Understanding Retirement Fidelity: A Comprehensive Guide To Planning Your Future

Retirement fidelity, a term often associated with the commitment to consistent and reliable retirement planning, plays a pivotal role in helping individuals achieve their long-term financial goals. Whether you're just starting your career or nearing retirement age, understanding the principles of retirement fidelity can provide a roadmap for building a secure future. From saving early to exploring diverse investment options, this guide will delve into actionable strategies to help you navigate the complexities of retirement planning. Retirement fidelity isn't just about setting aside money; it's about creating a comprehensive plan that aligns with your lifestyle, goals, and risk tolerance. Many people overlook the importance of starting early, but even small contributions made consistently over time can grow into substantial savings thanks to the power of compound interest. With the right tools and mindset, retirement fidelity can transform what might seem like an overwhelming task into a manageable and rewarding journey. In today's uncertain economic climate, having a solid retirement plan is more important than ever. This article will explore everything you need to know about retirement fidelity, from understanding the basics to advanced strategies for maximizing your savings. Whether you're looking to learn how to balance your current financial needs with future goals or seeking advice on navigating retirement accounts, this guide has you covered. By the end of this article, you'll have a clear understanding of how to build a retirement plan that works for you, ensuring peace of mind as you transition into your golden years.

Table of Contents

- What is Retirement Fidelity and Why Does It Matter?

- How to Start Planning for Retirement Fidelity Today?

- What Are the Best Investment Options for Retirement Fidelity?

- Common Mistakes to Avoid in Retirement Fidelity Planning

- Understanding the Tax Implications of Retirement Fidelity

- What Tools Can Help You Track Your Retirement Fidelity Progress?

- Frequently Asked Questions About Retirement Fidelity

- Conclusion: Securing Your Future with Retirement Fidelity

What is Retirement Fidelity and Why Does It Matter?

Retirement fidelity refers to the unwavering commitment to adhering to a disciplined retirement savings and investment strategy. It's not just about setting aside money but ensuring that your financial decisions align with your long-term goals. This concept is particularly important in an era where traditional pension plans are becoming less common, and individuals are increasingly responsible for their own retirement security. By embracing retirement fidelity, you can create a robust financial plan that withstands economic uncertainties and personal challenges. One of the key reasons retirement fidelity matters is its ability to provide peace of mind. When you consistently contribute to your retirement accounts and make informed investment choices, you're building a safety net that allows you to enjoy your later years without financial stress. This commitment also helps you avoid the pitfalls of procrastination, which can lead to inadequate savings and a diminished quality of life during retirement. Furthermore, retirement fidelity encourages you to regularly review and adjust your plan as your circumstances change, ensuring that your strategy remains relevant and effective. Incorporating retirement fidelity into your financial planning can yield significant benefits. For instance, it helps you take full advantage of employer-sponsored retirement plans, such as 401(k)s, and tax-advantaged accounts like IRAs. By consistently contributing to these accounts and maximizing employer matches, you can accelerate your savings growth. Additionally, retirement fidelity fosters a mindset of long-term thinking, helping you resist the temptation to dip into your retirement funds for short-term needs. Ultimately, it's about creating a sustainable financial future that aligns with your vision of retirement.

How to Start Planning for Retirement Fidelity Today?

Starting your retirement fidelity journey might seem daunting, but taking the first step is often the hardest part. The good news is that with a clear plan and actionable steps, you can set yourself up for success. One of the most effective ways to begin is by assessing your current financial situation. This involves evaluating your income, expenses, debts, and existing savings. By understanding where you stand financially, you can identify areas where you can allocate more resources toward retirement savings.

Read also:Dawn Wells Measurements A Complete Guide To Her Life And Career

What Are the Key Components of a Retirement Fidelity Plan?

