Comprehensive First Premier Bank Review: What You Need To Know

When evaluating a bank, it’s essential to consider factors like fees, account options, customer service, and accessibility. First Premier Bank has positioned itself as a versatile financial institution, catering to both personal and business banking needs. From savings accounts and credit cards to loans and investment services, the bank offers a comprehensive suite of financial products. However, like any financial institution, it has its strengths and weaknesses, which we’ll dissect in this First Premier Bank review. To ensure you’re making an informed decision, this article will delve into the pros and cons of banking with First Premier Bank. We’ll analyze its offerings, compare them to industry standards, and provide insights into customer experiences. Whether you’re a first-time account holder or a seasoned investor, this First Premier Bank review aims to equip you with the knowledge you need to determine if this bank aligns with your financial goals.

Table of Contents

- Is First Premier Bank Right for You?

- What Are the Key Features of First Premier Bank?

- How Does First Premier Bank Compare to Other Banks?

- What Are the Pros and Cons of First Premier Bank?

- How Does First Premier Bank Handle Customer Service?

- What Are the Most Common Complaints About First Premier Bank?

- How Can You Open an Account with First Premier Bank?

- Frequently Asked Questions About First Premier Bank

Is First Premier Bank Right for You?

Choosing the right bank is a crucial decision that can significantly impact your financial well-being. First Premier Bank offers a variety of services designed to cater to different types of customers, but how do you know if it’s the right fit for you? Let’s break down the factors that can help you decide.

First Premier Bank is known for its diverse account offerings, including checking, savings, and money market accounts. These accounts often come with competitive interest rates and minimal fees, making them attractive to individuals who prioritize savings growth. Additionally, the bank’s online and mobile banking platforms are user-friendly, allowing customers to manage their finances conveniently from anywhere. If you value digital accessibility and straightforward account management, First Premier Bank might be a strong contender.

Read also:What Are Examples A Comprehensive Guide To Understanding And Using Examples Effectively

However, it’s essential to consider your specific needs. For instance, if you’re someone who frequently travels internationally, you might want to evaluate the bank’s foreign transaction fees and ATM network availability. On the other hand, if you’re a small business owner, you’ll want to assess the bank’s business banking services, such as merchant services and business loans. By aligning your requirements with the bank’s offerings, you can determine if First Premier Bank is the right choice for your financial journey.

Who Benefits Most from First Premier Bank?

- Individuals seeking high-yield savings accounts

- Business owners in need of tailored financial solutions

- Customers who prioritize digital banking convenience

What Are the Key Features of First Premier Bank?

First Premier Bank stands out for its comprehensive range of financial products and services. Understanding these features is vital to assessing whether the bank aligns with your financial goals. Let’s explore some of the standout aspects that define First Premier Bank.

One of the key highlights of First Premier Bank is its commitment to providing personalized banking solutions. Whether you’re looking for a basic checking account or a sophisticated investment portfolio, the bank offers tailored options to meet your needs. For example, their high-yield savings accounts are designed to help customers maximize their savings potential with competitive interest rates. Additionally, the bank’s credit card offerings often come with unique perks, such as cashback rewards and travel benefits, which can enhance your financial experience.

Another notable feature of First Premier Bank is its robust digital banking platform. The bank’s mobile app and online portal are equipped with advanced tools for budgeting, bill payments, and account monitoring. This level of accessibility is particularly beneficial for tech-savvy individuals who prefer managing their finances on the go. Furthermore, the bank’s customer support team is available 24/7, ensuring that any issues or queries are addressed promptly.

How Does First Premier Bank Enhance Customer Experience?

- 24/7 customer support for resolving queries

- Advanced digital tools for financial management

- Competitive interest rates on savings and loan products

How Does First Premier Bank Compare to Other Banks?

In the competitive world of banking, it’s essential to compare First Premier Bank with other financial institutions to understand its unique value proposition. While many banks offer similar services, First Premier Bank distinguishes itself through specific attributes that cater to diverse customer needs.

When comparing First Premier Bank to larger national banks, one of the most noticeable differences is its community-focused approach. Unlike mega-banks that often prioritize mass-market strategies, First Premier Bank emphasizes personalized service and local engagement. This focus on community banking can be particularly appealing to individuals who value a more intimate banking relationship. Additionally, the bank’s fee structure is often more transparent and customer-friendly compared to some of its competitors.

Read also:Diane Furnberg Exploring Her Life Achievements And Impact

On the other hand, when compared to smaller credit unions, First Premier Bank offers a broader range of services and products. While credit unions are known for their low fees and member-centric approach, they may lack the technological advancements and extensive service offerings that First Premier Bank provides. For example, the bank’s investment services and business banking solutions are more comprehensive than what most credit unions can offer.

