Will Capital One Lower My Auto Loan Interest Rate? Exploring Your Options

Are you wondering whether Capital One might lower your auto loan interest rate? You're not alone. Many borrowers find themselves in situations where their current interest rates feel burdensome, and they seek ways to reduce their financial strain. Capital One, as a leading financial institution, offers auto loans with competitive terms, but the possibility of lowering your interest rate depends on several factors. Understanding these factors can help you make informed decisions about your financial future.

Capital One's auto loan interest rates are influenced by your credit score, market conditions, and the terms of your original loan agreement. While the lender may not automatically adjust your rate, there are proactive steps you can take to negotiate better terms or refinance your loan. This article will guide you through the process, answer common questions, and provide actionable tips to improve your chances of securing a lower interest rate. Whether you're a first-time borrower or looking to optimize your existing loan, this guide is designed to help you navigate the complexities of auto loan refinancing.

As we delve deeper into the topic, you'll discover strategies to negotiate with Capital One, understand the role of credit scores, and explore refinancing options. By the end of this article, you'll be equipped with the knowledge to take control of your auto loan and potentially save money in the long run. So, let’s dive into the details and explore whether Capital One can lower your auto loan interest rate and how you can make it happen.

Read also:Exploring The Unique Bond Of Colin Jost And Michael Che Friendship A Closer Look

Table of Contents

- Can Capital One Lower My Auto Loan Interest Rate?

- What Factors Influence Capital One Auto Loan Interest Rates?

- How Can I Negotiate a Lower Interest Rate with Capital One?

- Is Refinancing My Auto Loan a Viable Option?

- What Are the Benefits of Refinancing with Capital One?

- How Does My Credit Score Affect My Auto Loan Interest Rate?

- What Are the Steps to Refinance My Auto Loan with Capital One?

- Frequently Asked Questions About Capital One Auto Loan Rates

Can Capital One Lower My Auto Loan Interest Rate?

If you're asking, "Will Capital One lower my auto loan interest rate?" the answer depends on your specific circumstances. Capital One, like other financial institutions, evaluates loan modifications on a case-by-case basis. While the lender may not advertise a formal program for lowering interest rates, there are scenarios where they might be willing to adjust your terms. For example, if you've consistently made on-time payments and demonstrated financial responsibility, Capital One may consider your request favorably.

One way to approach this is by contacting Capital One's customer service team directly. Explain your situation, highlight your payment history, and inquire about potential options. In some cases, lenders may offer promotional rates or temporary reductions for loyal customers. However, it's essential to manage your expectations. Not all requests will be approved, and the lender may require you to meet specific eligibility criteria.

Another factor to consider is the timing of your request. If market interest rates have dropped significantly since you took out your loan, Capital One might be more inclined to adjust your rate to remain competitive. Additionally, if your credit score has improved since you secured the loan, you can use this as leverage during negotiations. Remember, persistence and preparation are key when asking, "Will Capital One lower my auto loan interest rate?"

What Factors Influence Capital One Auto Loan Interest Rates?

Understanding the factors that influence Capital One auto loan interest rates can help you better navigate your options. Several variables come into play when determining your loan terms, and being aware of these can empower you to make smarter financial decisions.