A well-rounded retirement fidelity plan includes several key components. First, determine your retirement goals. Ask yourself questions like, "What kind of lifestyle do I want in retirement?" and "How much income will I need to sustain that lifestyle?" These answers will help you calculate your retirement savings target. Next, consider your timeline. The earlier you start saving, the more time your money has to grow through compound interest. Even small contributions made consistently can add up significantly over time.

How Can You Maximize Employer-Sponsored Plans?

If your employer offers a retirement plan, such as a 401(k), take full advantage of it. Many employers provide matching contributions, which essentially amount to free money. For example, if your employer matches 50% of your contributions up to 6% of your salary, contributing at least 6% ensures you're not leaving money on the table. Additionally, familiarize yourself with the investment options available within your plan. Diversifying your investments can help mitigate risks and increase your chances of achieving long-term growth.

What Steps Should You Take After Setting Up Your Plan?

Once you've established your retirement fidelity plan, it's important to regularly review and adjust it as needed. Life circumstances, such as changes in income, family status, or health, can impact your retirement goals. Periodic reviews allow you to ensure your plan remains aligned with your objectives. Additionally, consider consulting a financial advisor to gain expert insights and tailor your strategy to your unique needs. By staying committed to your plan and making informed adjustments, you can build a solid foundation for your retirement.

What Are the Best Investment Options for Retirement Fidelity?

Choosing the right investment options is a critical aspect of retirement fidelity. The goal is to grow your savings while managing risk appropriately. A diversified portfolio that includes a mix of stocks, bonds, and other assets can help you achieve this balance. Stocks, for instance, offer the potential for high returns but come with greater volatility. Bonds, on the other hand, provide more stability and predictable income, making them a valuable component of a retirement portfolio.

Why Should You Consider Index Funds and ETFs?

Index funds and exchange-traded funds (ETFs) are popular choices for retirement fidelity due to their low fees and broad market exposure. These investment vehicles track a specific index, such as the S&P 500, and offer diversification across a wide range of companies. By investing in index funds or ETFs, you can reduce the risk associated with individual stock picking while still benefiting from market growth. Additionally, their low expense ratios make them cost-effective options for long-term investors.

How Can Real Estate Contribute to Your Retirement Fidelity?

Real estate is another asset class worth considering for retirement fidelity. Investing in rental properties can provide a steady stream of passive income during retirement. Alternatively, Real Estate Investment Trusts (REITs) offer a more accessible way to invest in real estate without the need to manage properties directly. REITs are publicly traded and provide liquidity, making them a flexible option for retirement portfolios. Including real estate in your investment mix can enhance diversification and potentially increase your overall returns.

Read also:Streameast Soccer Your Ultimate Guide To Live Soccer Streaming

What Role Do Annuities Play in Retirement Fidelity?

Annuities are financial products designed to provide guaranteed income during retirement, making them a valuable tool for retirement fidelity. By purchasing an annuity, you can ensure a steady cash flow that lasts for the rest of your life. While annuities come with fees and limitations, they can be particularly beneficial for individuals seeking to mitigate longevity risk—the possibility of outliving their savings. Consulting a financial advisor can help you determine whether annuities align with your retirement goals.

Common Mistakes to Avoid in Retirement Fidelity Planning

Even with the best intentions, it's easy to make mistakes when planning for retirement fidelity. One common error is underestimating how much money you'll need in retirement. Many people assume their expenses will decrease significantly, but factors like healthcare costs and inflation can quickly add up. To avoid this pitfall, aim to save at least 15-20% of your income for retirement and regularly reassess your savings target as your circumstances change.

Why Is Procrastination a Major Obstacle?

Procrastination is one of the biggest enemies of retirement fidelity. Delaying your savings efforts can significantly reduce the amount of money you'll have in retirement due to lost compound interest. For example, someone who starts saving at age 25 will have substantially more than someone who begins at age 40, even if both contribute the same amount annually. To combat procrastination, set up automatic contributions to your retirement accounts and treat them as non-negotiable expenses.

How Can Emotional Investing Harm Your Retirement Fidelity?