What Sets First Premier Bank Apart?

- Community-focused banking with personalized service

- Transparent fee structures and competitive rates

- Wide range of financial products for individuals and businesses

What Are the Pros and Cons of First Premier Bank?

Like any financial institution, First Premier Bank has its strengths and weaknesses. Understanding these pros and cons is crucial for making an informed decision about whether to bank with them. Let’s take a closer look at the advantages and disadvantages.

One of the biggest advantages of First Premier Bank is its customer-centric approach. The bank prioritizes building strong relationships with its clients, offering personalized financial advice and tailored solutions. Additionally, the bank’s digital banking platform is highly intuitive, making it easy for customers to manage their accounts online or via the mobile app. The competitive interest rates on savings accounts and loans further enhance the bank’s appeal.

However, there are some drawbacks to consider. For instance, some customers have reported limited ATM availability in certain areas, which can be inconvenient for those who rely heavily on cash withdrawals. Additionally, while the bank’s fees are generally reasonable, some specialized services may come with higher costs. It’s important to weigh these factors against your personal banking preferences to determine if First Premier Bank is the right choice for you.

Should You Choose First Premier Bank?

- Pros: Personalized service, competitive rates, robust digital platform

- Cons: Limited ATM network, higher fees for certain services

How Does First Premier Bank Handle Customer Service?

Customer service is a critical aspect of any banking experience, and First Premier Bank has made significant strides in this area. Understanding how the bank addresses customer concerns can help you gauge its reliability and commitment to client satisfaction.

First Premier Bank prides itself on offering 24/7 customer support through multiple channels, including phone, email, and live chat. This round-the-clock availability ensures that customers can resolve their issues promptly, regardless of the time or day. Additionally, the bank’s customer service representatives are trained to handle a wide range of queries, from account management to technical support, providing a seamless experience for clients.

Moreover, the bank’s online resources, such as FAQs and tutorials, are designed to empower customers to troubleshoot common issues independently. This self-service approach not only enhances convenience but also reduces wait times for those who prefer direct assistance. Overall, First Premier Bank’s customer service framework reflects its dedication to fostering trust and loyalty among its clients.

What Are the Most Common Complaints About First Premier Bank?

While First Premier Bank has earned a solid reputation, no institution is without its share of complaints. Understanding the most common grievances can help you anticipate potential challenges and make an informed decision.

