TurboTax Español: Your Ultimate Guide To Filing Taxes In Spanish

Filing taxes can be a daunting task, especially if English isn't your first language. That's where TurboTax Español comes in—a game-changing solution designed to simplify the tax-filing process for Spanish-speaking individuals. With its intuitive interface and comprehensive guidance, TurboTax Español ensures that you can confidently navigate the complexities of tax preparation without language barriers. Whether you're a first-time filer or a seasoned taxpayer, this platform bridges the gap between complicated tax jargon and clear, actionable steps in Spanish. TurboTax Español is not just a translation of its English counterpart; it’s a thoughtfully designed tool that caters to the unique needs of Spanish-speaking users, offering features like bilingual support, culturally relevant examples, and step-by-step instructions tailored to the U.S. tax system. This makes it an invaluable resource for millions of taxpayers who prefer communicating in Spanish.

What sets TurboTax Español apart is its commitment to accessibility and accuracy. The platform leverages advanced algorithms to ensure that every deduction, credit, and tax form is handled with precision, all while providing explanations in clear, easy-to-understand Spanish. For many, this removes the stress and confusion often associated with tax season. TurboTax Español also offers live support from bilingual tax experts, ensuring that users can get answers to their questions in real-time. Whether you're filing as an individual, a family, or a small business owner, TurboTax Español provides tailored solutions that meet your specific needs.

As tax laws continue to evolve, staying informed and compliant can feel overwhelming. TurboTax Español not only simplifies the process but also empowers users to maximize their refunds and minimize their tax liabilities. By combining cutting-edge technology with user-friendly features, TurboTax Español has become a trusted name in the tax preparation industry. In this article, we’ll explore everything you need to know about TurboTax Español, from its key features to step-by-step guidance on how to use it effectively. Let’s dive in!

Read also:Barry Weiss The Visionary Leader Transforming Industries

Table of Contents

- What is TurboTax Español and How Does It Work?

- Key Features of TurboTax Español That Simplify Tax Filing

- How to Use TurboTax Español: A Step-by-Step Guide

- Is TurboTax Español the Right Solution for You?

- What Are the Most Common Questions About TurboTax Español?

- How Does TurboTax Español Compare to Competitors?

- What Are Some Tips for Maximizing Refunds with TurboTax Español?

- Frequently Asked Questions About TurboTax Español

What is TurboTax Español and How Does It Work?

TurboTax Español is a specialized version of the popular TurboTax platform, designed specifically for Spanish-speaking taxpayers. It offers all the robust features of TurboTax but presents them in a way that's accessible and intuitive for those who prefer to file their taxes in Spanish. At its core, TurboTax Español uses a question-and-answer format to guide users through the tax-filing process. This approach ensures that even those unfamiliar with tax terminology can complete their returns with ease.

The platform works by breaking down the tax-filing process into manageable steps. Users are asked a series of straightforward questions about their income, deductions, and credits. Based on these responses, TurboTax Español automatically fills out the necessary tax forms and calculates the user’s refund or tax liability. The software also provides real-time guidance, offering explanations and tips in Spanish to help users make informed decisions. For example, if you qualify for the Earned Income Tax Credit (EITC) or the Child Tax Credit, TurboTax Español will highlight these opportunities and guide you through claiming them.

One of the standout features of TurboTax Español is its ability to adapt to the user’s specific tax situation. Whether you’re filing as a single individual, a married couple, or a business owner, the platform tailors its questions and recommendations accordingly. Additionally, TurboTax Español integrates seamlessly with IRS e-file, allowing users to submit their returns electronically for faster processing. This combination of simplicity, accuracy, and bilingual support makes TurboTax Español a go-to solution for Spanish-speaking taxpayers across the United States.

Key Features of TurboTax Español That Simplify Tax Filing

TurboTax Español is packed with features designed to make tax filing as painless as possible. Here are some of the standout tools and functionalities that set it apart:

- Bilingual Support: TurboTax Español offers bilingual support, allowing users to toggle between English and Spanish as needed. This is particularly helpful for bilingual households or individuals who may feel more comfortable with certain terms in English.

- Live Expert Assistance: If you ever find yourself stuck or unsure about a particular step, TurboTax Español provides access to live bilingual tax experts. These professionals can guide you through complex tax scenarios and ensure you’re taking full advantage of available deductions and credits.

- Automated Calculations: The platform’s advanced algorithms handle all the math for you, reducing the risk of errors. From calculating your adjusted gross income to determining your refund amount, TurboTax Español ensures precision at every step.

- Mobile Accessibility: TurboTax Español is fully optimized for mobile devices, allowing you to file your taxes on the go. Whether you’re using a smartphone or tablet, the platform’s responsive design ensures a seamless experience.