Emotional investing is another mistake that can derail your retirement fidelity plan. Reacting to short-term market fluctuations by buying or selling investments impulsively can lead to poor financial outcomes. Instead, focus on maintaining a long-term perspective and sticking to your investment strategy, regardless of market conditions. Diversifying your portfolio and working with a financial advisor can help you stay disciplined and avoid making emotionally driven decisions.

Understanding the Tax Implications of Retirement Fidelity

Taxes play a significant role in retirement fidelity planning, and understanding their implications can help you maximize your savings. Contributions to traditional retirement accounts, such as 401(k)s and IRAs, are typically tax-deductible, reducing your taxable income in the year you make the contribution. However, withdrawals during retirement are taxed as ordinary income. On the other hand, Roth accounts are funded with after-tax dollars, meaning withdrawals are tax-free if certain conditions are met.

What Are the Benefits of Tax-Advantaged Accounts?

Tax-advantaged accounts are a cornerstone of retirement fidelity planning. By utilizing accounts like 401(k)s, IRAs, and Health Savings Accounts (HSAs), you can reduce your tax burden while growing your savings. For example, HSAs offer triple tax advantages: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. Leveraging these accounts can significantly enhance your retirement savings potential.

How Can Strategic Withdrawals Minimize Taxes?

Strategic withdrawals are another way to optimize your retirement fidelity plan. By carefully timing your withdrawals from different accounts, you can minimize your tax liability. For instance, withdrawing from taxable accounts first can allow your tax-advantaged accounts to continue growing. Consulting a tax advisor can help you develop a withdrawal strategy that aligns with your financial goals and minimizes taxes.

What Tools Can Help You Track Your Retirement Fidelity Progress?

Tracking your retirement fidelity progress is essential for staying on course and making informed adjustments. Fortunately, there are numerous tools and resources available to help you monitor your savings and investments. Retirement calculators, for example, allow you to estimate how much you'll need to save based on your current contributions, expected returns, and retirement age. These tools can provide valuable insights into whether you're on track to meet your goals.

Why Should You Use Financial Planning Software?

Financial planning software offers a comprehensive way to manage your retirement fidelity plan. These platforms often include features like budgeting tools, investment tracking, and scenario analysis. By consolidating your financial information in one place, you can gain a holistic view of your progress and identify areas for improvement. Many software options also offer mobile apps, making it easy to stay engaged with your plan on the go.

How Can Working with a Financial Advisor Enhance Your Retirement Fidelity?

A financial advisor can be an invaluable resource for enhancing your retirement fidelity. Advisors provide personalized guidance based on your unique circumstances and goals, helping you navigate complex financial decisions. They can also assist with tax planning, estate planning, and investment management, ensuring that your retirement plan is comprehensive and effective. While hiring an advisor involves a cost, the potential benefits often outweigh the expense.

Frequently Asked Questions About Retirement Fidelity

What Is the Ideal Age to Start Retirement Fidelity Planning?

The ideal age to start retirement fidelity planning is as early as possible. While there's no one-size-fits-all answer, starting in your 20s or 30s allows you to take full advantage of compound interest and build a substantial nest egg over time.

How Much Should I Save for Retirement Fidelity?

As a general rule, aim to save at least 15-20% of your income for retirement fidelity. However, your specific target will depend on factors like your desired lifestyle, expected expenses, and retirement age.

Can I Adjust My Retirement Fidelity Plan if My Goals Change?

Absolutely! Life is unpredictable, and your retirement fidelity plan should be flexible enough to adapt to changes in your circumstances. Regularly reviewing and adjusting your plan ensures it remains aligned with your goals.