Your Credit Score: The Key Determinant

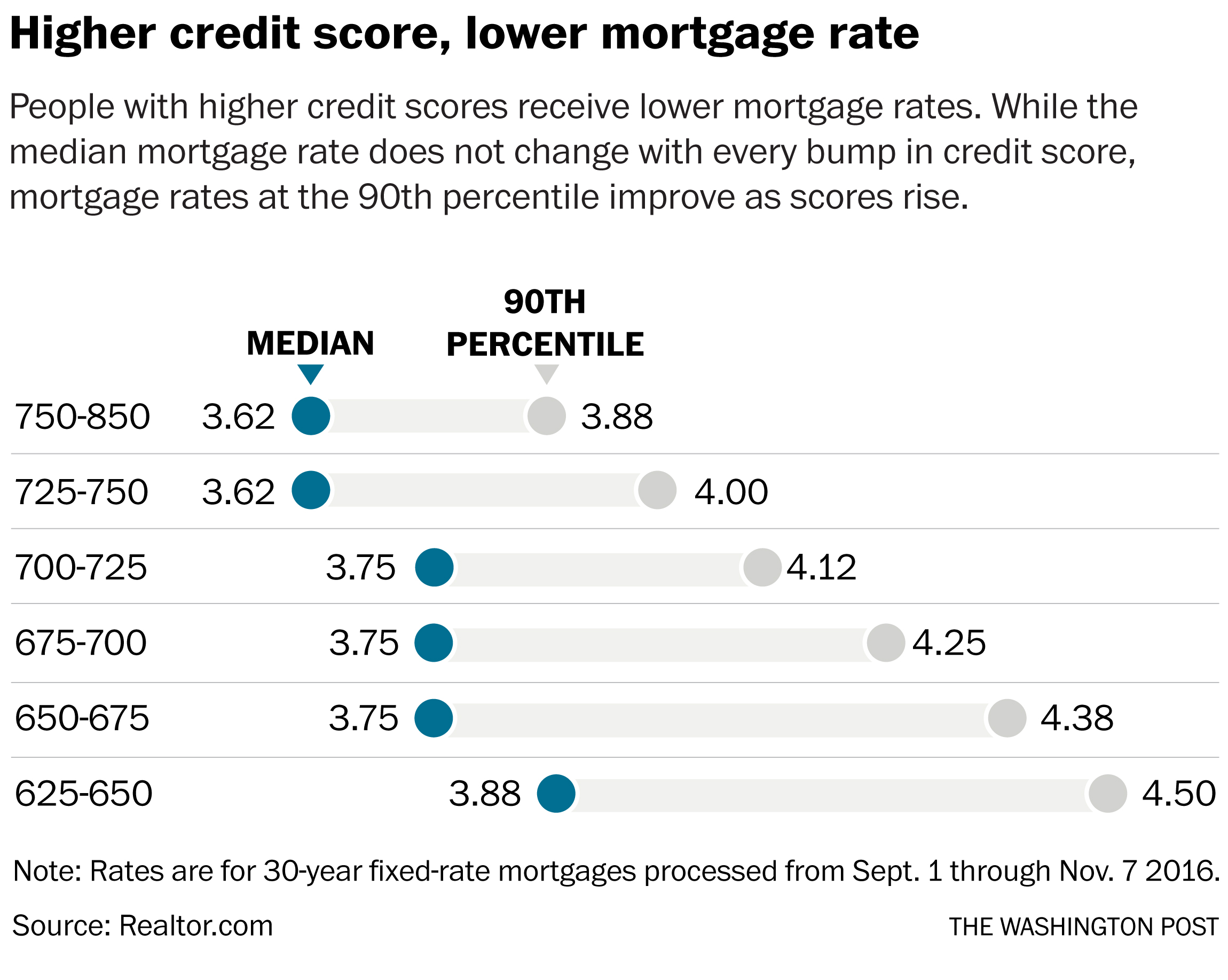

One of the most significant factors is your credit score. Lenders like Capital One use your credit score to assess your risk as a borrower. A higher credit score indicates a lower risk, which can translate into a lower interest rate. Conversely, a lower credit score may result in higher rates or even loan denial. If you're wondering, "Will Capital One lower my auto loan interest rate?" improving your credit score could be a crucial step.

Market Conditions and Economic Trends

Market conditions also play a vital role in determining interest rates. When the Federal Reserve adjusts interest rates, it can impact the rates offered by financial institutions like Capital One. For instance, during periods of economic growth, interest rates may rise, while during downturns, they may fall. Keeping an eye on these trends can help you time your refinancing or negotiation efforts effectively.

Read also:What Are Examples A Comprehensive Guide To Understanding And Using Examples Effectively

Loan Term and Vehicle Type

The length of your loan term and the type of vehicle you're financing can also affect your interest rate. Shorter loan terms typically come with lower rates because they represent less risk to the lender. Similarly, newer vehicles often qualify for better rates compared to older models, as they hold their value longer and are less likely to require costly repairs.

Down Payment and Loan-to-Value Ratio

Your down payment and loan-to-value (LTV) ratio are additional considerations. A larger down payment reduces the amount you need to borrow, which can lead to more favorable terms. A lower LTV ratio signals less risk for the lender, potentially resulting in a reduced interest rate. By understanding these factors, you can position yourself for better loan terms with Capital One.

How Can I Negotiate a Lower Interest Rate with Capital One?

Negotiating a lower interest rate with Capital One may seem daunting, but with the right approach, it's entirely possible. The key is to present a compelling case that demonstrates your value as a customer. Here are some strategies to help you negotiate effectively.

Prepare Your Case: Gather Supporting Documents

Before reaching out to Capital One, gather all relevant documents that support your request. This includes proof of your on-time payment history, recent credit score updates, and any evidence of improved financial stability. Presenting this information can strengthen your position and show that you're a low-risk borrower. If you're asking, "Will Capital One lower my auto loan interest rate?" having these documents ready is crucial.

Contact Customer Service: Be Polite but Persistent

When contacting Capital One, start by speaking with a customer service representative. Politely explain your situation and request a rate adjustment. If the representative is unable to assist, ask to speak with a supervisor or someone in the loan modification department. Persistence is key—sometimes, it takes multiple attempts to get the outcome you're hoping for.

