Is It Expensive To Live In Hawaii? A Comprehensive Guide

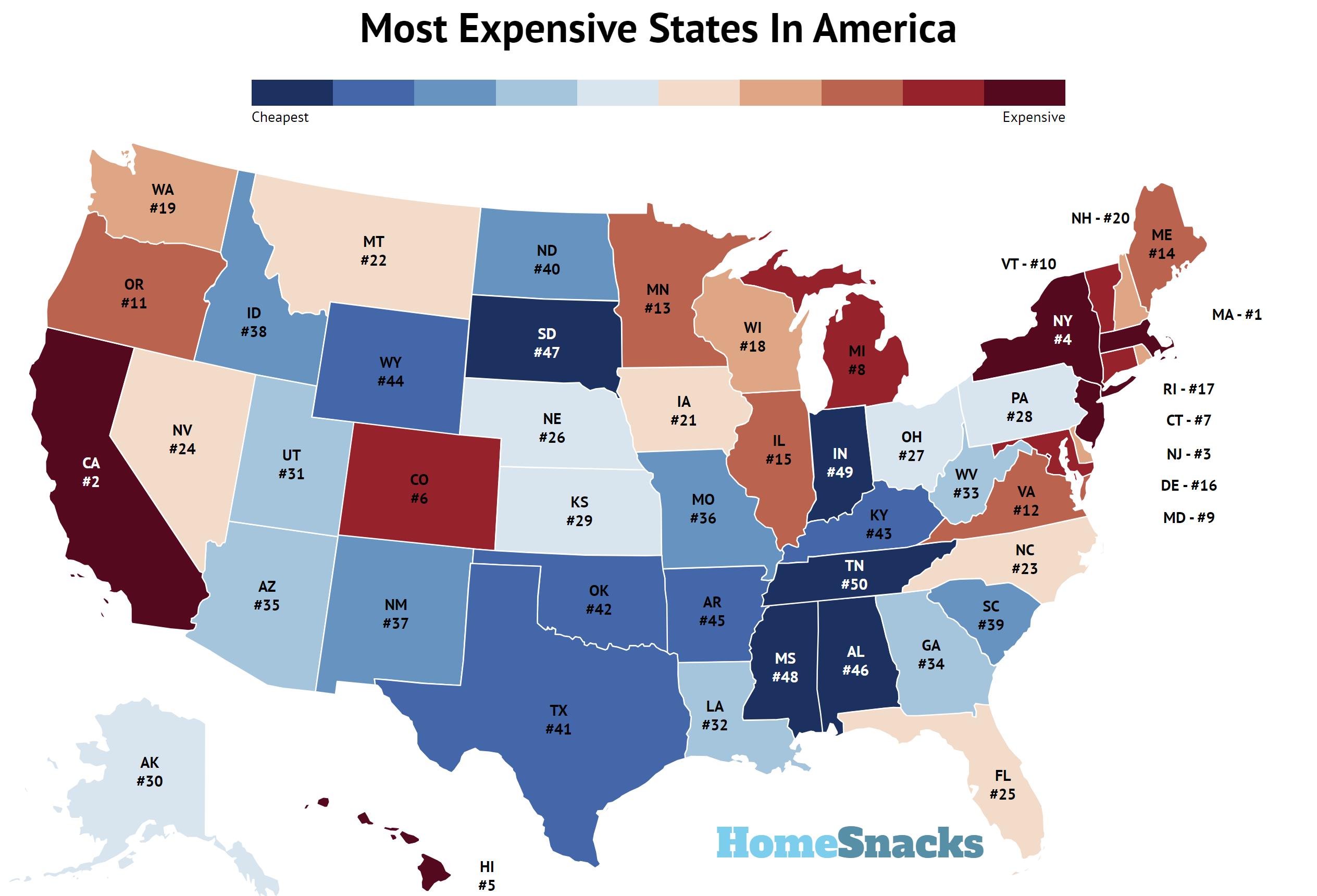

Hawaii, with its stunning landscapes, vibrant culture, and year-round tropical climate, is a dream destination for many. But beneath the surface of paradise lies a reality that many prospective residents and visitors must consider: is it expensive to live in Hawaii? From housing costs to groceries, transportation, and utilities, Hawaii consistently ranks as one of the most expensive states in the U.S. This article dives deep into the cost of living in Hawaii, offering insights into what makes it so pricey and how you can navigate these expenses.

While Hawaii's breathtaking beaches and lush mountains may seem like the perfect backdrop for a life of relaxation, the financial demands of living in the Aloha State can be daunting. With its geographic isolation, reliance on imported goods, and high demand for limited housing, Hawaii presents unique challenges for those considering a move. Whether you're planning a permanent relocation or simply curious about the lifestyle, understanding the cost dynamics is essential.

In this guide, we’ll explore the factors that contribute to Hawaii’s high cost of living, break down the expenses in key categories, and provide practical tips for managing your finances in paradise. By the end of this article, you'll have a clear picture of whether living in Hawaii aligns with your budget and lifestyle goals. So, let’s dive in and uncover the truth behind the question: is it expensive to live in Hawaii?

