Exploring The Cost Of Living In Hawaii: Is Paradise Affordable?

From Honolulu’s bustling streets to Maui’s serene beaches, every island has its unique charm and corresponding expenses. Whether you’re planning a permanent relocation, a long-term vacation, or simply weighing the pros and cons of island life, this guide will help you navigate the financial landscape of Hawaii. Living in Hawaii is a blend of natural wonders and economic challenges. The state’s geographic isolation contributes significantly to the high cost of goods and services, as most items must be imported. For instance, fresh produce, household goods, and even fuel often carry a premium price tag due to shipping costs. Additionally, housing prices in Hawaii are among the highest in the United States, particularly in urban areas like Honolulu. Yet, many residents find the trade-off worthwhile, citing the unparalleled quality of life, cultural richness, and access to nature as compelling reasons to call Hawaii home. As we delve deeper into this topic, we’ll explore how these factors affect everyday life and whether paradise truly comes at a price. To better understand the cost of living in Hawaii, it’s crucial to examine specific categories that impact your wallet. From housing and utilities to food, healthcare, and entertainment, each aspect contributes to the overall financial picture. This article will break down these components, offering insights into what you can expect when living in Hawaii. Whether you’re contemplating a move or simply curious about the lifestyle, this comprehensive guide will equip you with the knowledge to make informed decisions.

- Is Hawaii Really Worth the Cost of Living?

- What Are the Biggest Expenses in Hawaii?

- How Does Housing Cost in Hawaii Compare to the Mainland?

- What Makes Groceries and Dining So Expensive in Hawaii?

- Transportation Challenges and Costs in Hawaii

- Healthcare and Education Expenses in Hawaii

- How Can You Save Money While Living in Hawaii?

- Is the High Cost of Living in Hawaii Worth the Quality of Life?

Is Hawaii Really Worth the Cost of Living?

For many, the allure of Hawaii lies in its unparalleled natural beauty and unique cultural heritage. The islands offer a lifestyle that is hard to replicate elsewhere, with pristine beaches, lush rainforests, and a year-round tropical climate. However, the cost of living in Hawaii often raises questions about whether the benefits outweigh the financial burden. To answer this, it’s important to consider both tangible and intangible factors that contribute to the overall quality of life in the Aloha State.

One of the most significant advantages of living in Hawaii is the access to outdoor activities and natural wonders. Whether it’s surfing, hiking, or simply enjoying a sunset on the beach, the islands provide endless opportunities for recreation and relaxation. Additionally, Hawaii’s strong sense of community and cultural traditions, such as hula dancing and luaus, create a welcoming and enriching environment. These intangible benefits often make residents feel that the cost of living in Hawaii is justified, even if it requires financial sacrifices in other areas.

Read also:Jacob Lofland Net Worth Unveiling The Actors Career And Financial Journey

On the flip side, the financial realities of island life cannot be ignored. High housing costs, expensive groceries, and elevated utility bills are just a few of the challenges residents face. For some, the trade-off may not be worth it, especially if they struggle to maintain a comfortable standard of living. Yet, for others, the unique lifestyle and sense of belonging that Hawaii offers are priceless. Ultimately, whether Hawaii is worth the cost of living depends on individual priorities and financial circumstances.

What Are the Biggest Expenses in Hawaii?

When evaluating the cost of living in Hawaii, it’s essential to identify the key areas where expenses tend to be highest. Housing, groceries, and transportation are often the most significant contributors to the overall cost of living. Understanding these factors can help you prepare for the financial realities of life in Hawaii and make informed decisions about your budget.

