Understanding The Security Code On American Express: A Complete Guide

When it comes to safeguarding your financial transactions, the security code on American Express plays a pivotal role. This small yet powerful feature is a key line of defense against fraud and unauthorized use of your card. Whether you’re shopping online or over the phone, the security code ensures that the person using the card is its rightful owner. Understanding how this code works and why it’s essential can significantly enhance your payment security. With cybercrime on the rise, knowing the ins and outs of this feature is more important than ever.

The security code on American Express, also known as the Card Identification Number (CID), is a unique set of digits printed on the front of your card. Unlike other credit card companies that place their security codes on the back, American Express places it prominently on the front, making it easier to locate. This code is used by merchants to verify that the customer has the physical card in hand during transactions where the card is not present. It’s a simple yet effective way to add an extra layer of security to your financial activities.

But what exactly is the security code on American Express, and how does it differ from other card verification methods? This guide will delve into everything you need to know about this critical feature. From its purpose and location to tips on keeping it safe, we’ll cover all aspects of the security code on American Express. By the end of this article, you’ll be well-equipped to use this feature confidently and securely.

Read also:Exploring The Legacy Of Norma Strait A Journey Through Time

Table of Contents

- What Is the Security Code on American Express?

- Why Is the Security Code on American Express Important?

- How to Locate the Security Code on American Express?

- Can the Security Code on American Express Be Changed?

- What Happens If Someone Knows Your Security Code on American Express?

- Tips for Protecting Your Security Code on American Express

- How Merchants Use the Security Code on American Express

- Frequently Asked Questions About the Security Code on American Express

What Is the Security Code on American Express?

The security code on American Express, often referred to as the CID (Card Identification Number), is a unique 4-digit code printed on the front of your card. It is a critical component of card security, designed to verify the authenticity of the card during transactions. Unlike other credit card companies that use a 3-digit CVV (Card Verification Value) on the back of the card, American Express differentiates itself by placing the CID on the front. This strategic placement makes it easier for users to locate and reduces the likelihood of confusion during transactions.

The CID is not embossed or imprinted like the card number, expiration date, or cardholder name. Instead, it is printed in plain text, ensuring it cannot be easily replicated or forged. This simple yet effective design choice enhances its security. The security code on American Express is used exclusively for card-not-present transactions, such as online shopping or phone orders, where the merchant cannot physically inspect the card. By requiring the CID, merchants can confirm that the person making the transaction has access to the physical card, reducing the risk of fraud.

While the security code on American Express might seem like a small detail, its role in protecting your financial information is immense. It acts as a secondary layer of security, complementing the primary card details like the card number and expiration date. In today’s digital age, where cybercriminals are constantly seeking ways to exploit vulnerabilities, the CID serves as a robust deterrent against unauthorized transactions. Understanding its purpose and importance is the first step toward ensuring your card remains secure.

Why Is the Security Code on American Express Important?

The security code on American Express is far more than just a random set of digits. It plays a vital role in safeguarding your financial transactions and protecting your personal information. In a world where online shopping and digital payments are becoming increasingly common, the CID acts as a gatekeeper, ensuring that only authorized users can access your card. But why exactly is the security code on American Express so important? Let’s break it down.

First and foremost, the CID helps prevent fraud. When you make a purchase online or over the phone, the merchant cannot physically verify your card. By requiring the security code on American Express, they can confirm that the person making the transaction has the physical card in hand. This significantly reduces the risk of unauthorized use, especially in cases where card numbers have been stolen or compromised. Without the CID, fraudsters could potentially use stolen card information to make purchases, leaving you vulnerable to financial losses.

How Does the Security Code on American Express Differ from Other Security Features?

While the security code on American Express is a critical feature, it’s important to understand how it differs from other security measures. For instance, the card number and expiration date are embossed and required for all transactions, but they can be easily copied or skimmed. The CID, on the other hand, is not embossed and is only printed on the card, making it harder for fraudsters to replicate. Additionally, the CID is never stored by merchants or payment processors, ensuring it cannot be accessed in the event of a data breach.

Read also:Dawn Wells Measurements A Complete Guide To Her Life And Career

What Role Does the Security Code Play in Online Transactions?

In online transactions, the security code on American Express serves as a secondary form of authentication. When you enter your card details during checkout, the merchant sends the CID to the card issuer for verification. If the code matches, the transaction is approved. If it doesn’t, the transaction is declined. This process adds an extra layer of security, making it nearly impossible for fraudsters to complete unauthorized transactions without the physical card.

Ultimately, the security code on American Express is a simple yet powerful tool that enhances the safety of your financial activities. By understanding its importance and how it works, you can take proactive steps to protect your card and enjoy peace of mind during every transaction.

