Discover The Best Earnin Alternatives: Your Guide To Financial Flexibility

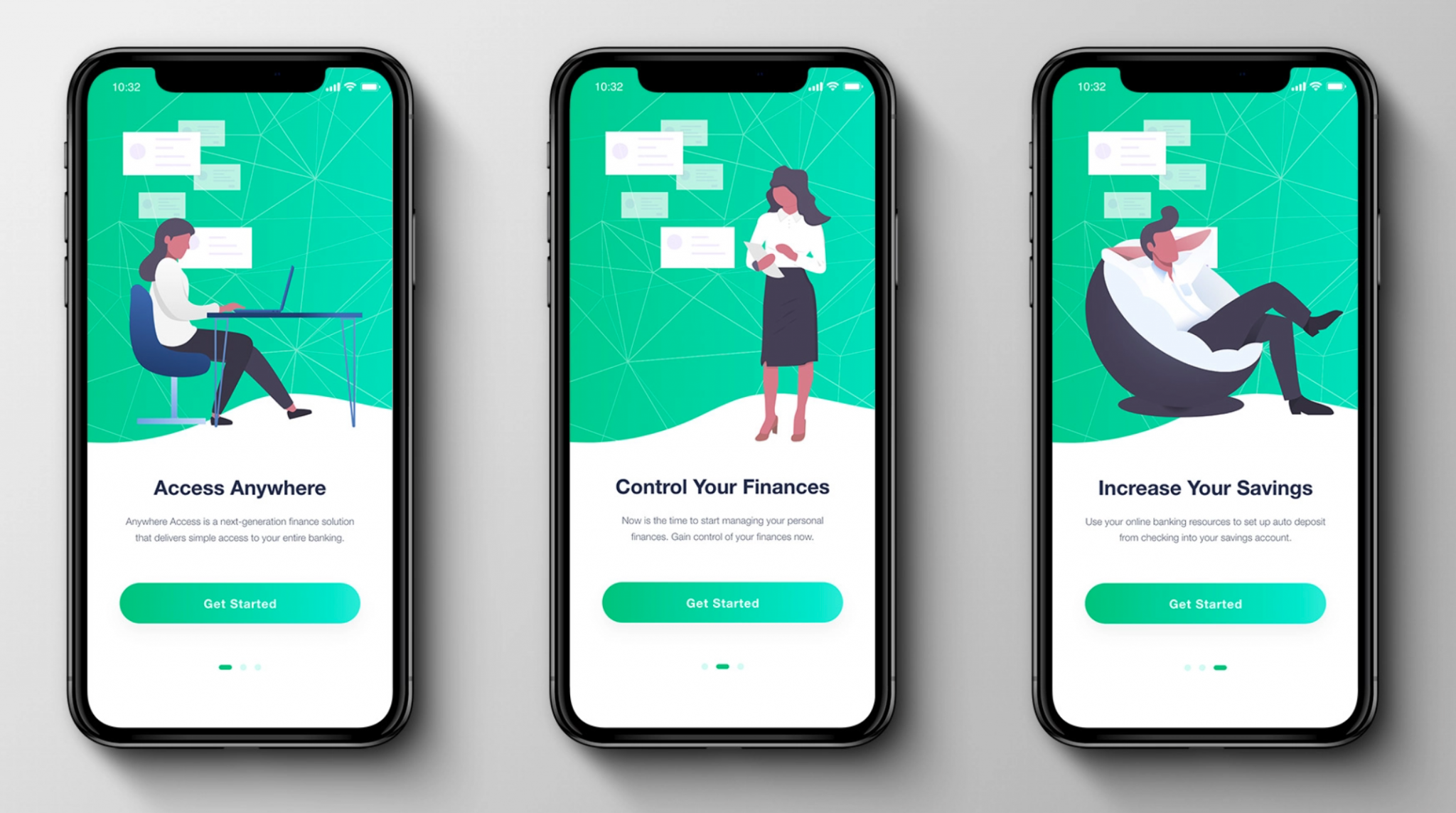

In today's fast-paced world, financial flexibility has become more important than ever. Whether you're facing unexpected expenses or simply looking for ways to manage your cash flow better, finding reliable earnin alternatives can make all the difference. These platforms offer innovative solutions that allow users to access their hard-earned money when they need it most, without the stress of traditional loans or high-interest credit cards. With so many options available, it's crucial to understand what makes each one unique and how they can fit into your financial strategy.

