How To Improve Your Credit Score With Experian Boost: A Complete Guide

Are you struggling to improve your credit score despite paying your bills on time? Experian Boost offers a unique solution to help you take control of your financial future. This innovative tool allows you to include utility and telecom payments in your credit report, giving you the opportunity to boost your score instantly. For many individuals, traditional credit scoring models overlook everyday financial responsibilities like phone and utility bills. However, with Experian Boost, you can showcase these payments and potentially see an increase in your credit score within minutes.

Credit scores play a crucial role in determining your financial opportunities, from securing loans to renting an apartment or even landing a job. A higher credit score not only reflects your financial responsibility but also opens doors to better interest rates and more favorable terms. Experian Boost is designed to help individuals, especially those with thin credit files or limited credit history, improve their scores by leveraging payments they’re already making. This guide will walk you through everything you need to know about Experian Boost, how it works, its benefits, and whether it’s the right tool for you.

Whether you’re new to credit building or looking to enhance your existing score, understanding how Experian Boost fits into your financial strategy is essential. In this article, we’ll explore the ins and outs of this tool, answer common questions, and provide actionable tips to maximize its potential. Let’s dive in and discover how you can take advantage of Experian Boost to achieve your credit goals.

Read also:Discovering Kevin Beets A Journey Through His Life And Achievements

Table of Contents

- What is Experian Boost and How Does It Work?

- Can Experian Boost Help You Improve Your Credit Score?

- Benefits of Using Experian Boost for Credit Building

- How to Use Experian Boost: A Step-by-Step Guide

- Is Experian Boost Safe to Use for Credit Monitoring?

- Alternatives to Experian Boost for Credit Score Improvement

- How Quickly Can You See Results with Experian Boost?

- Frequently Asked Questions About Experian Boost

What is Experian Boost and How Does It Work?

Experian Boost is a free tool offered by Experian, one of the three major credit bureaus in the United States, designed to help individuals improve their credit scores by incorporating alternative payment data into their credit reports. Traditional credit scoring models primarily consider credit-related activities such as credit card payments, loans, and mortgages. However, Experian Boost allows you to include non-credit-related payments, such as utility bills, phone bills, and even streaming service subscriptions, to demonstrate your financial responsibility.

