Understanding The Semiconductor Index: A Comprehensive Guide To Growth And Innovation

In today’s rapidly evolving technological landscape, the semiconductor index has emerged as a critical benchmark for tracking the performance of companies involved in semiconductor manufacturing and innovation. As a key driver of modern electronics, semiconductors play an indispensable role in powering everything from smartphones and laptops to electric vehicles and artificial intelligence systems. Investors, analysts, and tech enthusiasts alike closely monitor this index to gauge the health of the semiconductor industry, which often serves as a bellwether for broader technological advancements. With global demand for semiconductors skyrocketing, understanding the dynamics of this index is more important than ever.

The semiconductor index encompasses a diverse range of companies, from industry giants like Intel and TSMC to emerging players driving cutting-edge research and development. These companies operate in a highly competitive and innovation-driven market, where breakthroughs in chip design, fabrication processes, and material science can redefine industries overnight. The index not only reflects the financial performance of these firms but also highlights the technological trends shaping our future. For instance, advancements in 5G, artificial intelligence, and renewable energy systems are heavily reliant on semiconductor innovations, making the index a crucial indicator of where the tech world is headed.

As the semiconductor industry continues to expand, the index serves as a valuable tool for both seasoned investors and newcomers seeking to understand the sector’s growth potential. By analyzing the semiconductor index, stakeholders can identify opportunities for investment, assess risks, and stay informed about the latest developments in this dynamic field. Whether you’re a tech enthusiast curious about the next big breakthrough or an investor looking to diversify your portfolio, the semiconductor index offers a wealth of insights into one of the most transformative industries of our time.

Read also:Discover Robie Uniacke A Journey Into His Life And Achievements

Table of Contents

- What is the Semiconductor Index?

- How Does the Semiconductor Index Impact Investors?

- Why is the Semiconductor Industry So Important?

- What Are the Key Factors Driving Semiconductor Growth?

- How Are Semiconductor Companies Adapting to New Challenges?

- What Role Does Technology Play in the Semiconductor Index?

- How Can Investors Use the Semiconductor Index Effectively?

- What Are the Future Prospects of the Semiconductor Industry?

What is the Semiconductor Index?

The semiconductor index is a specialized stock market index that tracks the performance of companies engaged in the design, manufacture, and distribution of semiconductors. These indices are often weighted by market capitalization, meaning that larger companies have a more significant impact on the index’s overall performance. Prominent examples include the Philadelphia Semiconductor Index (SOX) and the iShares Semiconductor ETF (SOXX), both of which are widely followed by investors and analysts. The index serves as a barometer for the semiconductor industry, reflecting its growth, challenges, and innovations.

Companies included in the semiconductor index span a broad spectrum of the industry. Some focus on designing advanced chips for artificial intelligence and machine learning, while others specialize in manufacturing processes or materials like silicon wafers. The diversity of these companies ensures that the index captures a comprehensive view of the sector’s health. For instance, a breakthrough in chip architecture by one company can lead to a surge in the index, while supply chain disruptions may cause a downturn. This interconnectedness makes the semiconductor index a valuable tool for understanding broader economic and technological trends.

Investors often use the semiconductor index to gain exposure to the tech sector without having to pick individual stocks. By investing in index-based funds or ETFs, they can benefit from the collective growth of the industry while mitigating the risks associated with individual companies. Additionally, the index provides insights into emerging trends, such as the shift toward 3D chip architectures or the increasing demand for energy-efficient semiconductors. These trends not only shape the index’s performance but also influence the direction of technological innovation worldwide.

How Does the Semiconductor Index Impact Investors?

For investors, the semiconductor index serves as both a performance indicator and a strategic tool. By tracking the index, investors can gain insights into the financial health of semiconductor companies and the broader tech sector. A rising index often signals strong demand for semiconductors, driven by factors such as increased consumer electronics sales, advancements in AI, or the rollout of new technologies like 5G. Conversely, a declining index may indicate challenges such as supply chain disruptions, geopolitical tensions, or reduced consumer spending.