As the demand for financial tools grows, the market for earnin alternatives has expanded significantly. These platforms are designed to cater to a wide range of needs, from short-term cash advances to long-term financial planning. By leveraging technology and user-friendly interfaces, they provide seamless experiences that empower individuals to take control of their finances. However, not all earnin alternatives are created equal, and it's essential to evaluate their features, fees, and benefits to make an informed decision.

Throughout this article, we'll dive deep into the world of earnin alternatives, exploring their benefits, limitations, and how they compare to one another. We'll also answer some of the most common questions users have about these platforms and provide actionable insights to help you choose the best option for your needs. Whether you're new to the concept or looking to switch to a better solution, this guide will equip you with the knowledge you need to make the right choice.

Read also:Dawn Wells Measurements A Complete Guide To Her Life And Career

Table of Contents

- What Are Earnin Alternatives?

- How Do Earnin Alternatives Work?

- Top Earnin Alternatives to Consider in 2023

- Can Earnin Alternatives Help You Avoid Debt?

- What Are the Fees and Limitations of Earnin Alternatives?

- How to Choose the Right Earnin Alternative for You

- Are There Any Hidden Risks with Earnin Alternatives?

- FAQs About Earnin Alternatives

What Are Earnin Alternatives?

Earnin alternatives are financial tools or platforms that allow users to access their earned wages before their official payday. Unlike traditional payday loans, these platforms are designed to provide short-term financial relief without trapping users in cycles of debt. They typically operate by partnering with employers or integrating with payroll systems to verify income and employment status. Once verified, users can request an advance on their earnings, which is often deposited into their bank account within minutes.

These alternatives have gained popularity due to their flexibility and user-centric approach. Many of them offer features such as no interest, no hidden fees, and customizable repayment schedules. Some platforms even provide additional tools, like budgeting apps and financial education resources, to help users manage their money more effectively. By offering a modern alternative to traditional financial products, earnin alternatives empower individuals to take control of their finances and avoid high-interest debt.

Key Features of Earnin Alternatives

- Instant access to earned wages

- No interest or hidden fees

- Integration with payroll systems

- Customizable repayment options

- Additional financial tools and resources

How Do Earnin Alternatives Work?

Understanding how earnin alternatives function is crucial to making the most of these platforms. Most of these services operate on a simple premise: they allow users to access a portion of their earned wages before their official payday. To get started, users typically need to download the app, verify their employment and income, and link their bank account. Once these steps are completed, they can request an advance, which is often deposited into their account within minutes.

The repayment process is equally straightforward. When the user's paycheck is deposited, the advanced amount is automatically deducted, along with any optional tips or fees the user chooses to pay. Some platforms also offer flexible repayment options, allowing users to adjust the amount they repay based on their financial situation. This transparency and flexibility make earnin alternatives an attractive option for those seeking short-term financial relief.

Benefits of Using Earnin Alternatives

- Avoid high-interest payday loans

- Access funds quickly in emergencies

- No credit checks or long approval processes

- Build financial discipline with budgeting tools

- Optional tips instead of mandatory fees

Top Earnin Alternatives to Consider in 2023

With so many earnin alternatives available, it can be challenging to determine which one is the best fit for your needs. Below, we'll explore some of the top options in 2023, highlighting their unique features and benefits. Each platform caters to different user preferences, so it's essential to evaluate them based on your financial goals and circumstances.

1. Brigit: A Budgeting-Focused Earnin Alternative

Brigit is more than just an earnin alternative; it's a comprehensive financial tool designed to help users manage their money effectively. The platform offers instant cash advances of up to $250, with no interest or hidden fees. What sets Brigit apart is its focus on financial health. It provides users with personalized budgeting insights, spending alerts, and overdraft protection to prevent unnecessary fees.

Read also:Exploring Adam Savages Children A Glimpse Into Their Lives And Influence

Why Choose Brigit?

- Personalized budgeting tools

- Overdraft protection

- No interest or hidden fees

- Up to $250 in cash advances

2. Dave: A Community-Driven Earnin Alternative

Dave has gained a reputation for its community-focused approach and user-friendly interface. It offers cash advances of up to $200, with no interest or hidden fees. Additionally, Dave provides features like budgeting tools, job search assistance, and a savings account with a competitive interest rate. The platform also allows users to tip what they can afford, making it an affordable option for many.

Why Choose Dave?