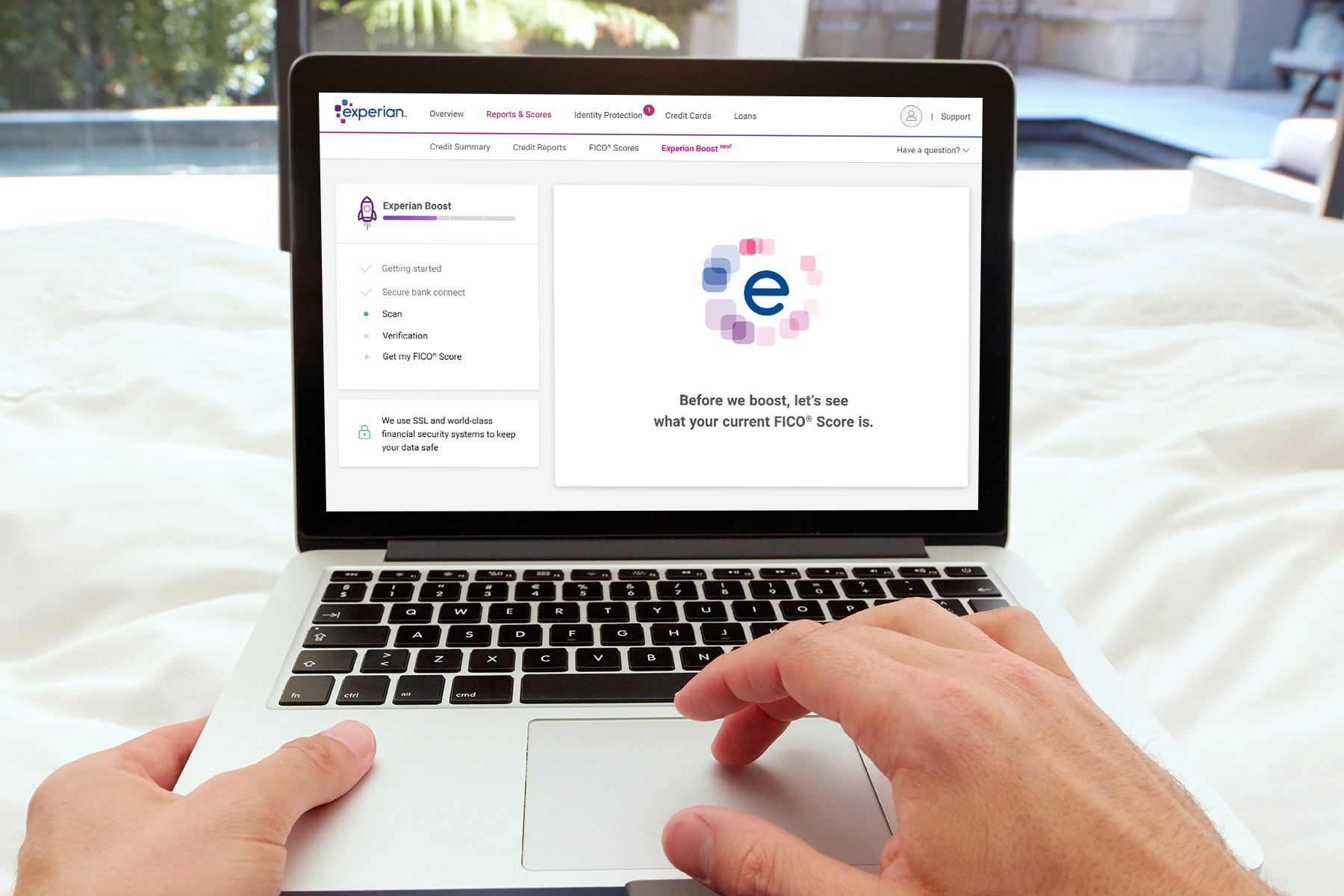

How does Experian Boost work? Once you sign up for the service, you’ll be prompted to connect your bank accounts securely. Experian will then analyze your transaction history to identify qualifying payments. These payments are added to your credit report, and your FICO score is recalculated to reflect the updated information. This process is entirely free and can be completed within minutes. It’s important to note that only positive payment history is added—missed or late payments won’t be included, ensuring that your credit score isn’t negatively impacted.

One of the key advantages of Experian Boost is its accessibility. It’s particularly beneficial for individuals with thin credit files or those who are new to credit building. By incorporating everyday payments, Experian Boost provides a more comprehensive picture of your financial habits, which can lead to a more accurate credit score. Whether you’re trying to qualify for a mortgage, car loan, or credit card, this tool can help you take a significant step toward achieving your financial goals.

Can Experian Boost Help You Improve Your Credit Score?

Can Experian Boost really make a difference in your credit score? The answer is a resounding yes, especially for individuals with limited credit history or those who consistently pay their utility and telecom bills on time. Experian Boost is particularly effective for people who may not have a robust credit file but are financially responsible in other ways. By adding these payments to your credit report, you provide lenders with a more complete view of your financial behavior.

Studies have shown that users of Experian Boost often see an average increase of 13 points in their credit scores, with some experiencing boosts of up to 50 points or more. This can be a game-changer for individuals who are on the cusp of qualifying for a loan or credit card. For example, if your credit score is hovering around 680, a 13-point increase could push you into the “good” credit range, unlocking better interest rates and terms.

It’s worth noting that Experian Boost is not a one-size-fits-all solution. While it’s highly effective for certain individuals, its impact may vary depending on your existing credit profile. If you already have an extensive credit history with a high score, the boost may be less significant. However, for those with thin files or limited credit activity, this tool can be a powerful way to build or enhance your credit score.

Read also:What Are Examples A Comprehensive Guide To Understanding And Using Examples Effectively

Benefits of Using Experian Boost for Credit Building

Experian Boost offers several compelling benefits that make it a valuable tool for anyone looking to improve their credit score. One of the most significant advantages is its ability to provide instant results. Unlike traditional credit-building methods that can take months or even years to show progress, Experian Boost recalculates your credit score immediately after adding your qualifying payments.

Why Should You Consider Using Experian Boost?

Why should you consider using Experian Boost? For starters, it’s completely free to use, making it an accessible option for individuals of all financial backgrounds. Additionally, it’s a low-risk tool since only positive payment history is included. This means that if you’ve missed a utility payment in the past, it won’t negatively impact your credit score.

Key Advantages of Experian Boost

- Improved Credit Score: By incorporating utility and telecom payments, Experian Boost can help you achieve a higher credit score.

