity’s advisors recommend conducting an annual review to evaluate your progress and update your strategy. This process involves revisiting your savings goals, investment allocations, and risk tolerance. By staying proactive, you can adapt to changing circumstances and maintain confidence in your retirement plan.

How Can You Optimize Your Social Security Benefits?

Social Security benefits play a crucial role in retirement planning, and Fidelity retirement advice offers valuable insights into maximizing these payouts. The timing of your claim can significantly impact the amount you receive. For example, claiming benefits at your full retirement age (typically between 66 and 67) ensures you receive 100% of your entitled amount. Delaying your claim beyond this age can increase your benefits by up to 8% per year, up to age 70.

Fidelity’s advisors can help you weigh the pros and cons of claiming early versus delaying. They also provide strategies for coordinating benefits with a spouse

Tattoo Fonts Block: The Ultimate Guide To Choosing The Perfect Style

What Are The Mini Stepper Muscles Worked And How Do They Benefit You?

Can I Use Jergens Natural Glow On Face Safely?

Chicago Bulls statements on the retirement of Derrick Rose

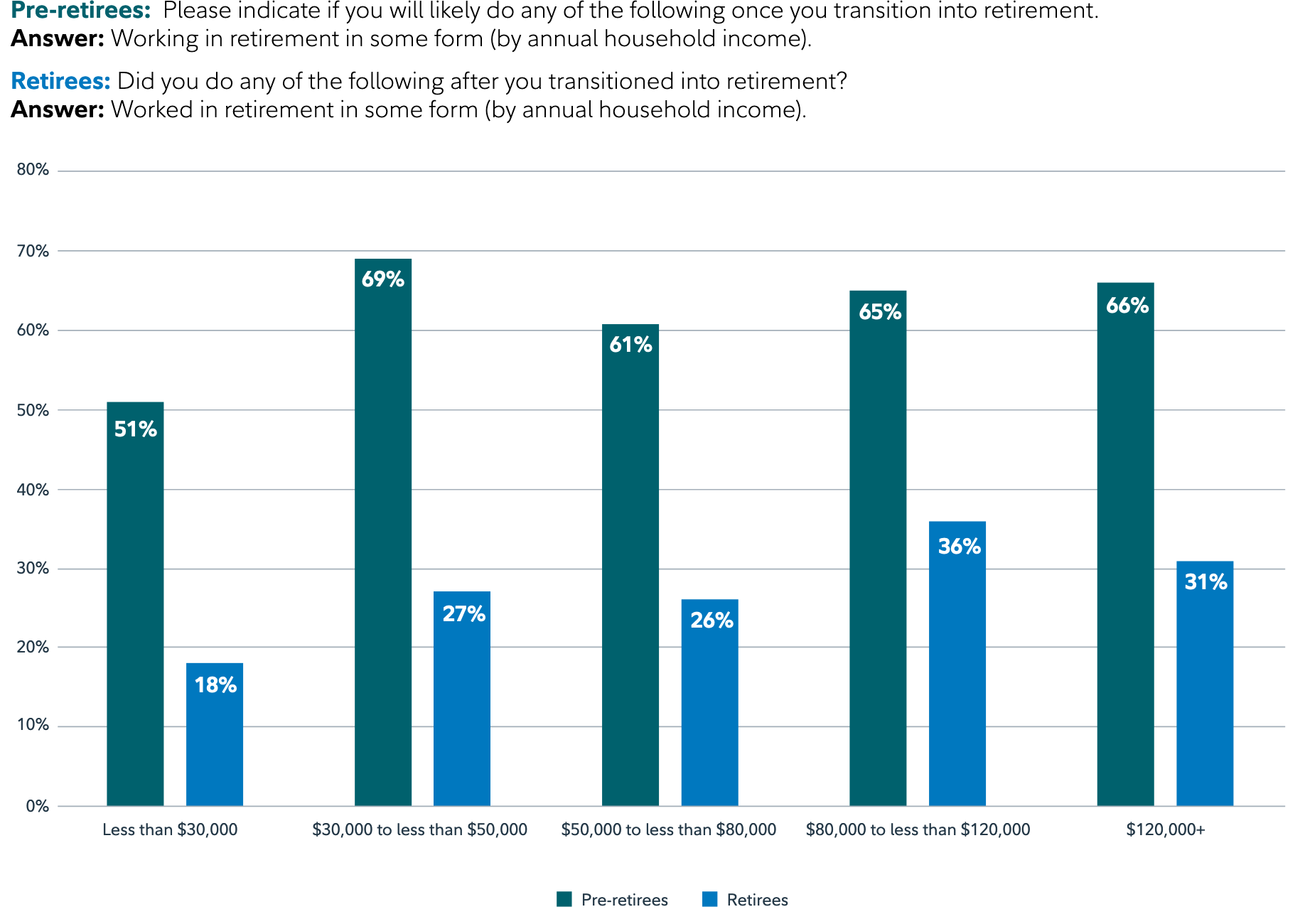

Screenshot 20240506 at 112818 2024 Fidelity Retirement Report