How to Locate the Security Code on American Express?

One of the most common questions users have is, “Where can I find the security code on American Express?” The answer is straightforward, but it’s essential to know exactly where to look to avoid confusion. Unlike other credit card companies, American Express places its security code, or CID, on the front of the card. This unique placement makes it easy to locate and reduces the chances of errors during transactions.

To find the security code on American Express, simply look at the front of your card. The CID is a 4-digit number printed above the card number, typically on the right-hand side. It is not embossed or raised like the card number, expiration date, or cardholder name, making it less susceptible to being copied or forged. The plain text format ensures that the code remains discreet and secure, visible only to those who physically hold the card.

What Should You Do If You Can’t Find the Security Code?

If you’re having trouble locating the security code on American Express, don’t panic. There are a few things you can do to ensure you’re looking in the right place. First, double-check the front of the card, focusing on the area above the card number. If you still can’t find it, consider the following tips:

- Ensure you’re looking at the correct card if you have multiple American Express cards.

- Check for any wear or damage to the card that might have obscured the code.

- Contact American Express customer service for assistance if the code is missing or illegible.

Why Is the Placement of the Security Code on American Express Unique?

The placement of the security code on American Express is a deliberate design choice aimed at enhancing security and usability. By placing the CID on the front of the card, American Express ensures that users can quickly locate it without flipping the card over. This reduces the likelihood of errors during transactions and makes the process more efficient. Additionally, the unique placement sets American Express apart from other card issuers, reinforcing its reputation for innovation and security.

Knowing where to find the security code on American Express is essential for smooth and secure transactions. By familiarizing yourself with its location and understanding its purpose, you can use your card with confidence and ease.

Can the Security Code on American Express Be Changed?

A common question among cardholders is, “Can the security code on American Express be changed?” The short answer is no. The CID is a permanent feature of your card and cannot be altered or updated once it has been issued. This immutability is a key aspect of its security, as it ensures that the code remains consistent and reliable throughout the card’s lifespan. But what happens if your CID becomes compromised or illegible? Let’s explore this scenario in detail.

If your security code on American Express becomes unreadable due to wear and tear, the best course of action is to request a replacement card. American Express provides a straightforward process for cardholders to obtain a new card with a fresh CID. This ensures that your financial transactions remain secure and that you can continue using your card without interruption. It’s important to note that the new card will have a different CID, so you’ll need to update any stored payment information with merchants or subscription services.

What Should You Do If Your Security Code Is Compromised?

If you suspect that your security code on American Express has been compromised, immediate action is crucial. While the CID itself cannot be changed, you can take the following steps to protect your account:

- Contact American Express customer service to report the issue and request a new card.

- Monitor your account for any unauthorized transactions and report them promptly.

- Enable additional security features, such as two-factor authentication, to safeguard your account.

Why Can’t the Security Code Be Changed Independently?

The inability to change the security code on American Express independently is a deliberate security measure. Allowing cardholders to modify the CID could create vulnerabilities, as fraudsters might exploit such a feature to bypass security checks. By keeping the CID fixed and unchangeable, American Express ensures that it remains a reliable and tamper-proof component of card security.

In conclusion, while the security code on American Express cannot be changed, there are effective measures you can take to address any issues that arise. By staying vigilant and proactive, you can maintain the security of your card and enjoy peace of mind during every transaction.

What Happens If Someone Knows Your Security Code on American Express?

One of the most pressing concerns for cardholders is, “What happens if someone knows your security code on American Express?” While the CID is a robust security feature, it is not foolproof. If a fraudster gains access to your security code, they could potentially use it to make unauthorized transactions. However, there are several safeguards in place to mitigate this risk and protect your financial information.

First and foremost, the security code on American Express is only one piece of the puzzle. To complete a transaction, fraudsters would also need your card number, expiration date, and possibly your billing address. This multi-layered approach makes it significantly harder for unauthorized users to exploit your card. Additionally, American Express employs advanced fraud detection systems that monitor your account for suspicious activity. If any unusual transactions are detected, the system will flag them for review, and you may be contacted to verify their legitimacy.

How Can You Protect Your Security Code from Being Compromised?

To minimize the risk of someone accessing your security code on American Express, it’s essential to adopt good security practices. Here are some tips to keep your CID safe:

- Avoid sharing your CID with anyone, even if they claim to be from American Express or a trusted merchant.

- Be cautious when entering your CID online and ensure you’re using secure websites (look for “https://” in the URL).

- Regularly monitor your account for unauthorized transactions and report any suspicious activity immediately.