Housing: A Major Financial Commitment

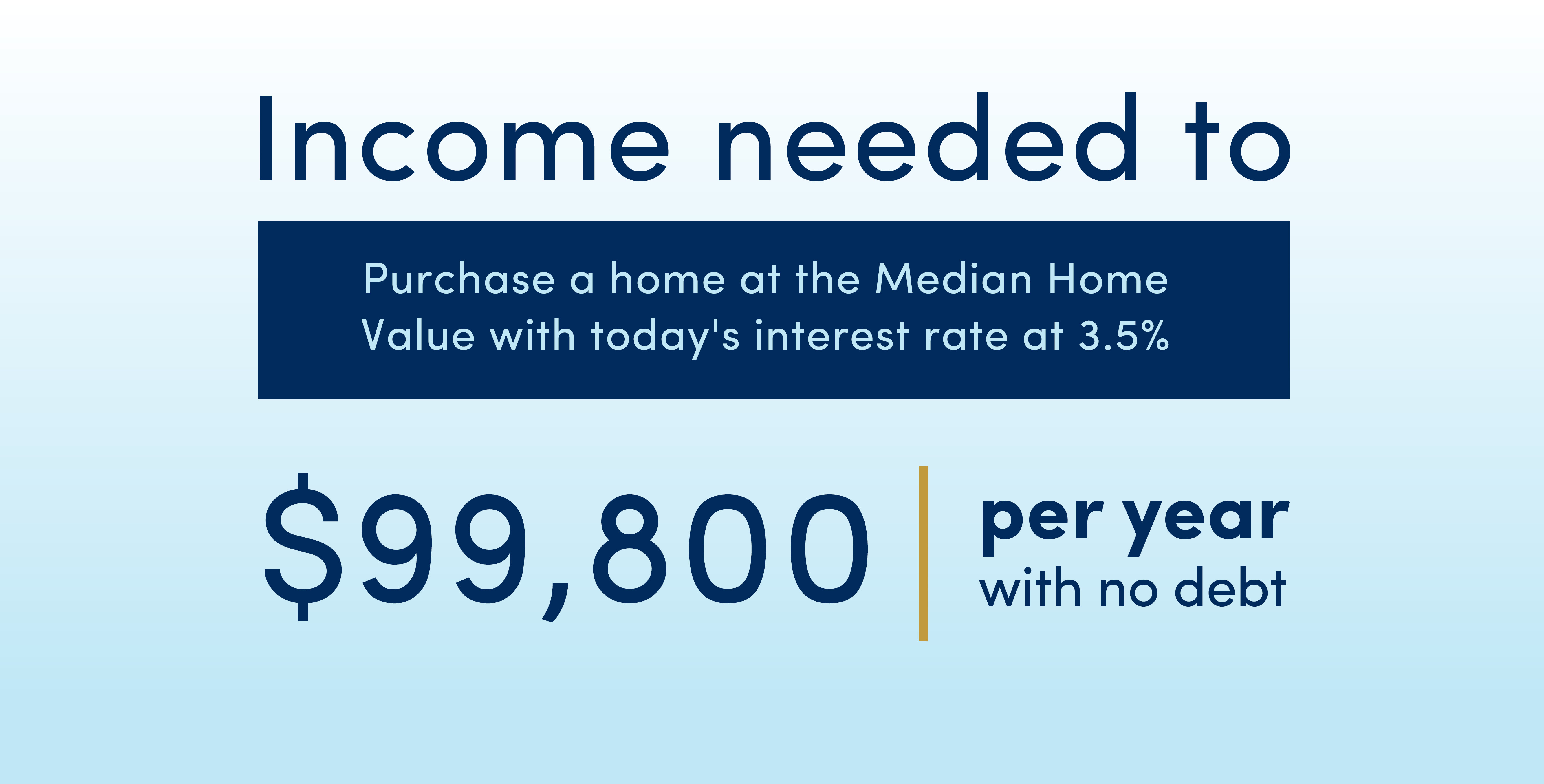

Hawaii’s housing market is notoriously expensive, with prices far exceeding the national average. The limited availability of land and high demand for properties, especially in popular areas like Honolulu and Maui, drive up costs significantly. Renting an apartment or purchasing a home in Hawaii requires careful planning and a realistic assessment of your financial situation. For example, the median home price in Honolulu is often double or triple that of many mainland cities, making homeownership a challenging goal for many.

Groceries and Dining: Imported Goods Come at a Premium

Another major expense in Hawaii is food. Since the islands rely heavily on imported goods, groceries and dining out can be considerably more expensive than on the mainland. Fresh produce, dairy products, and even basic pantry staples often carry a premium price tag due to shipping costs. Dining at restaurants is similarly pricey, with even casual meals costing significantly more than in other parts of the country. Residents often adapt by growing their own fruits and vegetables or shopping at local farmers' markets to save money.

Utility Bills: The Hidden Costs of Island Living

Utilities are another area where Hawaii’s cost of living stands out. Electricity rates in Hawaii are among the highest in the United States, primarily due to the state’s reliance on imported oil for energy production. Air conditioning, while not as commonly used as in warmer mainland states, can still add to the monthly utility bill. Water and internet services are also more expensive, making it crucial for residents to budget carefully and explore energy-efficient solutions.

How Does Housing Cost in Hawaii Compare to the Mainland?

One of the most striking differences between Hawaii and the mainland is the cost of housing. Whether you’re renting or buying, the price of real estate in Hawaii is significantly higher than in most parts of the continental United States. This disparity is driven by a combination of factors, including limited land availability, high demand, and the unique challenges of island living.

Read also:Discover The Best Remote Iot Vpc Solutions For Your Business Needs

For instance, the median home price in Hawaii often exceeds $1 million, particularly in sought-after areas like Waikiki and Lahaina. Even smaller towns and rural areas come with a hefty price tag, as the scarcity of developable land restricts supply. Renters face similar challenges, with average monthly rents for a one-bedroom apartment in Honolulu hovering around $2,500 or more. These figures are substantially higher than the national average, making housing one of the most significant financial hurdles for residents.

Despite the high costs, many people find ways to make housing more affordable. Some opt for shared living arrangements or choose to live in less tourist-heavy areas where prices are slightly lower. Others explore alternative housing options, such as tiny homes or off-grid living, to reduce expenses. While the cost of housing in Hawaii may seem daunting, creative solutions and careful planning can help mitigate the financial strain.

What Makes Groceries and Dining So Expensive in Hawaii?