- Community-driven platform

- Job search assistance

- High-interest savings account

- No interest or hidden fees

3. Chime: A Banking-Centric Earnin Alternative

Chime is a neobank that offers a unique earnin alternative through its "SpotMe" feature. This feature allows users to overdraw their account by up to $200 without incurring overdraft fees. While Chime doesn't offer traditional cash advances, its SpotMe feature provides a similar benefit for users who need quick access to funds. Additionally, Chime offers early direct deposit, allowing users to access their paycheck up to two days early.

Why Choose Chime?

- No overdraft fees with SpotMe

- Early direct deposit

- Neobank with no monthly fees

- Free financial tools

Can Earnin Alternatives Help You Avoid Debt?

One of the most significant advantages of earnin alternatives is their potential to help users avoid debt. Traditional payday loans and credit cards often come with high-interest rates and fees, which can quickly spiral into unmanageable debt. By contrast, earnin alternatives typically charge no interest and offer flexible repayment options, making them a safer choice for short-term financial needs.

These platforms also encourage responsible financial behavior by providing tools and resources to help users manage their money. For example, many earnin alternatives include budgeting apps, spending alerts, and financial education resources. By promoting financial literacy and discipline, these platforms empower users to break the cycle of debt and build a more secure financial future.

How Earnin Alternatives Compare to Payday Loans

- No high-interest rates

- Flexible repayment options

- No credit checks required

- Focus on financial education

What Are the Fees and Limitations of Earnin Alternatives?

While earnin alternatives offer many benefits, it's essential to understand their fees and limitations before committing to one. Most platforms charge no interest or hidden fees, but some may allow users to leave optional tips to support the service. These tips are entirely voluntary and can range from a few dollars to a percentage of the advanced amount.

Another limitation to consider is the maximum advance amount. Most earnin alternatives cap advances at $200 to $500, depending on the platform and the user's income. Additionally, some platforms require users to have a consistent income and direct deposit to qualify for their services. While these limitations may not be deal-breakers for most users, they are worth considering when evaluating your options.

Common Limitations of Earnin Alternatives

- Capped advance amounts

- Income and direct deposit requirements

- Optional tips instead of mandatory fees

- Availability may vary by location

How to Choose the Right Earnin Alternative for You

Choosing the right earnin alternative depends on your unique financial needs and preferences. Start by evaluating your goals: Are you looking for a platform that offers quick cash advances, or do you need additional tools like budgeting apps and financial education resources? Once you've identified your priorities, compare the features and benefits of different platforms to find the best match.

It's also important to consider the platform's fees, advance limits, and eligibility requirements. Some earnin alternatives may offer higher advance limits but require consistent income and direct deposit, while others may have lower limits but fewer restrictions. By carefully weighing these factors, you can select an earnin alternative that aligns with your financial situation and goals.

Questions to Ask When Choosing an Earnin Alternative

- What is the maximum advance amount?

- Are there any fees or hidden charges?

- Does the platform offer additional financial tools?

- What are the eligibility requirements?

Are There Any Hidden Risks with Earnin Alternatives?

While earnin alternatives are generally safer than traditional financial products, they are not without risks. One potential risk is over-reliance on these platforms, which can lead to financial instability if users consistently rely on advances to cover expenses. To avoid this, it's crucial to use earnin alternatives responsibly and only when absolutely necessary.

Another risk to consider is the potential impact on your budget. While most platforms offer no-interest advances, optional tips and fees can add up over time. Additionally, some users may face challenges if their employer or payroll system is incompatible with certain earnin alternatives. By understanding these risks and using these platforms responsibly, you can minimize their impact on your financial health.

How to Mitigate Risks with Earnin Alternatives

- Use advances sparingly and only in emergencies

- Monitor optional tips and fees

- Ensure compatibility with your employer or payroll system

- Build an emergency fund to reduce reliance on advances

FAQs About Earnin Alternatives

1. Are Earnin Alternatives Safe to Use?

Yes, earnin alternatives are generally safe to use as long as you choose a reputable platform and use it responsibly. Most platforms use secure encryption to protect your personal and financial information. Additionally, they offer transparent terms and conditions, ensuring you know exactly what to expect.

2. Do Earnin Alternatives Affect Your Credit Score?

No, most earnin alternatives do not require a credit check or report your activity to credit bureaus. This makes them a great option for individuals with poor or limited credit history. However, it's essential to repay your advances on time to

What Is Betpro Online And Why Should You Care?

Tasteful Selections Seafood Boil: A Culinary Adventure You Can't Miss

Unveiling The Identity Behind Kdot Real Name: A Comprehensive Exploration

Earnin Pricing, Reviews, Features & Alternatives B2Saas

Apps Like Dave and Earnin 5 Great Alternatives