Read also:Understanding The Connection Between Melania Trump And Vladimir Putin A Comprehensive Insight

Table of Contents

- What Makes Hawaii So Expensive?

- Is It Expensive to Live in Hawaii? Housing Costs

- Groceries and Dining Out: How Much Does It Cost?

- What Are the Transportation Costs Like in Hawaii?

- Utilities and Other Monthly Expenses

- Is It Worth It to Live in Hawaii?

- How Can You Save Money While Living in Hawaii?

- Frequently Asked Questions About Living in Hawaii

What Makes Hawaii So Expensive?

Hawaii's reputation as one of the most expensive states in the U.S. is not unfounded. Several key factors contribute to the high cost of living in this tropical paradise. First and foremost is its geographic isolation. As an archipelago located in the middle of the Pacific Ocean, Hawaii relies heavily on imports for nearly all of its goods. This dependence on shipping drives up prices for everything from groceries to furniture and clothing.

Another major factor is the limited availability of land. With only so much space to build homes and infrastructure, the demand for housing far exceeds the supply. This imbalance results in skyrocketing real estate prices and rental rates, making it challenging for many residents to afford a place to live. Additionally, Hawaii's popularity as a tourist destination further inflates housing costs, as short-term vacation rentals compete with long-term housing options.

Lastly, Hawaii’s unique economy plays a role. While tourism is the backbone of the state’s economy, it also creates a volatile job market. Many residents work in service-oriented industries, which often pay lower wages compared to the high cost of living. Combined with the state’s high taxes, these factors make it difficult for some families to make ends meet. Understanding these dynamics is crucial for anyone considering a move to Hawaii.

Is It Expensive to Live in Hawaii? Housing Costs

When it comes to answering the question, "Is it expensive to live in Hawaii?" housing costs are often the first thing that comes to mind. The median home price in Hawaii is significantly higher than the national average, with properties in popular areas like Honolulu and Maui commanding premium prices. For example, a modest single-family home in Honolulu can easily exceed $1 million, while rentals are equally steep, with median rents for a two-bedroom apartment often surpassing $3,000 per month.

So, why are housing costs so high? The answer lies in Hawaii's limited land availability and strict zoning laws. With 95% of the land in Hawaii owned by the government or large private entities, the amount of land available for development is minimal. This scarcity drives up prices, especially in urban areas where demand is highest. Additionally, building costs are higher due to the need for materials to withstand tropical weather conditions like hurricanes and heavy rainfall.

For those looking to buy or rent in Hawaii, it’s essential to plan carefully. Many residents opt for more affordable neighborhoods on the outskirts of major cities or choose to live on less tourist-heavy islands like the Big Island or Kauai. While these areas may offer more reasonable prices, they often come with trade-offs, such as longer commutes or fewer amenities. Despite the challenges, owning a home in Hawaii remains a dream for many, even if it requires significant financial planning.

Read also:Top Unblocked Car Games For Endless Fun And Thrills

Groceries and Dining Out: How Much Does It Cost?

Living in Hawaii means adjusting to higher prices not just for housing but also for everyday essentials like groceries. Due to the state’s reliance on imports, food prices in Hawaii are approximately 60% higher than the national average. Staples like fresh produce, dairy, and meat often carry a hefty price tag, as they must be shipped from the mainland or other countries. For instance, a gallon of milk can cost upwards of $6, while a loaf of bread might set you back $5 or more.

Dining out in Hawaii is equally expensive, with restaurant meals costing significantly more than in other states. A casual dinner for two at a mid-range restaurant can easily exceed $100, while fine dining experiences can run into the hundreds. However, many locals embrace the island’s vibrant food culture by frequenting local eateries, food trucks, and farmers' markets, where meals are often more affordable and showcase Hawaii’s diverse culinary heritage.

To manage grocery expenses, residents often adopt creative strategies. Growing your own fruits and vegetables, shopping at local farmers' markets, and taking advantage of sales and discounts can help stretch your budget. Additionally, buying in bulk and sharing costs with neighbors or friends can make imported goods more affordable. While the cost of groceries and dining out in Hawaii is undeniably high, these tips can help you navigate the challenges without sacrificing your love for good food.

What Are the Transportation Costs Like in Hawaii?

Transportation is another area where Hawaii’s cost of living stands out. With no public rail systems outside of Oahu’s limited train network, most residents rely on personal vehicles to get around. However, owning and maintaining a car in Hawaii comes with its own set of expenses. Gas prices, for example, are consistently higher than the national average, often hovering around $4–$5 per gallon due to shipping costs and state taxes.

Additionally, car insurance premiums in Hawaii are among the highest in the country. The combination of dense urban areas, narrow roads, and frequent accidents drives up insurance rates. For those considering a move to Hawaii, it’s important to factor in these costs when budgeting for transportation. Public transportation options, such as buses, are available but often limited in scope and frequency, making them less convenient for daily commutes.

Despite these challenges, there are ways to save on transportation costs. Carpooling, biking, and walking are popular alternatives in more compact areas like Honolulu. Some residents also opt for fuel-efficient or electric vehicles, which can help reduce gas expenses over time. By understanding the nuances of transportation in Hawaii, you can make informed decisions that align with your budget and lifestyle.