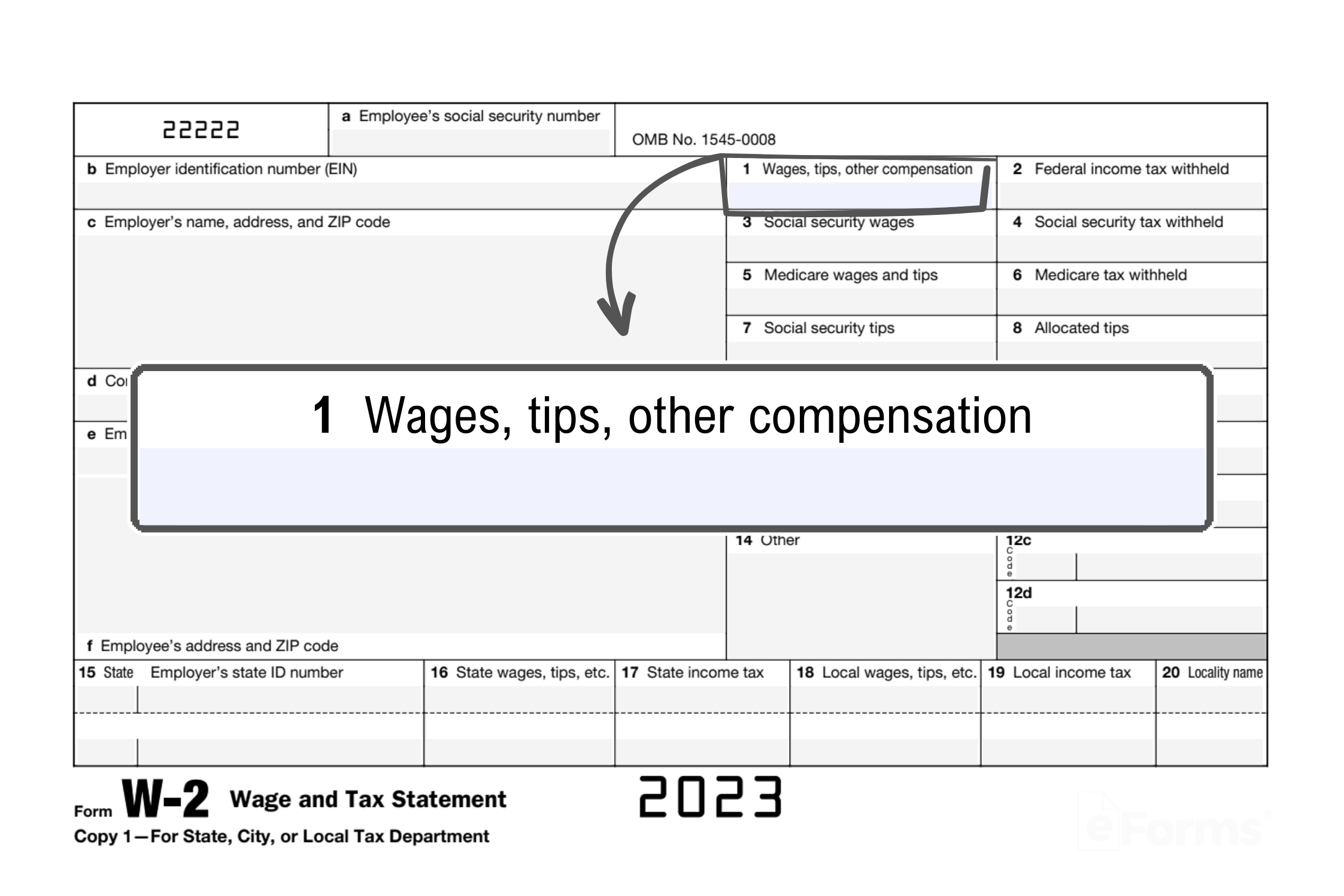

- Importing Documents: TurboTax Español supports document importing, making it easy to upload W-2s, 1099s, and other tax forms directly into the platform. This eliminates the need for manual data entry and speeds up the filing process.

These features collectively make TurboTax Español a versatile and user-friendly tool. Whether you’re a first-time filer or a seasoned taxpayer, the platform’s intuitive design and comprehensive support ensure that you can file your taxes with confidence.

How to Use TurboTax Español: A Step-by-Step Guide

Filing your taxes with TurboTax Español is a straightforward process, thanks to its intuitive design and step-by-step guidance. Here’s how you can get started:

Read also:Rick Moranis A Comprehensive Look At The Comedy Legends Life And Legacy

- Create an Account: Begin by visiting the TurboTax Español website and creating an account. You’ll need to provide some basic information, such as your name and email address, to set up your profile.

- Select Your Filing Status: TurboTax Español will ask you to select your filing status—single, married filing jointly, head of household, etc. This determines which tax forms you’ll need to complete.

- Answer Guided Questions: The platform will guide you through a series of questions about your income, expenses, and deductions. These questions are presented in clear, easy-to-understand Spanish, ensuring you can provide accurate information.