Why Should Investors Monitor the Semiconductor Index?

Monitoring the semiconductor index allows investors to make informed decisions about their portfolios. For example, a surge in the index might suggest that it’s an opportune time to invest in semiconductor-related stocks or ETFs. On the other hand, a prolonged downturn could signal the need for caution or diversification into other sectors. Additionally, the index can highlight emerging trends that may influence investment strategies. For instance, the growing emphasis on sustainability has led to increased demand for energy-efficient semiconductors, a trend that savvy investors can capitalize on.

What Are the Risks Associated with the Semiconductor Index?

While the semiconductor index offers numerous opportunities, it also comes with risks. The industry is highly cyclical, with periods of boom and bust driven by factors such as technological advancements, global demand, and geopolitical issues. For example, trade restrictions or export bans can significantly impact semiconductor companies, leading to volatility in the index. Investors must also consider the risks associated with rapid technological change, as companies that fail to innovate may quickly lose market share. Diversification and thorough research are essential for mitigating these risks.

Read also:Understanding Steve Dulcichs Illness A Comprehensive Guide

Why is the Semiconductor Industry So Important?

The semiconductor industry is often referred to as the backbone of modern technology, and for good reason. Semiconductors are the building blocks of virtually all electronic devices, enabling functions ranging from basic computing to complex artificial intelligence algorithms. Without semiconductors, industries such as telecommunications, healthcare, automotive, and consumer electronics would grind to a halt. This critical role makes the semiconductor industry a cornerstone of global economic growth and technological progress.

Beyond their technological importance, semiconductors also have significant geopolitical implications. Countries that lead in semiconductor manufacturing and innovation gain a strategic advantage in the global economy. For instance, the United States, South Korea, and Taiwan are home to some of the world’s largest semiconductor companies, giving them considerable influence over global supply chains. This dominance has sparked intense competition, with nations investing heavily in semiconductor research and development to secure their positions in the industry.

Moreover, the semiconductor industry is a major driver of job creation and economic activity. From engineers and researchers to factory workers and supply chain managers, the industry supports millions of jobs worldwide. As demand for semiconductors continues to grow, so too does the need for skilled professionals and advanced manufacturing facilities. This creates a virtuous cycle of innovation, investment, and economic growth that benefits not only the industry but also society as a whole.

What Are the Key Factors Driving Semiconductor Growth?

Several key factors are driving the unprecedented growth of the semiconductor industry. One of the most significant is the increasing demand for advanced computing power, fueled by the rise of artificial intelligence, machine learning, and big data analytics. These technologies require high-performance semiconductors capable of processing vast amounts of data quickly and efficiently. As a result, companies are investing heavily in research and development to create next-generation chips that meet these demands.

How Is AI Influencing Semiconductor Innovation?

Artificial intelligence is a major catalyst for semiconductor innovation. AI applications, such as autonomous vehicles, smart cities, and personalized healthcare, rely on specialized chips designed to handle complex computations. This has led to the development of new chip architectures, such as neural processing units (NPUs) and graphics processing units (GPUs), which are optimized for AI workloads. The semiconductor index reflects this trend, with companies specializing in AI chips often outperforming their peers.

What Role Does 5G Play in Semiconductor Demand?

The rollout of 5G networks is another key driver of semiconductor growth. 5G technology requires advanced semiconductors for base stations, smartphones, and IoT devices, creating a surge in demand for high-performance chips. Additionally, 5G enables new applications such as augmented reality, virtual reality, and smart manufacturing, further boosting the need for innovative semiconductor solutions. Investors tracking the semiconductor index should pay close attention to companies involved in 5G-related technologies, as they are likely to benefit from this trend.

How Are Semiconductor Companies Adapting to New Challenges?