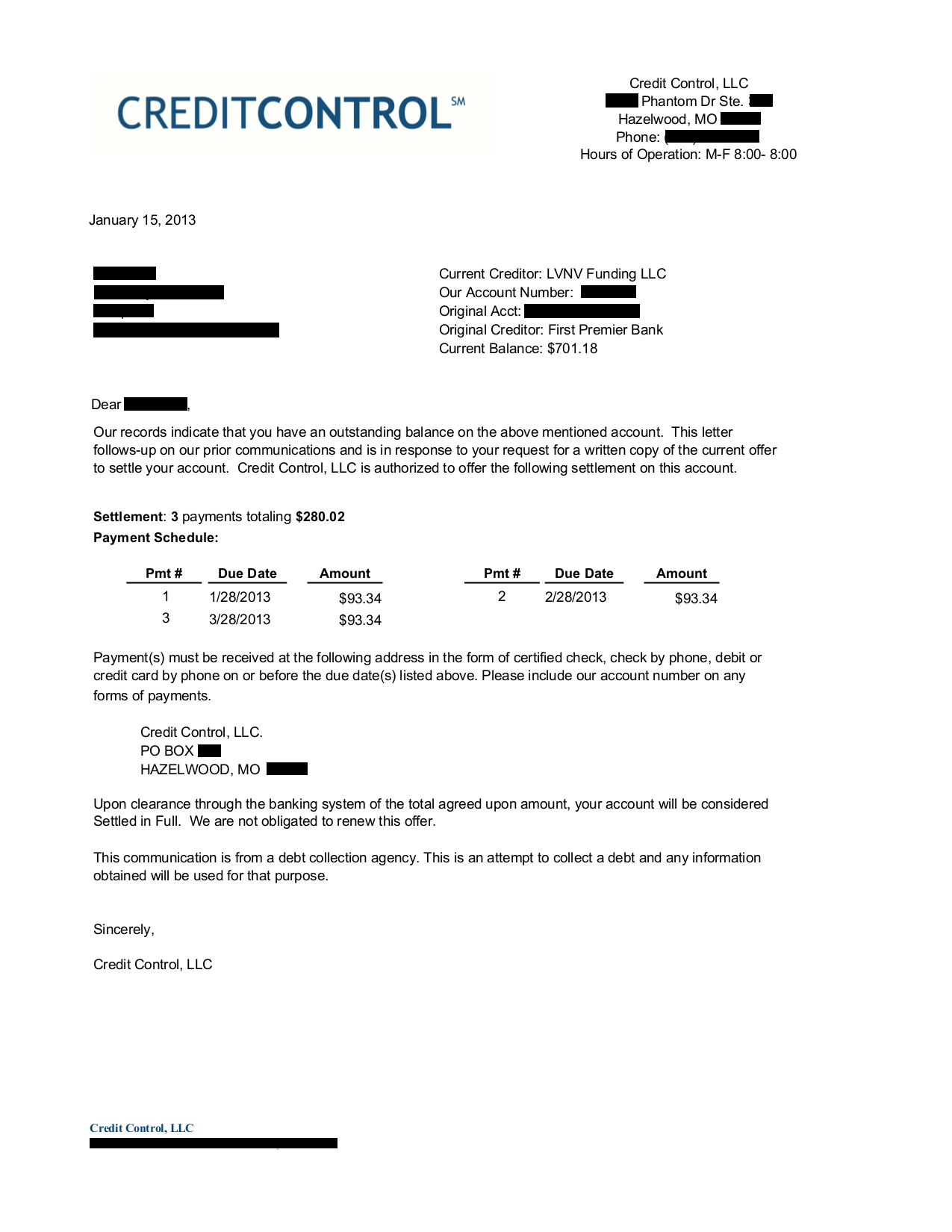

One frequent complaint about First Premier Bank is the limited ATM network in certain regions. Customers in rural or underserved areas may find it inconvenient to access cash without incurring out-of-network fees. Additionally, some users have expressed concerns about the bank’s credit card policies, particularly regarding interest rates and late payment penalties. These issues can be frustrating for individuals who rely heavily on credit for their financial activities.

Another area of criticism is the bank’s fee structure for specific services, such as wire transfers and international transactions. While the fees are generally transparent, they can be higher than those of some competitors, which may deter cost-conscious customers. Despite these complaints, it’s worth noting that First Premier Bank actively addresses feedback and strives to improve its services based on customer input.

How Can You Open an Account with First Premier Bank?

Opening an account with First Premier Bank is a straightforward process, but it’s essential to understand the steps involved to ensure a smooth experience. Whether you’re setting up a personal or business account, the bank provides multiple options to accommodate your needs.

To begin, you’ll need to visit the bank’s website or a local branch to explore the available account types. First Premier Bank offers a variety of options, including checking, savings, and money market accounts, each with its own set of features and benefits. Once you’ve selected the account that best suits your requirements, you’ll need to provide some basic personal information, such as your name, address, and Social Security number. This information is used to verify your identity and comply with regulatory requirements.

After submitting your application, the bank will review your details and notify you of any additional steps, such as depositing the minimum balance or providing supplementary documentation. Once your account is approved, you’ll gain access to the bank’s digital tools and services, allowing you to manage your finances efficiently. With its streamlined account-opening process, First Premier Bank ensures that new customers can get started quickly and hassle-free.

Frequently Asked Questions About First Premier Bank

What Are the Eligibility Requirements for Opening an Account?

To open an account with First Premier Bank, you must be at least 18 years old and provide valid identification, such as a driver’s license or passport. Additionally, you’ll need to provide proof of address and a Social Security number for verification purposes.

Does First Premier Bank Offer Business Banking Services?

Yes, First Premier Bank provides a comprehensive suite of business banking services, including business loans, merchant services, and cash management solutions. These services are designed to support small and medium-sized enterprises in achieving their financial goals.

How Can I Contact First Premier Bank for Support?

You can reach First Premier Bank’s customer support team 24/7 via phone, email, or live chat. The bank also offers an extensive FAQ section on its website for quick answers to common queries.

Conclusion

In conclusion, this First Premier Bank review has explored the bank’s key features, strengths, and potential drawbacks to help you make an informed decision. Whether you’re seeking a reliable savings account, a robust digital banking platform, or personalized customer service, First Premier Bank offers a range of services to meet diverse financial needs. By weighing the pros and cons and considering your specific requirements, you can determine if this bank aligns with your goals.

Ultimately, First Premier Bank’s commitment to customer satisfaction and community engagement sets it apart in the banking industry. While it may not be the perfect fit for everyone, its competitive rates, transparent fee structure, and innovative digital tools make it a strong contender

Who Is Johan Riley Fyodor Taiwo Samuel? Discover The Story Behind The Name

Understanding 34DD: A Comprehensive Guide To Its Meaning, Impact, And Importance

Billy Bob Thornton Net Worth: A Deep Dive Into His Wealth And Career

First Premier Bank

Architecture Inc First PREMIER Bank Corporate Headquarters