Utilities and Other Monthly Expenses

Utilities in Hawaii are another significant factor to consider when evaluating the cost of living. Electricity rates, in particular, are among the highest in the nation, primarily due to the state’s reliance on imported fossil fuels for energy production. Residents can expect to pay upwards of $0.30–$0.40 per kilowatt-hour, compared to the national average of around $0.13. This means that even basic electricity usage, such as running air conditioning or powering household appliances, can quickly add up.

Other monthly expenses, such as internet and phone services, are also pricier in Hawaii. The cost of high-speed internet plans often exceeds $100 per month, and cell phone plans may come with additional fees due to the islands’ remote location. Water and waste management services, while relatively stable, still contribute to the overall financial burden. For example, a typical household might spend $100–$150 per month on water alone.

To manage these expenses, many residents adopt energy-saving practices, such as using solar panels, energy-efficient appliances, and LED lighting. Some utility providers offer discounts or incentives for customers who reduce their energy consumption. Additionally, bundling services like internet and phone plans can help lower costs. While utilities and other monthly expenses in Hawaii are undeniably high, these strategies can help mitigate the financial impact.

Is It Worth It to Live in Hawaii?

Despite the high cost of living, many people find that living in Hawaii is worth every penny. The state’s unparalleled natural beauty, rich cultural heritage, and laid-back lifestyle create a unique quality of life that’s hard to replicate elsewhere. From surfing world-class waves to hiking lush rainforests and enjoying breathtaking sunsets, Hawaii offers endless opportunities for adventure and relaxation.

However, the decision to live in Hawaii ultimately depends on your priorities and financial situation. For some, the trade-off between higher expenses and the unparalleled lifestyle is worth it. Others may find the financial strain too overwhelming, especially if they’re unable to secure a well-paying job or afford housing. It’s important to weigh the pros and cons carefully and consider whether Hawaii aligns with your long-term goals.

One way to determine if Hawaii is right for you is to visit and experience the lifestyle firsthand. Many people who move to Hawaii do so after falling in love with the islands during a vacation. By spending time in different areas and talking to locals, you can gain valuable insights into what life in Hawaii is really like. Ultimately, the question of whether it’s worth it to live in Hawaii is deeply personal and varies from individual to individual.

How Can You Save Money While Living in Hawaii?

Living in Hawaii doesn’t have to break the bank if you’re strategic about managing your expenses. One of the most effective ways to save money is to embrace the local lifestyle. For example, shopping at farmers' markets, growing your own produce, and cooking at home can significantly reduce your grocery bill. Many residents also take advantage of Hawaii’s natural resources by fishing, foraging, or harvesting fruits like coconuts and papayas from backyard trees.

Another way to save is by exploring alternative housing options. Renting a room or sharing a home with roommates can make housing more affordable, especially in expensive areas like Honolulu. Some residents also choose to live in less tourist-heavy neighborhoods or on less populated islands, where costs are generally lower. Additionally, downsizing your living space or opting for a smaller vehicle can help reduce monthly expenses.

Finally, taking advantage of free or low-cost activities is a great way to enjoy Hawaii without overspending. From hiking trails and beaches to community events and cultural festivals, there’s no shortage of affordable ways to experience the islands. By adopting a frugal mindset and making the most of Hawaii’s unique offerings, you can enjoy the Aloha lifestyle without sacrificing your financial stability.

Frequently Asked Questions About Living in Hawaii

Is It Expensive to Live in Hawaii Compared to the Mainland?

Yes, Hawaii is significantly more expensive than most states on the mainland. The cost of housing, groceries, utilities, and transportation is consistently higher due to the state’s geographic isolation and limited resources. However, many residents find that the unique lifestyle and natural beauty of Hawaii justify the higher expenses.

What Are the Cheapest Islands to Live On in Hawaii?

The Big Island and Kauai are generally considered the most affordable islands to live on. While housing and living costs are still higher than the national average, these islands offer more reasonable prices compared to Oahu and Maui. Additionally, rural areas on these islands often provide a more laid-back lifestyle.

Can You Live in Hawaii on a Budget?

Yes, it’s possible to live in Hawaii on a budget if you’re willing to make adjustments. Strategies like growing your own food, sharing housing costs, and embracing a minimalist lifestyle can help reduce expenses. Many residents also supplement their income with side gigs, such as freelance work or tourism-related jobs, to make ends meet.

In conclusion, while Hawaii’s cost of living is undeniably high, it’s not an insurmountable challenge. With careful planning and a willingness to adapt, you can enjoy the Aloha lifestyle without compromising your financial well-being. Whether you’re dreaming

Discover The Magic Of Vanillagify.com: Your Ultimate Guide To Flavorful Experiences

10100F Vs 5600: Which CPU Reigns Supreme For Your Needs?

Why Do Peacocks Display Their Brilliant Plumage? Unraveling Nature's Spectacle

Most Expensive Place to Live in U.S.? Hawaii, Where Toilet Paper Costs

Expensive States To Live In 2024 Anita Leisha