Semiconductor companies face a myriad of challenges, from supply chain disruptions to geopolitical tensions. To remain competitive, these companies are adopting innovative strategies to address these issues. For example, many are investing in domestic manufacturing facilities to reduce reliance on foreign suppliers. This trend, often referred to as "onshoring" or "reshoring," is gaining traction in countries like the United States and Europe, where governments are offering incentives to boost local semiconductor production.

Another key adaptation is the shift toward sustainable manufacturing practices. As environmental concerns grow, semiconductor companies are exploring ways to reduce their carbon footprint and conserve resources. This includes adopting renewable energy sources, improving energy efficiency in manufacturing processes, and developing eco-friendly materials. These efforts not only benefit the environment but also enhance the companies’ reputations and appeal to socially conscious investors.

Finally, semiconductor companies are increasingly focusing on collaboration and partnerships to drive innovation. By working with universities, research institutions, and other companies, they can accelerate the development of new technologies and bring them to market more quickly. This collaborative approach is essential for addressing the complex challenges facing the industry and ensuring its continued growth and success.

What Role Does Technology Play in the Semiconductor Index?

Technology is the lifeblood of the semiconductor index, driving both its performance and its potential for future growth. Advances in chip design, fabrication techniques, and materials science are constantly reshaping the industry, creating new opportunities and challenges for companies. For instance, the transition from traditional silicon-based chips to alternative materials like gallium nitride (GaN) and silicon carbide (SiC) is opening up new possibilities for high-performance and energy-efficient semiconductors.

Additionally, the rise of edge computing and the Internet of Things (IoT) is fueling demand for specialized semiconductors that can operate in diverse environments. These technologies require chips that are not only powerful but also compact, energy-efficient, and capable of withstanding extreme conditions. As a result, companies that can innovate in these areas are likely to see significant growth, reflected in their performance within the semiconductor index.

Finally, the integration of semiconductors into emerging fields such as quantum computing and biotechnology is expanding the industry’s horizons. These cutting-edge applications are still in their infancy but hold immense potential for transforming industries and creating new markets. Investors who understand the role of technology in the semiconductor index are better positioned to identify and capitalize on these opportunities.

How Can Investors Use the Semiconductor Index Effectively?

Investors can leverage the semiconductor index in several ways to enhance their portfolios. One approach is to use the index as a benchmark for evaluating the performance of individual semiconductor stocks. By comparing a company’s performance to the index, investors can identify underperforming or overperforming stocks and make informed decisions about buying or selling. This strategy is particularly useful for those seeking to build a diversified portfolio of semiconductor-related investments.

Another effective strategy is to invest in index-based funds or ETFs that track the semiconductor index. These funds offer a convenient way to gain exposure to the industry without the need to pick individual stocks. They also provide diversification, reducing the risks associated with investing in a single company. For example, the iShares Semiconductor ETF (SOXX) is a popular choice for investors looking to capitalize on the growth of the semiconductor industry.

Finally, investors should stay informed about the latest trends and developments in the semiconductor industry. By monitoring news, research reports, and market analysis, they can identify emerging opportunities and risks. This proactive approach enables investors to stay ahead of the curve and make strategic decisions that align with their financial goals.

What Are the Future Prospects of the Semiconductor Industry?

The future of the semiconductor industry looks bright, with numerous opportunities for growth and innovation. One of the most promising areas is the development of quantum computing, which has the potential to revolutionize industries ranging from finance to healthcare. Quantum computers rely on advanced semiconductors to perform complex calculations at unprecedented speeds, making them a key focus for research and development.

Another exciting prospect is the integration of semiconductors into biotechnology and healthcare. For example, wearable devices equipped with advanced sensors can monitor vital signs and provide real-time health data, enabling early detection of medical conditions. Similarly

Discover The Best Stay In Arizona: Why Choose The Phoenix Hilton Garden Inn?