The high cost of groceries and dining in Hawaii is a direct result of the state’s geographic isolation and reliance on imported goods. Since the islands produce only a fraction of the food consumed locally, the majority of items must be shipped in from the mainland or other countries. This logistical challenge translates into higher prices for consumers, making everyday shopping a more expensive endeavor.

The Impact of Shipping Costs on Grocery Prices

Shipping goods to Hawaii involves significant expenses, including fuel, labor, and storage. These costs are passed on to consumers, resulting in inflated prices for basic necessities. For example, a gallon of milk or a loaf of bread can cost 50-100% more in Hawaii than on the mainland. Fresh produce, which is often flown in to ensure quality, is particularly pricey. Residents frequently rely on sales, bulk purchases, and local farmers' markets to stretch their grocery budgets.

Dining Out: A Luxury or a Necessity?

Dining out in Hawaii is another area where the cost of living becomes apparent. Restaurants face the same challenges as grocery stores when it comes to sourcing ingredients, leading to higher menu prices. Even casual eateries, like burger joints or coffee shops, charge premiums that might seem shocking to mainland visitors. Fine dining establishments, while offering exceptional quality and ambiance, come with an even steeper price tag. For locals, dining out is often reserved for special occasions rather than a regular part of their routine.

Local Solutions: Growing Your Own Food

To combat the high cost of groceries, many Hawaii residents have turned to growing their own fruits and vegetables. Backyard gardens, community plots, and even rooftop farms are becoming increasingly popular. This not only reduces grocery expenses but also fosters a sense of self-sufficiency and connection to the land. Additionally, buying from local farmers' markets supports the community and ensures access to fresh, high-quality produce at more reasonable prices.

Transportation Challenges and Costs in Hawaii

Transportation in Hawaii presents unique challenges due to the islands’ geographic layout and limited infrastructure. Unlike the mainland, where road networks span vast distances, Hawaii’s transportation options are constrained by the size and isolation of each island. This reality contributes to higher costs and logistical hurdles for residents and visitors alike.

For starters, owning a car is almost a necessity in Hawaii, as public transportation is limited and often inconvenient. However, the cost of purchasing and maintaining a vehicle can be steep. Gas prices in Hawaii are consistently higher than the national average, often exceeding $4 per gallon. Additionally, car insurance rates are elevated due to the increased risk of accidents on narrow, winding roads and the higher cost of vehicle repairs. These factors make transportation one of the most significant ongoing expenses for residents.

Public transportation options, such as buses, are available but not always practical for daily commuting. On Oahu, theBus system is the most extensive, but schedules can be infrequent, and routes may not reach more remote areas. Ride-sharing services like Uber and Lyft are also available but come with higher fares due to demand and distance. For inter-island travel, flights are the primary mode of transportation, and ticket prices can fluctuate significantly depending on the season and availability. These challenges highlight the importance of planning and budgeting for transportation when considering the cost of living in Hawaii.

Healthcare and Education Expenses in Hawaii

Healthcare and education are two critical components of the cost of living in Hawaii, and both come with their own set of financial considerations. While the state offers high-quality services in these areas, the associated costs can be a significant burden for residents. Understanding these expenses is essential for anyone planning to live in Hawaii long-term.

Healthcare: High Quality, High Cost

Hawaii’s healthcare system is known for its quality and accessibility, but it comes at a premium. Medical services, prescription medications, and health insurance premiums are generally higher than the national average. This is partly due to the state’s geographic isolation, which increases the cost of medical supplies and specialized care. Additionally, the demand for healthcare services often outpaces supply, particularly in rural areas, leading to higher prices.

Fortunately, Hawaii has a unique advantage in the form of its Prepaid Health Care Act, which mandates that employers provide health insurance to employees working at least 20 hours per week. This law helps reduce the financial burden on residents, but out-of-pocket expenses can still add up. For retirees or those without employer-sponsored insurance, navigating the healthcare system can be particularly challenging. It’s crucial to factor these costs into your budget when considering a move to Hawaii.

Education: From Public Schools to Private Institutions

Education is another area where costs can vary significantly. Hawaii’s public school system is centralized under a single statewide district, which can lead to disparities in resources and quality across different islands. While public education is free for residents, additional expenses such as school supplies, extracurricular activities, and transportation can add up. For families seeking private education, tuition fees are often comparable to or higher than those on the mainland.

Higher Education Opportunities in Hawaii

For those pursuing higher education, Hawaii offers several reputable institutions, including the University of Hawaii system. Tuition rates are generally in line with other public universities, but out-of-state students face significantly higher costs. Scholarships and financial aid are available, but competition can be fierce. Prospective students should carefully research their options and plan for the financial commitment involved in pursuing

Understanding The Age Of Consent In Russia: A Comprehensive Guide

Understanding The Soviet Union Age Of Consent: Historical Context And Modern Implications

Exploring Ioan Gruffudd's Net Worth: A Glimpse Into The Welsh Actor’s Success

Cost of Living in Hawaii 2023

Cost Of Living In Hawaii 2022 Your Handy Guide