What Should You Do If Your Security Code Is Used Fraudulently?

If you discover that your security code on American Express has been used fraudulently, act quickly to minimize the damage. Contact American Express customer service to report the issue and request a new card. They will guide you through the process of disputing unauthorized charges and securing your account. Remember, American Express offers robust fraud protection, so you’re unlikely to be held liable for any unauthorized

Cirie From Survivor: The Ultimate Guide To Her Journey, Strategies, And Legacy

How To Calibrate Laser Thermometer: A Comprehensive Guide

Choosing The Right 100 Amp Size Wire For Your Electrical Needs

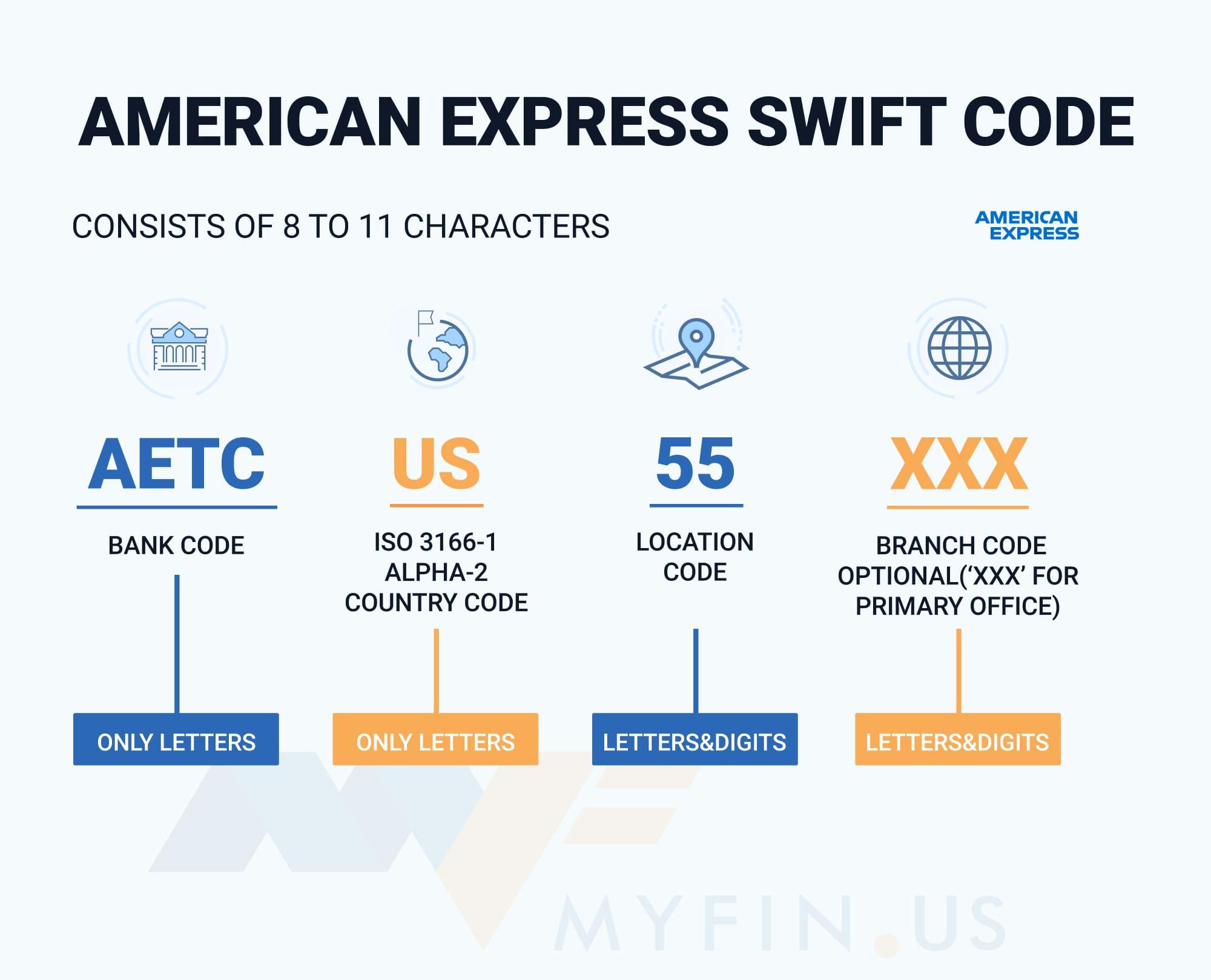

American Express® SWIFT/BIC Code is AETCUS55 — Find Your SWIFT/BIC Code

Amex Newsroom