Everything You Need To Know About The Fiesta Texas Season Pass

What Is MoneyLion: A Comprehensive Guide To Financial Wellness

ASE Semiconductor

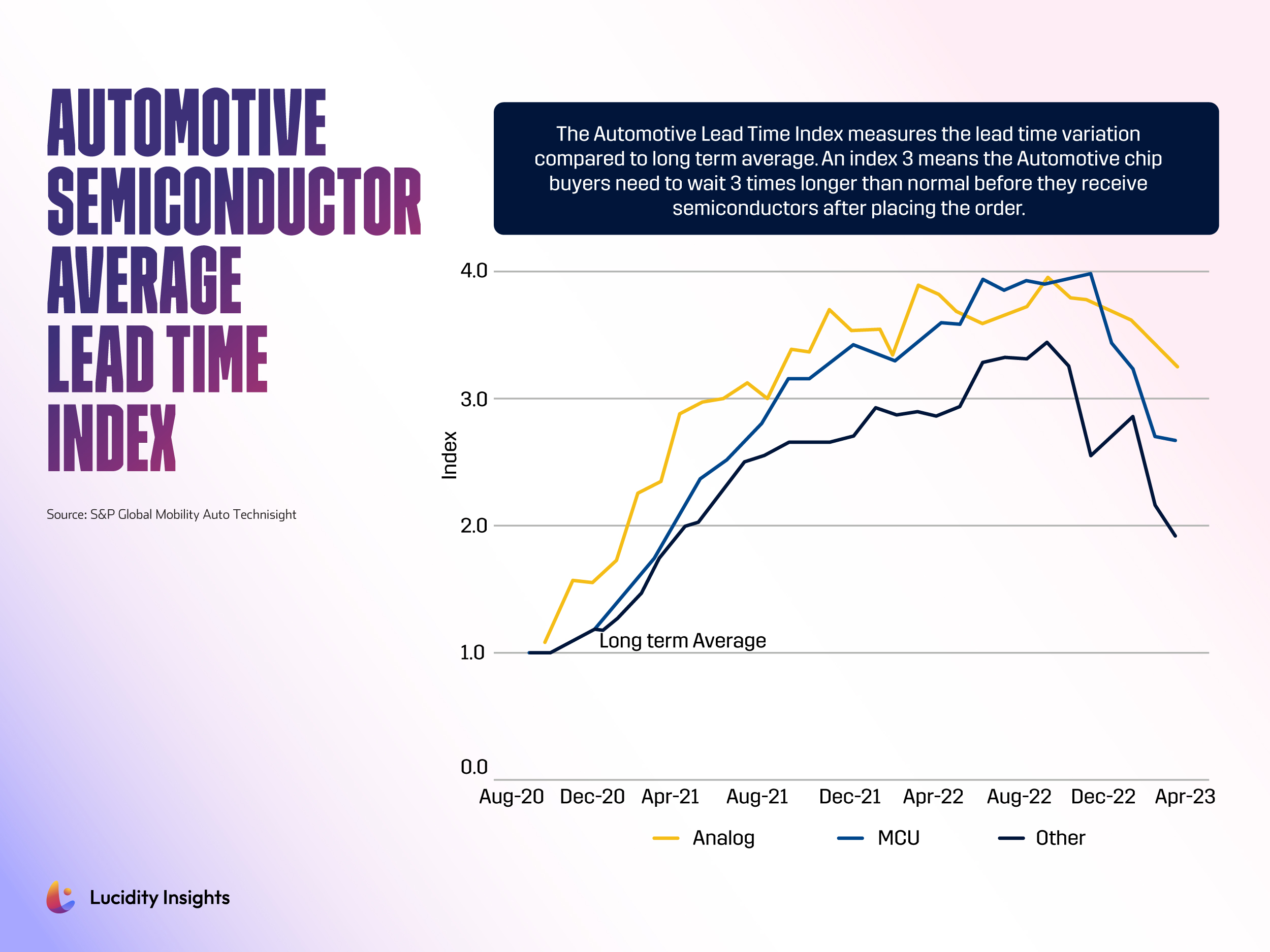

Automotive Semiconductor Average Lead Time Index Shows the Waiting Time