- Upload Documents: TurboTax Español allows you to upload your W-2s, 1099s, and other tax documents directly into the platform. This eliminates the need for manual data entry and reduces the risk of errors.

- Review and Submit: Once you’ve completed all the necessary steps, TurboTax Español will generate your tax return. Take a moment to review everything for accuracy, then submit your return electronically through the platform.

By following these steps, you can file your taxes efficiently and with minimal stress. TurboTax Español’s user-friendly interface ensures that even those new to tax filing can complete the process with confidence.

Is TurboTax Español the Right Solution for You?

With so many tax preparation options available, it’s natural to wonder whether TurboTax Español is the best choice for your needs. The answer largely depends on your specific circumstances and preferences. For Spanish-speaking taxpayers, TurboTax Español offers unparalleled accessibility and support. Its bilingual interface, live expert assistance, and step-by-step guidance make it an excellent option for those who want a hassle-free filing experience.

However, TurboTax Español may not be the ideal solution for everyone. For instance, if you have an extremely complex tax situation—such as owning multiple businesses or dealing with international income—you might benefit from consulting a professional tax advisor. Additionally, while TurboTax Español is competitively priced, some users may find its premium features to be on the pricier side. It’s important to weigh these factors and consider your budget and tax needs before making a decision.

Ultimately, TurboTax Español strikes a balance between affordability, ease of use, and comprehensive support. If you value a user-friendly platform that speaks your language and simplifies the tax-filing process, TurboTax Español is likely a great fit for you.

What Are the Most Common Questions About TurboTax Español?

How Accurate Is TurboTax Español?

Accuracy is a top priority for TurboTax Español, and the platform employs advanced algorithms to ensure precise calculations. By automating the math and guiding users through each step, TurboTax Español minimizes the risk of errors. Additionally, the platform’s live expert assistance provides an extra layer of accuracy, as users can consult bilingual tax professionals to address any uncertainties.

Can I Switch Between English and Spanish While Using TurboTax Español?

Yes, TurboTax Español offers bilingual support, allowing users to toggle between English and Spanish as needed. This feature is particularly helpful for bilingual households or individuals who may feel more comfortable with certain terms in English. The ability to switch languages ensures that users can file their taxes in the language that best suits their needs.

How Does TurboTax Español Compare to Competitors?

When comparing TurboTax Español to other tax preparation platforms, several factors set it apart. Unlike many competitors, TurboTax Español is specifically designed for Spanish-speaking users, offering culturally relevant examples and explanations. Its bilingual support and live expert assistance further enhance its appeal, providing users with the resources they need to file confidently.

In terms of pricing, TurboTax Español is competitively priced, though some of its premium features may be slightly more expensive than those of its competitors. However, the platform’s comprehensive support and user-friendly interface often justify the cost. For users who prioritize accessibility and ease of use, TurboTax Español is a standout choice.

What Are Some Tips for Maximizing Refunds with TurboTax Español?

Maximizing your refund with TurboTax Español involves taking full advantage of available deductions and credits. Here are some tips to help you get the most out of your tax return:

- Claim All Eligible Deductions: TurboTax Español will guide you through identifying deductions, such as student loan interest, medical expenses, and charitable contributions. Be sure to provide accurate information to ensure you’re claiming everything you’re entitled to.

- Explore Tax Credits: Tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit, can significantly reduce your tax liability. TurboTax Español will highlight these opportunities and help you claim them.

- Review Your Return: Before submitting your return, take the time to review everything for accuracy. Double-check your income, deductions, and credits to ensure nothing is overlooked.

By following these tips, you can ensure that you’re maximizing your refund and minimizing your tax liability with TurboTax Español.

Frequently Asked Questions About TurboTax Español

Is TurboTax Español Free to Use?

TurboTax Español offers a free version for simple tax filings, such as those involving W-2 income and standard deductions. However, more complex filings may require one of the platform’s paid plans.

Can I File State Taxes with TurboTax Español?

Yes, TurboTax Español supports both federal and state tax filings. The platform will guide you through the process for both, ensuring compliance with all applicable laws.

How Long Does It Take to File Taxes with TurboTax Español?

The time required to file taxes with TurboTax Español depends on the complexity of your tax situation. On average, users can complete their returns in a few hours, thanks to the platform’s streamlined process.

In conclusion, TurboTax Español is a powerful tool that simplifies the tax-filing process for Spanish-speaking taxpayers. With its user-friendly interface, comprehensive support, and advanced features, it’s an excellent choice for anyone looking to file their taxes with confidence. By

How To Hide A Hickey Instantly: Quick Fixes And Expert Tips

How To Access Exclusive Content: A Guide To Bypassing Patreon Paywall

Unlocking The Power Of Patreon Bypasser: A Comprehensive Guide

TurboTax Deal Get TurboTax Deluxe On Sale For Mashable, 49 OFF

What Is A W2 Form? TurboTax Tax Tips Videos, 59 OFF