- Accessibility: It’s particularly beneficial for individuals with thin credit files or limited credit history.

- Instant Results: Your credit score is recalculated immediately after connecting your accounts.

- Free to Use: There are no hidden fees or charges associated with Experian Boost.

- Secure Process: Experian uses bank-level encryption to ensure your financial data is protected.

How to Use Experian Boost: A Step-by-Step Guide

Using Experian Boost is a straightforward process that can be completed in just a few steps. Here’s a detailed guide to help you get started:

Step 1: Sign Up for Experian Boost

To begin, visit the official Experian Boost website and create an account. You’ll need to provide some basic personal information, such as your name, address, and Social Security number, to verify your identity. This step ensures that your credit report is accurate and secure.

Step 2: Connect Your Bank Accounts

Once your account is set up, you’ll be prompted to connect your bank accounts. Experian uses secure encryption to protect your financial data, so you can feel confident that your information is safe. After connecting your accounts, Experian will analyze your transaction history to identify qualifying payments.

Step 3: Review and Confirm Payments

After identifying your utility, telecom, and streaming service payments, Experian will provide a summary of the payments that will be added to your credit report. You’ll have the opportunity to review this information and confirm that it’s accurate before proceeding. Once confirmed, your credit score will be recalculated to reflect the updated data.

By following these simple steps, you can take advantage of Experian Boost to improve your credit score and achieve your financial goals.

Is Experian Boost Safe to Use for Credit Monitoring?

Is Experian Boost a safe tool for credit monitoring? Absolutely. Experian employs bank-level encryption and advanced security measures to protect your financial data. When you connect your bank accounts, Experian only accesses the transaction history needed to identify qualifying payments. Your sensitive information, such as account numbers and login credentials, is never stored or shared.

In addition to its security features, Experian Boost is also transparent about how it uses your data. The tool only adds positive payment history to your credit report, ensuring that missed or late payments won’t negatively impact your score. This makes it a low-risk option for individuals looking to improve their credit without worrying about potential downsides.

Alternatives to Experian Boost for Credit Score Improvement

While Experian Boost is an excellent tool for improving your credit score, it’s not the only option available. Here are some alternatives you can consider:

- Authorized User Status: Becoming an authorized user on someone else’s credit card can help you build credit.

- Secured Credit Cards: These cards require a security deposit and are a great way to establish credit history.

- Credit-Builder Loans: These loans are specifically designed to help individuals build credit.

Each of these alternatives has its own advantages and may be more suitable depending on your financial situation.

How Quickly Can You See Results with Experian Boost?

How quickly can you see results with Experian Boost? One of the most appealing aspects of this tool is its ability to deliver instant results. Once you’ve connected your bank accounts and confirmed your qualifying payments, your credit score is recalculated immediately. Many users report seeing an increase in their score within minutes of completing the process.

However, it’s important to note that the extent of the boost will depend on your existing credit profile. For individuals with thin credit files, the impact is often more significant. Regardless of your starting point, Experian Boost provides a quick and effective way to improve your credit score.

Frequently Asked Questions About Experian Boost

Does Experian Boost Affect All Credit Scores?

No, Experian Boost only affects your Experian credit report and the scores based on it. Other credit bureaus, such as Equifax and TransUnion, won’t be impacted.

Is Experian Boost Free to Use?

Yes, Experian Boost is completely free. There are no hidden fees or charges associated with using the tool.

Can Experian Boost Help with Credit Card Approvals?

Yes, by improving your Experian credit score, you may increase your chances of being approved for credit cards with better terms and interest rates.

In conclusion, Experian Boost is a powerful and accessible tool for improving your credit score. By leveraging everyday payments, it provides a unique opportunity to showcase your financial responsibility and achieve your credit goals. Whether you’re new to credit building or looking to enhance your existing score, Experian Boost can help you take a significant step forward.

Learn how Experian Boost can help you improve your credit score instantly by including utility and telecom payments. Discover its benefits, safety, and step-by-step guide to get started today!

For more information on credit scores and financial tools, visit Experian's official website.

Discovering The World Of Miaz And Girtmaster: A Comprehensive Guide

Understanding The Formula For Hypochlorous Acid: A Comprehensive Guide

Elizabeth Taylor Visina: A Timeless Icon And Her Height's Influence

This is How to Get the Most From Experian Boost Rent +More Credit

Consumers across America empowered to potentially boost their credit score