Discovering The States With The Most Humidity: A Comprehensive Guide

CSL Plasma Donation Requirements: A Comprehensive Guide To Qualify And Donate

Dishwater Blonde: The Ultimate Guide To This Subtle And Versatile Hair Color

Chicago Bulls statements on the retirement of Derrick Rose

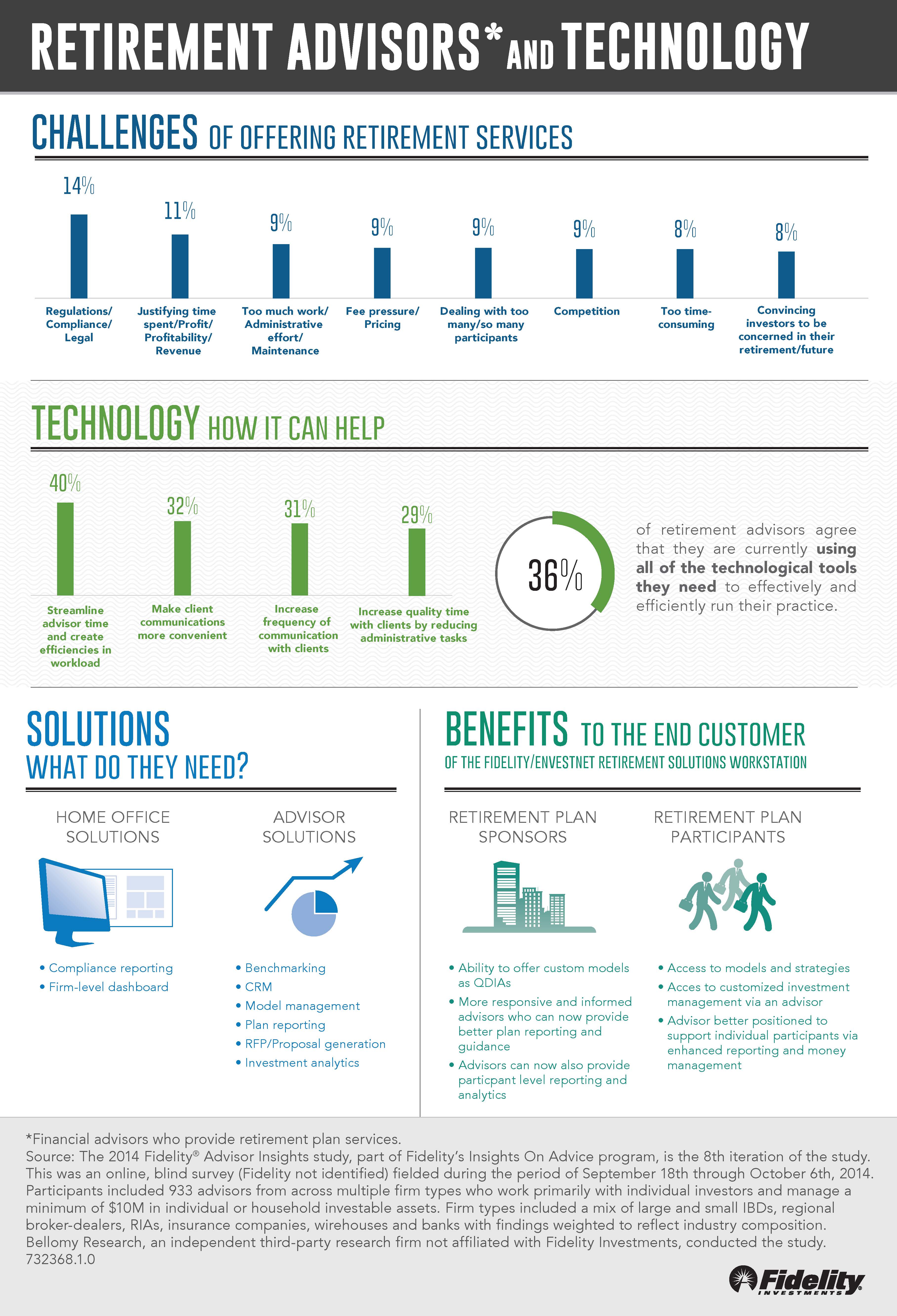

Fidelity to Offer Retirement Solutions Integrated Workstation