Highlight Competitor Offers

If you've received better offers from other lenders, don't hesitate to mention them during your negotiation. Lenders like Capital One often want to retain their customers, and knowing that you have competitive options can motivate them to offer better terms. However, be honest and ensure that the offers you mention are legitimate.

Explore Loyalty Programs

Capital One may have loyalty programs or promotional offers for long-term customers. Inquire about these programs and see if you qualify for any benefits. Sometimes, simply being a loyal customer can open doors to better rates or reduced fees. By taking these steps, you increase your chances of successfully negotiating a lower interest rate with Capital One.

Is Refinancing My Auto Loan a Viable Option?

Refinancing your auto loan can be an excellent way to lower your interest rate and reduce your monthly payments. If you're asking, "Will Capital One lower my auto loan interest rate?" and haven't had success negotiating, refinancing might be the next best step. This process involves replacing your current loan with a new one, ideally under more favorable terms.

When Should You Consider Refinancing?

Refinancing is particularly beneficial if your credit score has improved since you took out your original loan. A higher credit score can qualify you for better rates, potentially saving you thousands of dollars over the life of the loan. Additionally, if market interest rates have dropped, refinancing can help you secure a lower rate and reduce your overall borrowing costs.

How to Choose the Right Lender

While Capital One may offer refinancing options, it's essential to shop around and compare offers from multiple lenders. Look for lenders with competitive rates, low fees, and excellent customer service. Some lenders may offer prequalification, allowing you to check your potential rates without impacting your credit score. This step can help you make an informed decision and ensure you're getting the best deal possible.

Understand the Costs of Refinancing

Before refinancing, be aware of any associated costs, such as application fees, title transfer fees, or prepayment penalties. While these costs can add up, they may be outweighed by the long-term savings from a lower interest rate. Calculate the break-even point to determine whether refinancing is financially beneficial for your situation.

Steps to Refinance Your Auto Loan

To refinance your auto loan, start by gathering your current loan details, including your outstanding balance and interest rate. Next, research lenders and submit applications to those offering the best terms. Once approved, the new lender will pay off your existing loan, and you'll begin making payments under the new agreement. This process can simplify your finances and potentially save you money in the long run.

What Are the Benefits of Refinancing with Capital One?

Refinancing your auto loan with Capital One can offer several advantages, particularly if you're already a customer. While the question, "Will Capital One lower my auto loan interest rate?" may have led you here, refinancing could provide additional benefits beyond just a reduced rate.

Streamlined Process for Existing Customers

As an existing Capital One customer, you may find the refinancing process more straightforward compared to starting with a new lender. Capital One already has your financial information on file, which can expedite the application and approval process. This convenience can save you time and effort, allowing you to focus on other financial priorities.

Competitive Rates and Flexible Terms

Capital One is known for offering competitive interest rates and flexible loan terms. By refinancing with them, you might secure a lower rate that aligns with your financial goals. Additionally, you can choose a loan term that better suits your budget, whether that means extending the term to lower monthly payments or shortening it to pay off the loan faster.

Improved Customer Service Experience

Capital One prides itself on providing excellent customer service. If you've had positive experiences with their support team in the past, refinancing with them can ensure continuity in service quality. Their representatives are often well-equipped to address your concerns and guide you through the refinancing process, making it a smoother experience overall.

Potential Savings on Interest and Fees

Refinancing with Capital One can lead to significant savings on interest and fees. By securing a lower interest rate, you can reduce the total amount you pay over the life of the loan. Furthermore, Capital One may offer promotional deals or waive certain fees for loyal customers, further enhancing the financial benefits of refinancing with them.

How Does My Credit Score Affect My Auto Loan Interest Rate?

Your credit score plays a pivotal role in determining your auto loan interest rate. If you're asking, "Will Capital One lower my auto loan interest rate?" understanding the connection between your credit score and loan terms is essential. Lenders like Capital One use your credit score as a primary indicator of your financial responsibility and risk level.

Understanding Credit Score Ranges

Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Borrowers with scores above 700 are generally considered low-risk and are more likely to qualify for the best interest rates. On the other hand, scores below 600 may result in higher rates or loan denial. If your credit score falls in the middle range, you might still qualify for reasonable rates, but improving your score can lead to better terms.

Steps to Improve Your Credit Score

If your credit score is holding you back from securing a lower interest rate, there are actionable steps you can take to improve it. Start by paying your bills on time, as payment history is the most significant factor in your credit score. Reducing your credit utilization ratio—keeping your balances low relative to your credit

Unveiling The Mysteries Of The January 5 Zodiac Sign: Traits, Compatibility, And More

How Much Does Ice-T Earn Per Episode? A Complete Breakdown

Exploring The Fascinating Story Of Johnny Cash Marriages: Love, Loss, And Legacy

Factors Lenders Consider To Determine Auto Loan Interest Rate

Average Auto Loan Interest Rate 650 Credit Score Loan Walls